The Nasdaq is up 15% with the center of February. Wall surface Road’s danger hunger expands as financiers cost in cooling down rising cost of living and also a near-term profits base. Tesla, Nvidia, Meta Operatings Systems, and also others have all skyrocketed over 50% to begin 2023.

The tech-heavy index is currently easily back over both its 50-day and also 200-day relocating standards (and also its 50-week and also 200-week). And also, the Nasdaq still trades concerning 25% listed below its heights and also innovation will certainly undeniably continue controling our lives and also the economic climate.

Still, some financiers may be worried to chase after these supplies, and also probably truly so, as their assessments obtain extended better. Fortunately, several solid innovation supplies have actually underperformed the Nasdaq and also the S&P 500 YTD and also aren’t yet overheated.

Both supplies we study today run instead special companies within the larger innovation environment that must assist them remain to increase for many years to find.

Both supplies are additionally monetarily audio and also rest at rather eye-catching access factors that must assist financiers with lasting perspectives really feel comfy acquiring also if the marketplace and also technology supplies encounter near-term marketing stress after the big rally.

Intuit Inc. (INTU) and also Garmin Ltd. (GRMN) both report their profits outcomes throughout the week of February 20.

Allow’s study why financiers could wish to get these supplies, or a minimum of place them on their watchlists to scoop up depending upon just how their records and also advice clean.

Photo Resource: Zacks Financial Investment Research Study

Intuit Inc. ( INTU) — (Records Q2 FY23 Outcomes on Feb. 23)

Intuit is the software application titan behind TurboTax, in addition to numerous bookkeeping software application, and also local business finance devices. Intuit invested the last a number of years growing its lineup to make it much more eye-catching to a broader swath of customers and also company customers. INTU purchased Credit history Fate in December 2020 and also Mailchimp in November 2021.

Along with TurboTax, bookkeeping, and also various other monetary solutions, Inuit currently supplies e-mail advertising, digital-ad solutions, customer-relationship-management devices, credit report, and also various other individual monetary solutions. Intuit, which presently flaunts over 100 consumers worldwide, expanded its income in between 11% and also 32% throughout the previous 7 years and also published just 2 small YoY sales dips over the last 25 years.

Photo Resource: Zacks Financial Investment Research Study

Zacks approximates ask for Intuit’s sales to climb up one more 11% in both FY23 and also FY24 to assist raise its modified EPS by 15% and also 13%, specifically. Intuit’s regular double-digit development highlights just how crucial its software application is and also every person understands tax obligations, bookkeeping, and also advertising aren’t going anywhere regardless of what the future holds.

INTU lands a Zacks Ranking # 3 (Hold) and also its profits expectation has actually stood up instead well. It additionally flaunts a solid background of profits beats.

Intuit has actually conveniently increased the Zacks technology market over the last ten years, up 515% vs. 210%. Intuit’s outperformance is a lot more noticable throughout the last two decades, surprising Microsoft and also others. Intuit obtained struck difficult together with all points development, with it trading 40% from its heights.

INTU is up about 6% YTD to assist it climb up over its 50-day and also 200-day. INTU is additionally resting right at neutral RSI degrees also as the Teslas of the globe reach overbought area. Intuit trades at 43.1 X ahead profits. This is barely affordable, yet it matches its very own eight-year typical and also notes a 50% discount rate to its very own highs.

Photo Resource: Zacks Financial Investment Research Study

The software application power has a solid annual report, pays a reward, which it increased by 15% last summertime, and also it had $3 billion staying on its share bought program at the end of last quarter.And Wall surface Road stays exceptionally favorable on the supply, with 16 of the 18 brokerage firm referrals Zacks contends “Solid Buys.”

Garmin Ltd. ( GRMN) — (Records Q4 FY22 Outcomes on Feb. 22)

Garmin is most likely best understood for its consumer-centric general practitioner systems, having actually gone to the cutting-edge of the modern-day consumer-focused general practitioners activity and also market for many years. The company’s in-car navigating systems, physical fitness wearables, smartwatches, and also much more are staples in our linked globe. Garmin additionally makes much more sophisticated offerings that go method past the day-to-day customer.

Garmin offers premium fish finders, progressed radars and also systems for planes and also watercrafts. GRMN also has offers to provide scientific research fiction-sounding technology to flying taxis firms.

The Switzerland-based company’s varied and also engaging offerings assisted GRMN article six-straight years of income development, with double-digit growth in the tracking 3 years. Monetary 2021 was Garmin’s finest receiving over a years, uploading 19% income growth.

Photo Resource: Zacks Financial Investment Research Study

The boom times could not take place permanently and also the company is taking its swellings as its sales “remain to stabilize complying with 2 years of pandemic-driven development.” Garmin’s changed 2022 profits are predicted to slide 15% YoY as it meets a really tough to complete versus stretch on 3% reduced income that would certainly see it strike $4.85 billion (vs. $3.35 billion in FY18).

Garmin is after that predicted to recuperate and also publish 4% greater sales in FY23 to leading FY21 and also 6% more powerful profits. Garmin’s profits alterations have actually stood up well lately to assist it land a Zacks Ranking # 2 (Buy) right now. GRMN has actually covered our EPS price quotes for almost 5 years running beyond one tiny miss out on.

GMRN flaunts a solid annual report with $7.62 billion in properties, consisting of $1.5 billion in cash money and also matchings and also just $1.75 billion in responsibilities.

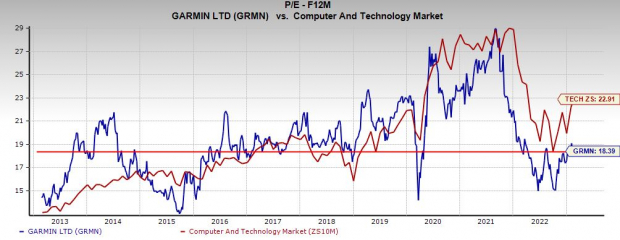

Photo Resource: Zacks Financial Investment Research Study

GRMN shares have actually climbed up 180% in the previous ten years to a little exceed the S&P 500. Regardless of the lasting toughness, Garmin presently trades 45% under its all-time highs at around $97 per share. Garmin has actually stood out 6% YTD and also it lately located assistance at its 50-day relocating standard.

The marketing, combined with Garmin’s steady expectation has it trading listed below its 10-year typical at 18.4 X ahead profits. And also, Garmin’s reward returns 3% and also it trades 16% underneath its ordinary Zacks cost target.

Facilities Supply Boom to Move America

A large press to restore the falling apart united state framework will certainly quickly be underway. It’s bipartisan, immediate, and also unpreventable. Trillions will certainly be invested. Lot of money will certainly be made.

The only inquiry is “Will you get involved in the best supplies early when their development capacity is best?”

Zacks has actually launched an Unique Record to assist you do simply that, and also today it’s totally free. Discover 5 unique firms that seek to get one of the most from building and construction and also fixing to roadways, bridges, and also structures, plus freight transporting and also power makeover on a virtually unthinkable range.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>

Garmin Ltd. (GRMN) : Free Stock Analysis Report

Intuit Inc. (INTU) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights and also viewpoints revealed here are the sights and also viewpoints of the writer and also do not always mirror those of Nasdaq, Inc.