Whereas most shares pay quarterly dividends, traders can nonetheless assemble a portfolio that permits them to receives a commission month-to-month.

How? Let me clarify –

The primary inventory pays dividends in January, April, July, and October. The second inventory pays out in February, Could, August, and November. And eventually, the third inventory pays its dividend in March, June, September, and December.

So, traders can reap regular month-to-month paydays with just a bit positioning.

A mixture of Coca-Cola KO, Caterpillar CAT, and McDonald’s MCD shares would offer exactly the mix wanted for this portfolio. Let’s take a better take a look at every one.

Coca-Cola

Coca-Cola is an American multinational company greatest recognized for its flagship Coca-Cola beverage. The corporate has seen its earnings outlook for its present and subsequent fiscal 12 months drift increased as of late, serving to land the inventory right into a Zacks Rank #2 (Purchase).

Reflecting an unparalleled dedication to shareholders, KO is a Dividend Aristocrat, a title held by firms with a minimal of 25+ consecutive years of elevated payouts. At present, Coca-Cola’s dividend yields 3.3% yearly, properly above the Zacks Shopper Staples sector common of three.1%.

The corporate’s shareholder-friendly nature is illustrated under.

Picture Supply: Zacks Funding Analysis

Caterpillar

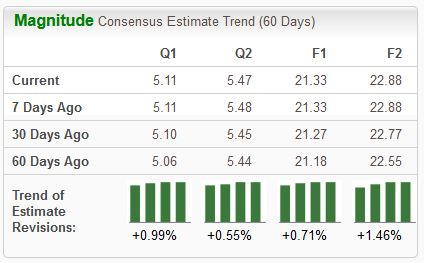

Caterpillar is the world’s largest development gear producer. We see its iconic yellow machines at practically each development web site. The corporate’s earnings outlook has inched increased throughout the board, reflecting optimism amongst analysts.

Picture Supply: Zacks Funding Analysis

Like KO, the corporate is a member of the elite Dividend Aristocrats group, with shares at present yielding 1.4% yearly. Whereas the present yield could also be on the decrease finish, Caterpillar’s 6.8% five-year annualized dividend progress price picks up the slack.

Picture Supply: Zacks Funding Analysis

McDonald’s

We’re all accustomed to the restaurant titan McDonald’s, seeing these golden arches at seemingly each cease. Analysts have develop into bullish on the corporate’s present 12 months outlook, with the $12.34 Zacks Consensus EPS estimate up practically 3% over the past 12 months and suggesting 3.3% progress.

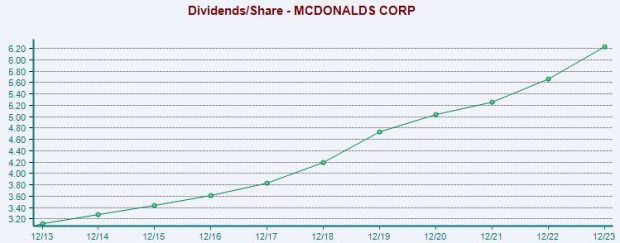

Picture Supply: Zacks Funding Analysis

MCD shares presently yield 2.5% yearly paired with a payout ratio sitting at 56% of the corporate’s earnings. Dividend progress has been strong, with MCD sporting a 7.4% five-year annualized dividend progress price. .

Picture Supply: Zacks Funding Analysis

Backside Line

Traders love dividends, as they supply a pleasant buffer in opposition to the affect of drawdowns in different positions and supply a passive earnings stream.

And whereas most firms pay their dividends on a quarterly foundation, traders can assemble a portfolio that permits for month-to-month payouts with only a little bit of positioning.

For these all for one of these portfolio, the mixture of all three shares above – Coca-Cola KO, Caterpillar CAT, and McDonald’s MCD – would offer the mandatory mix wanted.

Free Report – The Bitcoin Revenue Phenomenon

Zacks Funding Analysis has launched a Particular Report that can assist you pursue large earnings from the world’s first and largest decentralized type of cash.

No ensures for the long run, however prior to now three presidential election years, Bitcoin’s returns had been as follows: 2012 +272.4%, 2016 +161.1%, and 2020 +302.8%.

Zacks predicts one other important surge. Click on under for Bitcoin: A Tumultuous But Resilient Historical past.

Download Now – Today It’s FREE >>

Caterpillar Inc. (CAT) : Free Stock Analysis Report

CocaCola Company (The) (KO) : Free Stock Analysis Report

McDonald’s Corporation (MCD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.