After Alphabet’s GOOGL exhilarating quarterly outcomes final week, Wall Avenue will likely be eying its huge tech peer and cloud computing rival Amazon’s AMZN Q1 report on Tuesday, April 30.

Extra so than Alphabet, Amazon’s inventory has been on an ascending course to hit $200 a share after their 20-for-1 inventory splits in 2022 and buyers could also be questioning if it is time to purchase as earnings strategy.

Q1 Preview

Amazon’s Q1 earnings are thought to come back in at $0.81 per share which might be a 161% enhance from $0.31 a share within the comparative quarter. On the highest line, Q1 gross sales are projected to rise 12% to $142.55 billion.

Notably, Amazon has exceeded the Zacks EPS Consensus for 5 consecutive quarters and has posted a formidable common earnings shock of 51.04% in its final 4 quarterly experiences. Moreover, the Zacks Anticipated Shock Prediction (ESP) signifies Amazon might exceed earnings expectations once more with the Most Correct Estimate having Q1 EPS at $0.87 and seven% above the Zacks Consensus.

Picture Supply: Zacks Funding Analysis

Cloud Enlargement

Outdoors of its commanding e-commerce enterprise, Amazon’s AWS nonetheless controls the first share of the home cloud computing market forward of Microsoft’s MSFT Azure and Alphabet’s Google Cloud. In accordance with Zacks estimates, AWS phase gross sales are anticipated to rise 13% to $24.25 billion versus $21.35 billion in Q1 2023.

Edging In direction of $200 a Share

Amazon’s inventory has risen +19% this yr with a present inventory value of $180 a share and has matched Alphabet’s YTD efficiency with GOOGL having a present value of $166. Over the past yr, AMZN has now soared +77% to barely prime GOOGL at +55%.

Picture Supply: Zacks Funding Analysis

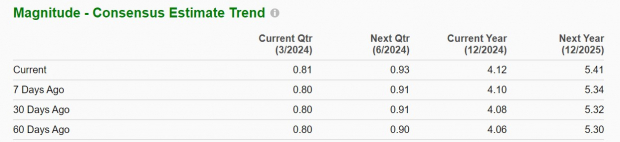

Earnings Estimate Revisions

The catalyst for Amazon’s inventory edging nearer to $200 a share has been the optimistic pattern of earnings estimate revisions. Over the past 60 days, fiscal 2024 and FY25 EPS estimates have now risen 1% and a pair of% respectively, and are barely up within the final week.

Even higher, Amazon’s annual earnings are presently projected to rise 42% this yr to $4.12 per share with one other 31% EPS development anticipated in FY25.

Picture Supply: Zacks Funding Analysis

Takeaway

Amazon’s inventory presently sports activities a Zacks Rank #2 (Purchase). To that time, the pattern of optimistic earnings estimate revisions forward of its Q1 report is compelling together with the Zack ESP suggesting the Magnificent Seven titan ought to prime backside line expectations.

Solely $1 to See All Zacks’ Buys and Sells

We’re not kidding.

A number of years in the past, we shocked our members by providing them 30-day entry to all our picks for the whole sum of solely $1. No obligation to spend one other cent.

1000’s have taken benefit of this chance. 1000’s didn’t – they thought there should be a catch. Sure, we do have a purpose. We would like you to get acquainted with our portfolio companies like Shock Dealer, Shares Underneath $10, Expertise Innovators,and extra, that closed 228 positions with double- and triple-digit good points in 2023 alone.

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.