Together with its Magnificent Seven peer Amazon AMZN, Apple AAPL highlighted every week that noticed a pleasant rally in broader markets after Fed Chair Jerome Powell dismissed the opportunity of price hikes on Wednesday.

Including momentum to the market, Apple was capable of exceed quarterly expectations for its fiscal second quarter yesterday night and announcied a rise in its dividend and inventory buybacks.

Q2 Monetary Highlights

Income data in additional than a dozen international locations helped Apple put up an all-time excessive for Q2 EPS at $1.53 which edged estimates of $1.51 a share and rose a proportion level from the comparative quarter. Canada, Latin America, and the Center East have been among the worldwide segments that noticed report development with Q2 gross sales of $90.75 billion beating estimates by 1% regardless of reducing from $94.83 billion a 12 months in the past.

Notably, Apple has exceeded prime and bottom-line expectations for 5 consecutive quarters posting a median earnings shock of 4.14% in its final 4 quarterly reviews.

Picture Supply: Zacks Funding Analysis

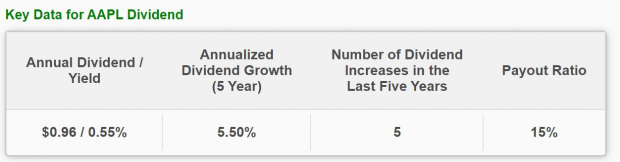

Dividend Enhance & Inventory Buybacks

Apple’s board licensed an extra $110 billion for share repurchases given continued confidence in its enterprise because the tech large goals to be cash-neutral. Moreover, Apple can be elevating its dividend by 4% to $0.25 per share (quarterly) and is planning for extra annual payout will increase going ahead.

Picture Supply: Zacks Funding Analysis

Development Trajectory

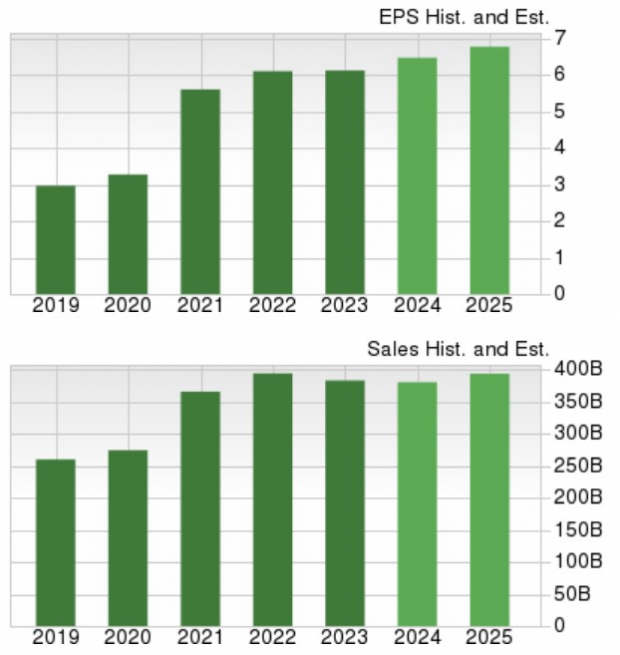

Primarily based on Zacks estimates, Apple’s annual earnings at the moment are anticipated to be up 6% in fiscal 2024 and are projected to rise one other 8% in FY25 to $7.10 per share. Complete gross sales are forecasted to be nearly flat this 12 months however are projected to rise 5% in FY25 to $403.72 billion.

Picture Supply: Zacks Funding Analysis

Takeaway

Apple’s inventory at the moment lands a Zacks Rank #3 (Maintain). To that time, Apple seems to be pushing previous home monopoly issues and regulatory points in China by increasing in different overseas markets though there might nonetheless be higher shopping for alternatives forward.

Highest Returns for Any Asset Class

It’s not even shut. Regardless of ups and downs, Bitcoin has been extra worthwhile for buyers than some other decentralized, borderless type of cash.

No ensures for the longer term, however up to now three presidential election years, Bitcoin’s returns have been as follows: 2012 +272.4%, 2016 +161.1%, and 2020 +302.8%. Zacks predicts one other important surge in months to return.

Hurry, Download Special Report – It’s FREE >>

Apple Inc. (AAPL) : Free Stock Analysis Report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.