We’re within the second month of the New 12 months, however we is not going to totally shut the books on 2024 until the continued This autumn earnings season is totally behind us. The main target these days has been on the Magazine 7 outcomes that many out there discovered to be comparatively underwhelming, however that unfavourable view is extra probably a mirrored image of those Tech leaders’ large AI-centric capex budgets and fewer concerning the substance of their earnings energy, which continues to be not solely monumental but additionally sustainable.

As we have now been flagging right here all alongside, the general earnings image stays sturdy and reassuring, with the tone and substance of administration commentary including to confidence in present market expectations of a major progress ramp-up in 2025 and past.

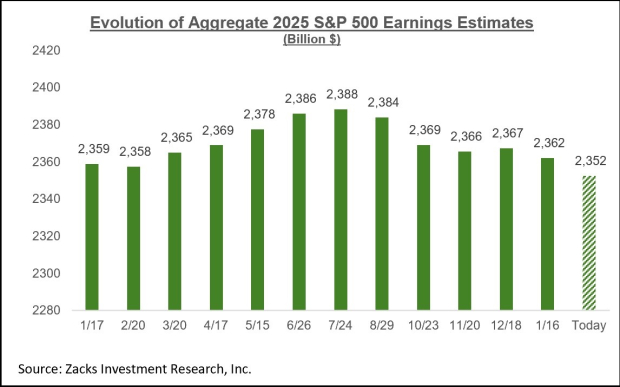

Check out the first chart under that offers you a big-picture view of company profitability.

Picture Supply: Zacks Funding Analysis

These numbers characterize the bottom-up aggregates for the index. In different phrases, we take the earnings estimates of the sell-side analysts, most of whom contribute their estimates to Zacks. This enables us to create the Zacks Consensus EPS for every inventory that we then mixture to the respective sector and the general index.

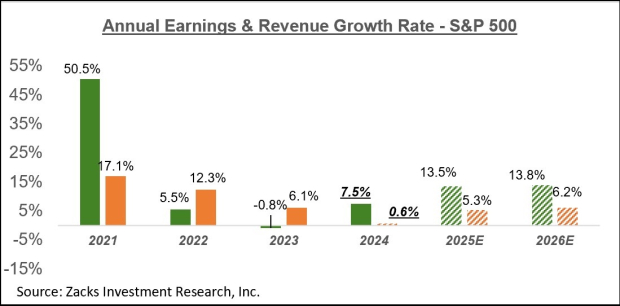

As you possibly can see, the expectation is that mixture 2025 earnings of $2.352 trillion shall be up +13.5% from the $2.072 trillion in 2024. This might observe the +7.5% earnings progress in 2024. Please notice that had it not been for the drag from the Power sector, the earnings progress in 2024 and 2025 could be +9.6% and +14%, respectively.

Let’s deal with 2025 and drill down the place this spectacular progress is predicted to come back from.

Not like 2024, when a lot of the progress got here from the Tech sector, 2025 progress may be very broad-based, with 15 of the 16 Zacks sectors anticipated to have constructive earnings progress (the Industrial Merchandise sector is predicted to see a -0.1% decline in 2025).

In case you exclude the Tech sector from the S&P 500 index, whole 2025 earnings for the remainder of the index could be up +11.9% (vs. +13.5% as an entire).

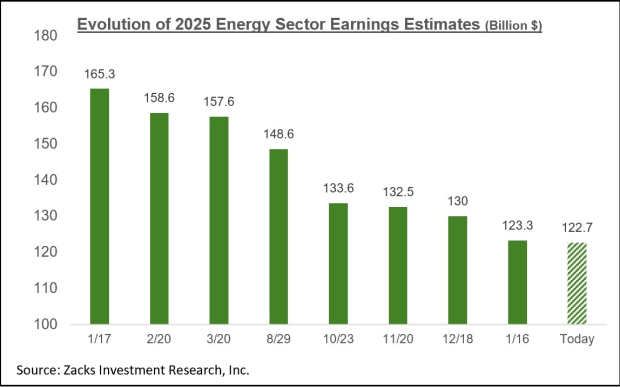

Let’s check out how mixture 2025 earnings estimates have advanced over the previous 12 months, which you’ll see within the second chart under.

Picture Supply: Zacks Funding Analysis

This chart reveals that estimates peaked in July 2024 and have been steadily trending down ever since. However earlier than you totally internalize this unfavourable improvement on the earnings entrance, let’s ‘look below the hood’ on the sector stage to see if something uncommon is going on there.

The third chart under reveals how mixture 2025 earnings estimates for the Power sector have advanced over the previous 12 months.

Picture Supply: Zacks Funding Analysis

Perhaps a giant a part of the unfavourable revisions to mixture estimates since July 2024 consequence from the earnings strain within the Power sector.

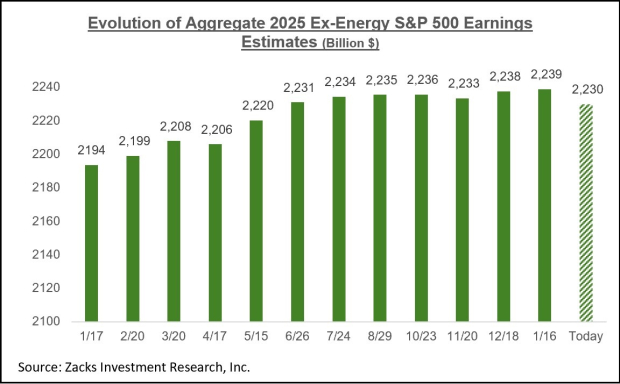

The fourth chart under reveals the mixture revisions pattern over the previous 12 months on an ex-Power foundation.

Picture Supply: Zacks Funding Analysis

This fourth chart confirms that the entire downtrend within the mixture numbers was because of the Power sector, with ex-Power estimates truly modestly up since final Summer season. Nevertheless, they appear to have began coming down over the previous month. It could possibly be a brand new improvement or one thing transitory.

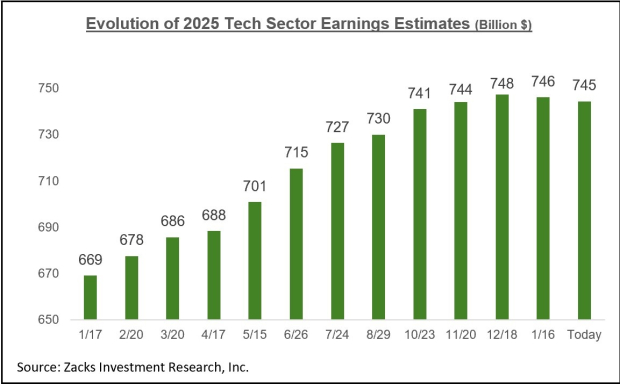

The fifth chart under reveals the identical revisions pattern for the Tech sector.

Picture Supply: Zacks Funding Analysis

As you possibly can see right here, the revisions pattern for the Tech sector has been very favorable. However as with the ex-Power image, there seems to be a modest downtick in estimates over the previous few weeks. We must monitor it carefully to make sure it isn’t the beginning of a brand new and unfavorable flip within the general earnings image.

This autumn Earnings Season Scorecard

By Friday, February 7th, we have now seen This autumn outcomes from 308 S&P 500 members, or 61.6% of the index’s whole membership. Complete earnings for these firms are up +13.8% from the identical interval final 12 months on +5.9% increased revenues, with 77.3% beating EPS estimates and 64.9% beating income estimates.

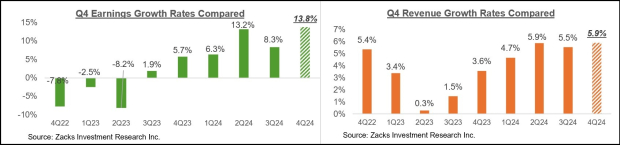

The comparability charts under put the This autumn earnings and income progress charges relative to different latest intervals for a similar group of index members.

Picture Supply: Zacks Funding Analysis

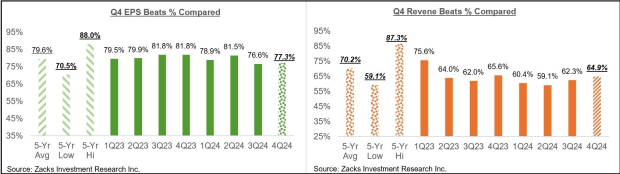

The comparability charts under put the This autumn EPS and income beats percentages relative to different latest intervals for a similar group of firms.

Picture Supply: Zacks Funding Analysis

Key Earnings Studies This Week

We’ve virtually 500 firms on deck to report outcomes this week, together with 78 S&P 500 members. Along with blue-chip gamers like McDonald’s, DuPont, Deere, Coke, CVS, and lots of others, we even have up-and-coming gamers like Shopify SHOP, Lyft LYFT, DoorDash DASH, and others reporting outcomes this week.

Shopify shares had been up following every of the final two quarterly releases and the inventory has achieved rather well over the previous 12 months, up +37.2% vs. +23% for the S&P 500 index and +37.2% for Amazon. Shopify is predicted to herald 44 cents in EPS on $2.72 billion in revenues, representing year-over-year good points of +29.4% and +27%, respectively.

Lyft shares had been up massive following the final quarterly launch on November 6th, however the inventory has virtually given again all these good points. Lyft shares have achieved higher than Uber over the previous 12 months, however have lagged the broader market. The chart under reveals the one-year efficiency of Lyft, Uber, DoorDash, and the S&P 500 index.

Picture Supply: Zacks Funding Analysis

The Earnings Large Image

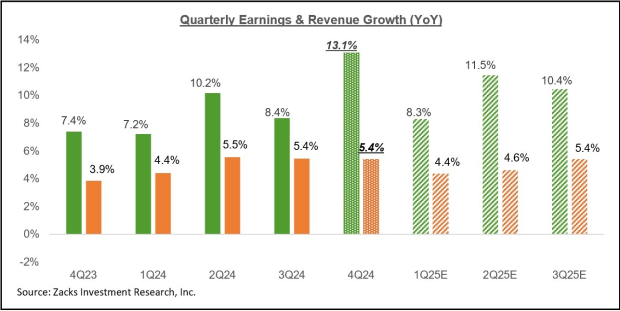

The chart under reveals the This autumn earnings and income progress expectations within the context of the place progress has been within the previous 4 quarters and what’s anticipated within the coming 4 quarters.

Picture Supply: Zacks Funding Analysis

Excluding the contribution from the Magazine 7 firms, This autumn earnings for the remainder of the S&P 500 index could be up +8.2% on +4.4% increased revenues.

The chart under reveals the general earnings image on a calendar-year foundation, with double-digit earnings progress anticipated in 2025 and 2026.

Picture Supply: Zacks Funding Analysis

For an in depth have a look at the general earnings image, together with expectations for the approaching intervals, please take a look at our weekly Earnings Developments report >>>> Mag 7 Members Report Strong Earnings, Double Down on CapEx

Simply Launched: Zacks High 10 Shares for 2025

Hurry – you possibly can nonetheless get in early on our 10 high tickers for 2025. Handpicked by Zacks Director of Analysis Sheraz Mian, this portfolio has been stunningly and constantly profitable. From inception in 2012 via November, 2024, the Zacks High 10 Shares gained +2,112.6%, greater than QUADRUPLING the S&P 500’s +475.6%. Sheraz has combed via 4,400 firms lined by the Zacks Rank and handpicked the perfect 10 to purchase and maintain in 2025. You possibly can nonetheless be among the many first to see these just-released shares with monumental potential.

Shopify Inc. (SHOP) : Free Stock Analysis Report

Lyft, Inc. (LYFT) : Free Stock Analysis Report

DoorDash, Inc. (DASH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.