Several technology supplies have actually seen a solid beginning to 2023 with the Nasdaq up +11% year to day to cover the more comprehensive S&P 500’s +5%.

This might have several financiers asking yourself if huge technology supplies like Apple ( AAPL), Alphabet ( GOOGL), as well as Amazon.com ( AMZN) can have prolonged rallies. Allow’s see if it’s time to acquire these technology titans’ supplies for 2023 as well as past.

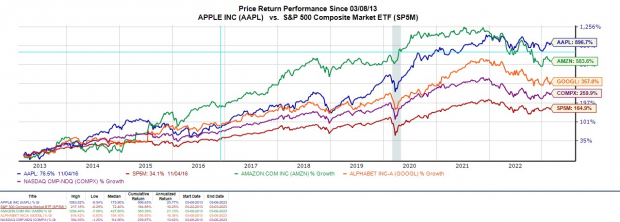

Efficiency

With high rising cost of living still widespread in the existing financial atmosphere financiers will certainly wish to check the appraisal as well as costs they are spending for technology supplies. This is specifically real after prolonged rallies as a greater inflationary atmosphere is testing for the majority of innovation business.

Photo Resource: Zacks Financial Investment Study

Still, Apple supply is up +18% this year with Amazon.com up +11% as well as Alphabet up +8% to all surpass the S&P 500 with only shares of GOOGL routing the Nasdaq. Over the last years, Apple’s +897% has actually led these huge technology peers, yet Amazon.com’s +583% as well as Alphabet’s +357% have actually likewise exceeded the more comprehensive indexes.

Photo Resource: Zacks Financial Investment Study

Appraisal

In spite of Alphabet supply routing the Nasdaq’s efficiency until now this year its appraisal is a lot more interesting than Apple as well as Amazon.com from a price-to-earnings point of view. Alphabet supply professions at $95 as well as 17.6 X ahead incomes which is perfectly listed below its market standard of 25X as well as the S&P 500’s 18.1 X. Shares of GOOGL likewise trade 44% listed below its decade-long high of 31.6 X as well as at a 29% discount rate to the average of 24.7 X.

Photo Resource: Zacks Financial Investment Study

Rotating to Apple, shares of AAPL profession at $155 per share at 23.9 X ahead incomes as well as over the criteria’s 18.1 X. Nonetheless, Apple trades on the same level with its market standard as well as listed below its years high of 33.6 X yet over the average of 14.9 X.

Amazon.com supply likewise trades over the criteria’s P/E appraisal at 65.1 X ahead incomes as well as $93 per share. Amazon.com does trade well listed below its very own decade-long high of 612X as well as at a 31% discount rate to the average of 93.2 X yet well over its market standard of 32.2 X.

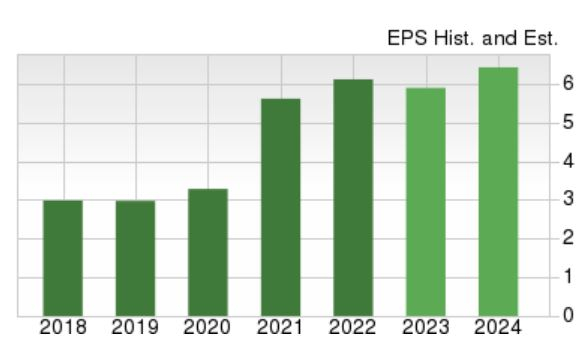

EPS Development

In addition to appraisal, keeping track of the development of Apple, Alphabet, as well as Amazon.com will certainly be necessary at their fully grown phases in business life.

To that note, Apple supply sticks out showing off an “A” Zacks Design Ratings quality for Development as well as a greater EPS number forecasted in its overview than Alphabet as well as Amazon.com. Apple’s financial 2023 incomes are forecasted to dip -1% this year yet rebound as well as dive 10% in FY24 at $6.68 per share. Extra excellent, financial 2024 would certainly stand for 125% EPS development over the last 5 years with 2019 incomes at $2.97 per share.

Photo Resource: Zacks Financial Investment Study

Alphabet as well as Amazon.com’s expectations are appealing in their very own right, with both lugging a “B” Design Ratings quality for Development. Alphabet’s incomes are anticipated to increase 12% in FY23 as well as jump an additional 21% in FY24 at $6.19 per share. Financial 2024 would certainly stand for 140% EPS development over the last 5 years with 2019 incomes at $2.58 per share.

Photo Resource: Zacks Financial Investment Study

Last but not least, Amazon.com’s incomes are anticipated to climb up 89% this year as well as dive an additional 59% in FY24 at $2.13 per share. Financial 2024 would certainly stand for 85% development over the last 5 years with 2019 EPS at $1.15.

Photo Resource: Zacks Financial Investment Study

Profits

Apple, Alphabet, as well as Amazon.com supply all land a Zacks Ranking # 3 (Hold) currently. In spite of more comprehensive financial worries still quite widespread as well as difficult on innovation business, their supplies trade beautifully about their past from a P/E appraisal viewpoint in addition to strong EPS development anticipated.

In the meantime, hanging on to these special as well as ingenious technology titans at their existing degrees can be gratifying lasting specifically when considering their historic efficiencies.

5 Supplies Ready To Dual

Each was handpicked by a Zacks specialist as the # 1 preferred supply to acquire +100% or even more in 2021. Previous suggestions have actually skyrocketed +143.0%, +175.9%, +498.3% as well as +673.0%.

A lot of the supplies in this record are flying under Wall surface Road radar, which supplies a terrific chance to participate the very beginning.

Today, See These 5 Potential Home Runs >>

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as point of views shared here are the sights as well as point of views of the writer as well as do not always show those of Nasdaq, Inc.