Procter & Gamble (NYSE: PG) is the most important family and private merchandise firm by market cap within the U.S. It has dozens of manufacturers spanning a number of daily-use classes, together with household care, house merchandise, hair and grooming wants, oral hygiene, child care, female merchandise, skincare, and extra.

P&G has traditionally been an ultra-reliable dividend inventory. With 68 consecutive years of dividend will increase, it is without doubt one of the longest-tenured Dividend Kings. It’s also the oldest part of the Dow Jones Industrial Common, having joined the index in 1932.

Begin Your Mornings Smarter! Get up with Breakfast information in your inbox each market day. Sign Up For Free »

However gross sales progress has slowed. And final quarter (the interval from July by September 2024), quantity progress was flat.

This is what to look at when administration stories 2025 second-quarter earnings on Jan. 22 — and whether or not the dividend inventory is a purchase now.

Picture supply: Getty Photos.

P&G is not on the high of its recreation

P&G’s final report wasn’t nice. The patron items firm kicked off fiscal 2025 with simply 2% natural gross sales progress and, as talked about, flat quantity progress. Its magnificence and grooming segments noticed a adverse 3% change in product combine.

Combine refers to purchaser conduct tendencies inside a class. A optimistic combine reveals that customers are gravitating towards dearer choices, whereas a adverse combine reveals a shift to worth.

The corporate has a various lineup of manufacturers inside a number of classes, making it properly positioned to retain prospects at the same time as they shift preferences. However nonetheless, a adverse combine in key classes is an indication that customers are tightening spending.

P&G’s full-year forecast can also be pretty weak. It sees 2% to 4% gross sales progress, 5% to 7% core earnings per share (EPS) progress, and 10% to 12% diluted EPS progress.

EPS outpacing income progress is a good signal as a result of it signifies pricing energy and robust margins. The corporate’s EPS progress additionally advantages from constant inventory repurchases. Over the past decade, P&G has spent over $146 billion on dividends and buybacks.

Administration additionally does an excellent job changing earnings to free money move (FCF). As you possibly can see within the following desk, the corporate usually grows earnings quicker than natural gross sales and is changing most of its earnings, if not all, to FCF.

|

Metric |

Fiscal 2019 |

Fiscal 2020 |

Fiscal 2021 |

Fiscal 2022 |

Fiscal 2023 |

Fiscal 2024 |

|---|---|---|---|---|---|---|

|

Natural gross sales progress |

5% |

6% |

6% |

7% |

7% |

4% |

|

Core EPS progress |

7% |

13% |

11% |

3% |

2% |

12% |

|

Foreign money impartial core EPS progress |

15% |

17% |

11% |

5% |

11% |

16% |

|

Adjusted free money move productiveness |

105% |

114% |

107% |

93% |

95% |

105% |

Knowledge supply: Procter & Gamble November 2024 investor presentation.

Adjusted FCF productiveness is calculated by dividing FCF by web earnings. It helps gauge the affordability of P&G’s capital return program (dividends and share buybacks) and if the corporate has further money out there to fund acquisitions or reinvest within the enterprise.

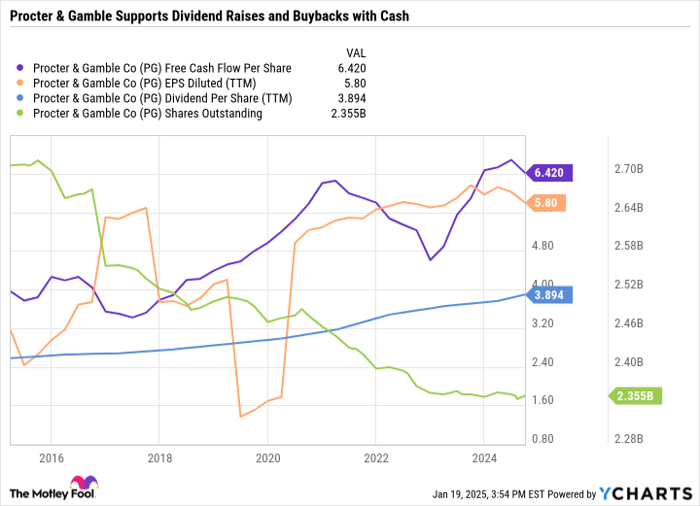

As you possibly can see within the following chart, P&G’s FCF per share usually exceeds EPS.

PG free cash flow per share, information by YCharts; TTM = trailing 12 months.

This implies it could possibly simply afford its rising dividend with money and nonetheless have dry powder left to repurchase inventory — which is why its excellent share rely has constantly ticked down 12 months after 12 months. P&G’s long-term targets name for natural gross sales progress forward of the market common, core EPS progress within the mid to excessive single digits, and adjusted FCF productiveness of at the very least 90%.

The less the excellent shares, the larger the EPS, which makes P&G a greater worth for long-term buyers.

Room for enchancment

The principle factor to look at for in P&G’s upcomingearnings callis quantity progress. The corporate has proved time and time once more that it could possibly develop earnings quicker than gross sales progress. However with out quantity progress, P&G faces an uphill climb to make good on full-year expectations.

The corporate additionally faces vital foreign money threat, given its world publicity. When P&G sells merchandise in a overseas foreign money, it should convert these earnings again into U.S. {dollars} when it stories earnings. So, a powerful greenback dilutes the worth of worldwide gross sales.

To offset a difficult demand cycle, the corporate will seemingly proceed leaning on its “noticeable superiority” big-picture technique, which requires superior merchandise, packaging, model communication (by advertising and marketing efforts), and retail execution, which conveys higher worth for purchasers and helps P&G justify worth will increase.

Nevertheless, within the close to time period, the largest profit for P&G can be a rebound in its weakest areas. Over the past 4 quarters, Higher China, Asia, the Center East, and Africa — which make up 15% of whole firm gross sales — noticed a 7.5% decline in natural gross sales progress, whereas the opposite 85% of the enterprise noticed 4.8% natural gross sales progress. If you happen to take out these underperforming areas, the enterprise is doing much better than it seems at first look.

Traders ought to be aware of administration’s commentary on these underperforming areas within the upcomingearnings name Financial challenges and foreign money headwinds are eroding the corporate’s pricing energy in these underperforming areas. So, any enchancment would go a great distance for the broader enterprise.

P&G stays a stable earnings inventory

P&G is down over 10% from its all-time excessive reached on Nov. 27. However the inventory isn’t cheap by any means, with a 27.8 price-to-earnings ratio (P/E) and a 23.3 ahead P/E. Nevertheless, it isn’t a foul purchase for buyers in search of an ultra-safe type of passive earnings: The Dow inventory yields a good 2.5%. However as talked about, it generates a ton of FCF, supporting dividend raises and buybacks.

The outcomes do not look nice at first look. However as soon as factoring within the big headwind from China, Asia, the Center East, and Africa, the enterprise is doing very properly even in a difficult working surroundings.

P&G continues to show why it’s the undisputed chief throughout a number of key daily-use client classes. The inventory stays a good purchase now — however not a screaming purchase till it could possibly overcome the mentioned challenges.

Must you make investments $1,000 in Procter & Gamble proper now?

Before you purchase inventory in Procter & Gamble, contemplate this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the 10 best stocks for buyers to purchase now… and Procter & Gamble wasn’t considered one of them. The ten shares that made the lower might produce monster returns within the coming years.

Contemplate when Nvidia made this checklist on April 15, 2005… for those who invested $1,000 on the time of our suggestion, you’d have $843,960!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of January 13, 2025

Daniel Foelber has no place in any of the shares talked about. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.