Investing does not need to be arduous. If you do not have the time and temperament to learn monetary statements and hand-pick wonderful shares, you’ll be able to depend on exchange-traded funds (ETFs).

What appears to be like and seems like a single inventory ticker can signify an enormous portfolio of diversified investments, and these easy insta-portfolios are good for automated investing. The outcomes will be downright game-changing — particularly in case you discover an ETF with an extended historical past of market-beating returns — and minimal charges.

The Vanguard Progress ETF (NYSEMKT: VUG) is a kind of unbelievable set-and-forget ETFs. By the magic of constant funding and years of compound returns, a mere $100 monthly ought to offer you roughly $178,000 in two quick a long time.

This is how.

What’s the Vanguard Progress ETF?

Let’s begin with the growth-oriented Vanguard fund.

This index-tracker ETF checks each field on Vanguard founder Jack Bogle’s want listing.

- It is a passively managed fund, merely reflecting the quarterly adjustments made in an impartial market index. On this case, it is the CRSP US Giant Cap Progress Index.

- The index is kind of diversified. Designed to match the highest 85% of whole market capitalization amongst American shares within the “progress” class, the CRSP index presently reveals 199 names.

- Due to a extremely automated portfolio administration system, the ETF expenses annual administration charges of simply 0.04%. That is $4 out of each $10,000 you’ve got bought invested on this fund. The typical ETF available on the market right now carries annual charges of 0.5%, which is greater than tenfold Vanguard’s charge ratio.

The underlying index is weighted by market cap, giving heavier price-moving weight to bigger shares. As anticipated, the entire “Magnificent Seven” group of high-growth tech giants are discovered amongst this fund’s prime 8 holdings, interrupted solely by pharmaceutical big Eli Lilly. Should you’ve been on the lookout for a high-octane progress ETF with Vanguard’s legendary low-cost options, the aptly named Vanguard Progress ETF ought to match the invoice.

Can this ETF run with the massive canine?

It is an awesome performer, too.

The S&P 500 (SNPINDEX: ^GSPC) index has loved a compound common progress charge of 8% during the last 20 years. With reinvested dividends alongside the best way, the annual progress charge swells to 10.1%.

These are nice long-term outcomes, fully worthy of constructing an funding portfolio round. However they can not sustain with the Vanguard Progress ETF’s outcomes over the identical interval:

VUG Total Return Level knowledge by YCharts

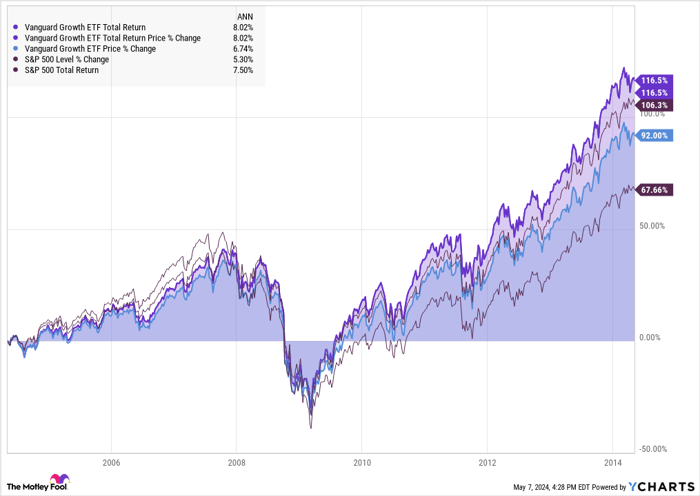

The expansion-oriented ETF lives as much as its title with a plain annual return of 10.3% in 20 years and a complete return charge of 11.5%. And it isn’t all about the recent artificial intelligence (AI) boom driving the expansion fund sharply larger. It additionally outperformed the S&P 500 between 2004 and 2014, albeit by a slimmer margin.

VUG Total Return Level knowledge by YCharts

Previous efficiency isn’t a assure of future winnings. Nonetheless, it is arduous to argue with the Vanguard Progress ETF’s observe file of strong long-term returns.

The magic of compound earnings over time

So what occurs in case you put $100 into the Vanguard Progress ETF each month, set the account to reinvest dividends into extra ETF shares, and depart this automated system alone for 20 years?

Truthfully, nothing however good issues.

By Might 2044, you should have added $24,000 to your chosen ETF. Doing it one small chunk at a time, I hope you barely missed one Benjamin a month within the grand scheme of household budgeting.

However these tons of began producing funding returns instantly, and the boosted funds added extra positive aspects on prime. It could not sound like a giant deal, however those compound returns add up over time. Assuming that the Vanguard Progress ETF stored up its established progress charge for an additional couple of a long time, you will have about $93,200 in your pocket.

Your invested {dollars} can have practically quadrupled through the years, and you’ll by no means have to choose a profitable inventory. Set it and neglect it, and let the mathematics of compound returns on regular investments do its magic. There shall be market dips and tech-innovation booms alongside the street, however all of them clean out to forgettable velocity bumps.

Day-to-day value adjustments do not matter so long as you are investing extra money out there over time. That is dollar-cost averaging at its most interesting.

And in case you can afford so as to add just a little extra money, your outcomes will rise. Double the funding charge to $200 a month and you will get roughly $196,400 as an alternative. Double the enter, double the anticipated output.

Once more, I am unable to assure that all the pieces will work out precisely this fashion — however luck favors the ready, and few long-term preparations can beat routinely setting apart a couple of dollars in an funding account.

Must you make investments $1,000 in Vanguard Index Funds – Vanguard Progress ETF proper now?

Before you purchase inventory in Vanguard Index Funds – Vanguard Progress ETF, take into account this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the 10 best stocks for traders to purchase now… and Vanguard Index Funds – Vanguard Progress ETF wasn’t one in every of them. The ten shares that made the minimize might produce monster returns within the coming years.

Take into account when Nvidia made this listing on April 15, 2005… in case you invested $1,000 on the time of our advice, you’d have $554,830!*

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of Might 6, 2024

Anders Bylund has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Vanguard Index Funds-Vanguard Progress ETF. The Motley Idiot has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.