Whirlpool‘s (NYSE: WHR) 6.8% dividend yield attracts high-yield traders in search of passive earnings, and its positioning as a inventory to learn from a decrease rate of interest setting makes it appropriate for worth traders keen to take a contrarian view. Does it add as much as make the inventory a purchase? Here is what it’s worthwhile to know.

Whirlpool’s challenges and alternatives

Final 12 months hasn’t gone as administration anticipated, and it is no shock the inventory was down greater than 15% in that timeframe. The Federal Reserve took longer than many, together with Whirlpool’s administration, anticipated to begin chopping rates of interest, and the enduringly excessive rates of interest all year long have pressured the housing market and, in flip, demand for main home home equipment.

The affect on Whirlpool’s enterprise has been noticeable. Administration continues to count on like-for-like gross sales to be flat on 2023. Nonetheless, it diminished its full-year earnings earlier than curiosity and taxation (EBIT) margin steering attributable to weaker end-market circumstances. Having began the 12 months forecasting an ongoing EBIT margin of 6.8%, administration lowered expectations to six% on theearnings callin July, and lately reaffirmed the 6% full-year EBIT steering on the third-quarterearnings name

Why Whirlpool’s margins have come beneath strain

As famous above, the underlying gross sales steering has remained unchanged, however margin steering has weakened. There are just a few causes for this. First, Whirlpool’s promotional exercise over final winter and spring failed to realize the supposed traction, as its promotions couldn’t spur elevated gross sales. As such, administration raised pricing on its promotions by 5% in Could — an exercise that might assist margins later within the 12 months.

Picture supply: Getty Photos.

Second, comparatively excessive rates of interest have pressured higher-margin discretionary purchases, reminiscent of these related to fitted kitchens and bogs, the place customers have a tendency to purchase comparatively extra premium merchandise. As such, the gross sales combine has shifted towards the lower-margin alternative gross sales market, the place customers have a tendency to exchange a damaged fridge or washer.

Third, administration began the 12 months anticipating $300 million to $400 million in value cuts, however began strolling again this determine to the low finish of the vary in April attributable to persistent inflation in its provide chain prices, after which confirmed in October that the full-year goal was for $300 million.

Will Whirlpool hit its full-year steering?

Frankly, I believe there is a good likelihood it can miss its steering. The reason being that, regardless of sustaining its total headline steering on the third quarterearnings name administration continues to stroll again expectations for its full-year steering in its most vital phase, MDA North America.

Picture supply: Getty Photos.

Administration began the 12 months forecasting a full-year MDA North America EBIT margin of 9% and a fourth-quarter EBIT margin of 10% to 11%. That steering was walked again to 7% for the complete 12 months and a fourth-quarter margin of 9% on the second-quarterearnings name Come the current third-quarterearnings name MDA North America’s EBIT margin steering is now 8% to 9%, in line with CEO Marc Bitzer. If the fourth-quarter MDA North America steering is being walked again, you possibly can assume the full-year steering can also be beneath menace.

As well as, CFO Jim Peters famous on the recentearnings name “we’re seeing additional deterioration within the underlying discretionary demand than what we skilled within the first half of 2024.”

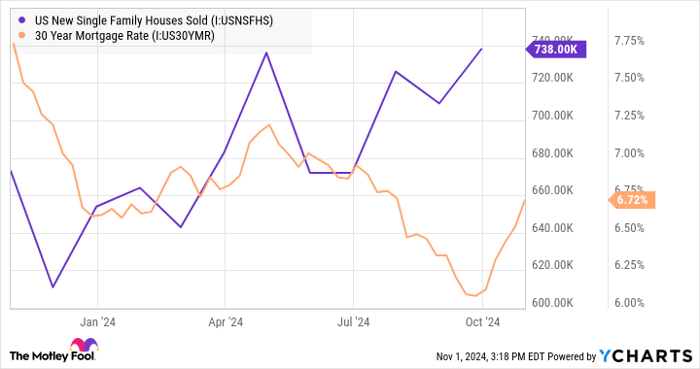

Lastly, as you possibly can see beneath, new home gross sales (good for discretionary spending on MDAs) did reply positively to the drop in rates of interest from July to October. Nonetheless, the current rise in charges might trigger an adversarial response.

US New Single Family Houses Sold information by YCharts

A inventory to purchase?

All of this is not to argue that Whirlpool is not a great worth inventory. Frankly, even when it misses its full-year steering by a small quantity, the inventory will stay at a great worth. Wall Road forecasts $11.88 in earnings per share for 2024, placing Whirlpool at simply 8.7 instances earnings this 12 months.

As such, it appears to be like like there’s some margin for error right here. With that strategy, Whirlpool is secure to purchase, it has good progress prospects in 2025, and the rate of interest setting will possible favor it. Nonetheless, do not buy the inventory if you cannot tolerate near-term danger, as a result of assembly its full-year steering will not be a stroll within the park.

Do you have to make investments $1,000 in Whirlpool proper now?

Before you purchase inventory in Whirlpool, think about this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the 10 best stocks for traders to purchase now… and Whirlpool wasn’t one among them. The ten shares that made the minimize may produce monster returns within the coming years.

Think about when Nvidia made this listing on April 15, 2005… for those who invested $1,000 on the time of our advice, you’d have $829,746!*

Inventory Advisor gives traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of November 4, 2024

Lee Samaha has no place in any of the shares talked about. The Motley Idiot recommends Whirlpool. The Motley Idiot has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.