Allowed’s admit it – looking for supplies can be tough with a lot of choices. Nevertheless, one method to remove the poor apples is by concentrating on supplies with solid cost-free capital.

Yet what is cost-free capital, and also why does it matter?

In its easiest type, cost-free capital is the quantity of cash money a firm maintains after spending for running prices and also capital investment.

A high cost-free capital permits even more development possibilities, constant returns payments, and also the capability to settle financial debt quickly.

As we can see, the advantages of solid cash-generating capacities are definitely large.

And also surprisingly sufficient, 3 technology titans– Apple AAPL, Alphabet GOOGL, and also Broadcom AVGO– all brag solid cash-generating capacities.

Allow’s take a more detailed consider every one.

Apple

We have actually all come to be very aware of Apple, the modern technology heavyweight that has actually transformed the smart phone landscape with its front runner apple iphone.

Apple is generally viewed as the king of cost-free capital; in its most current quarter, the heavyweight produced approximately $30.2 billion in cost-free capital, expanding 45% sequentially.

Photo Resource: Zacks Financial Investment Study

Financiers will certainly need to fork up a costs for shares. AAPL’s existing forward incomes multiple of 24.9 X is a couple of ticks over its 23.7 X five-year typical however stays listed below highs of 31.3 X in 2022.

The supply brings a Worth Design Rating of “D.”

Photo Resource: Zacks Financial Investment Study

Alphabet

Alphabet has actually developed from mostly being an internet search engine right into a firm with procedures in cloud computer, ad-based video clip and also songs streaming, self-governing automobiles, and also much more.

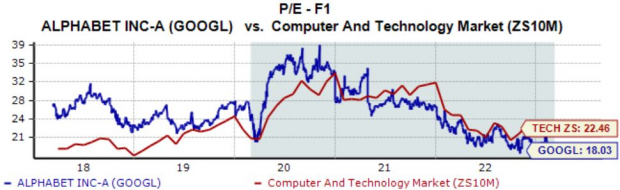

Unlike Apple, GOOGL shares profession at a good discount rate about their historical degrees; Alphabet’s 18.1 X ahead incomes multiple is well underneath the 26.1 X five-year typical and also Zacks Computer system and also Innovation market standard.

Photo Resource: Zacks Financial Investment Study

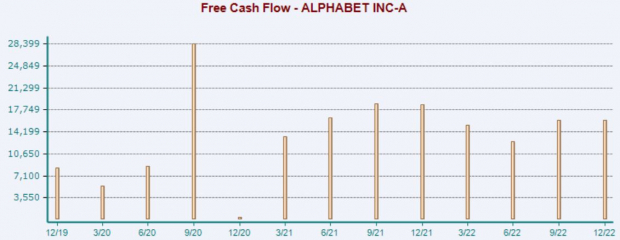

It’s difficult to neglect the business’s cost-free capital toughness, with GOOGL reporting cost-free capital of $16 billion in its most current quarter. Like Apple, Alphabet is among the leading cash-generating equipments within the S&P 500.

Photo Resource: Zacks Financial Investment Study

Broadcom

Broadcom is a top developer, programmer, and also worldwide distributor of a wide series of semiconductor tools.

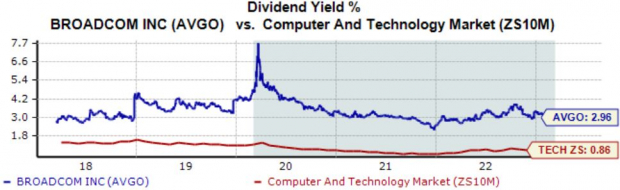

Broadcom’s returns metrics would certainly delight any type of income-focused financier; its yearly returns currently produces 2.9%, greater than three-way that of the Zacks Computer system and also Innovation market.

And also to cover it off, the business’s 21% five-year annualized returns development price mirrors a strong dedication to progressively fulfilling investors.

Photo Resource: Zacks Financial Investment Study

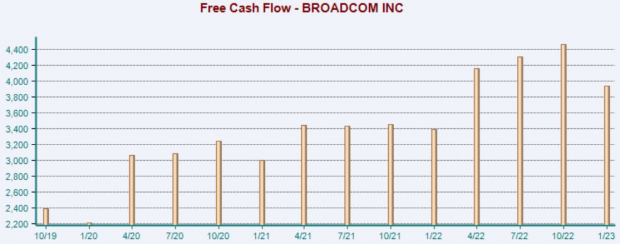

AVGO generated virtually $4 billion in cost-free capital in its most current quarter, expanding greater than 16% year-over-year. As we can see in the graph below, Broadcom’s cost-free capital has actually been expanding perfectly.

Photo Resource: Zacks Financial Investment Study

Profits

With a lot of choices around, it appears virtually difficult to discover the appropriate supplies.

Nevertheless, by concentrating on cost-free capital toughness, capitalists can obstruct a lot of the sound.

For those curious about business that create major cash money, all 3 business above– Apple AAPL, Alphabet GOOGL, and also Broadcom AVGO– might be factors to consider.

4 Oil Supplies with Large Advantages

International need for oil is via the roofing system … and also oil manufacturers are battling to maintain. So despite the fact that oil rates are well off their current highs, you can anticipate large benefit from the business that provide the globe with “black gold.”

Zacks Financial investment Research study has actually simply launched an immediate unique record to assist you count on this fad.

In Oil Market ablaze, you’ll uncover 4 unforeseen oil and also gas supplies placed for large gains in the coming weeks and also months. You do not intend to miss out on these suggestions.

Download your free report now to see them.

Apple Inc. (AAPL) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights and also viewpoints shared here are the sights and also viewpoints of the writer and also do not always mirror those of Nasdaq, Inc.