High egg rates have actually been extremely valuable to Cal-Maine Foods tranquility as the biggest manufacturer as well as supplier of covering eggs in the USA.

Cal-Maine supply has actually rallied after squashing its monetary third-quarter profits assumptions on Tuesday. Allow’s see if financiers ought to acquire right into the rally with shares of tranquility up 9% complying with the outstanding Q3 outcomes.

Q3 Testimonial

Cal-Maine was anticipated to have a solid quarter with the typical price of a lots eggs still over $4 according to the most recent CPI numbers. Still, Cal-Maine’s profits was extra excellent than lots of experts thought of defeating EPS price quotes by 30% at $6.62 contrasted to assumptions of $5.09 per share.

Year over year, third-quarter profits were up an astonishing 717% with EPS at $0.81 in Q3 2022. On the leading line, sales greater than increased to $997.5 million from $447.5 million in the previous year quarter.

In addition to high rising cost of living, the HPAI epidemic (Bird Influenza) remained to trigger a lack in egg products throughout the quarter. While Cal-Maine has actually had the ability to gain from the supply lack financiers will certainly wish to check the business’s development as this operating setting has actually been testing regardless of the business’s current success.

Photo Resource: Zacks Financial Investment Research Study

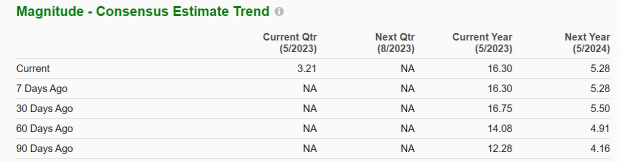

Incomes Expectation

According to Zacks approximates Cal-Maines profits are currently anticipated to skyrocket 499% this year at $16.30 per share contrasted to EPS of $2.72 in 2022. Monetary 2024 profits are predicted to go down -67% to $5.28 per share following what will certainly be an extremely difficult to complete versus year.

Incomes estatmite alterations have actually continued to be a lot greater throughout the quarter however have actually a little decreased over the last one month although this might alter as expert absorb Cal-Maine’s Q3 outcomes.

Photo Resource: Zacks Financial Investment Research Study

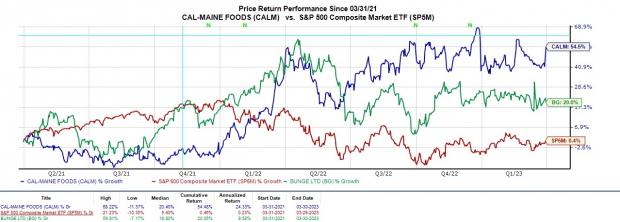

Efficiency & & Assessment

Year to day, Cal-Maine supply is up +9% to defeat the S&P 500’s +5%, the Agriculture-Products Markets -1%, as well as fellow market titan Bunge Limited’s ( BG) -4%. A lot more Remarkable, shares of tranquility are currently up +54% over the last 2 years to mainly outshine the criteria, Bunge Limited, as well as its Zacks Subindustyr’s -2%.

Photo Resource: Zacks Financial Investment Research Study

Trading around $59 per share as well as 9% from its 52-week highs Cal-Maine supply professions at simply 3.5 X ahead profits. This is perfectly underneath its market standard of 10.7 X as well as the S&P 500’s 18.5 X.

Also much better, shares of tranquility profession well listed below their years high of 258.8 X as well as at an 87% price cut to the typical of 29.3 X.

Takeaway

Cal-Maine Foods supply absolutely looks underestimated based upon its profits overview as well as P/E evaluation. Nevertheless, the marketplace is progressive as well as has a tendency to rate in upcoming aspects such as the reliability that egg rates will certainly not stay this high as rising cost of living starts to relieve which supply will be recovered as soon as the HPAI epidemic subsides.

To that factor, Cal-Maine Foods supply lands a Zacks Ranking # 3 (Hold). While there might absolutely be extra upside in shares of tranquility there might additionally be far better acquiring possibilities after one of the most current rally.

Is THIS the Ultimate New Clean Power Resource? (4 Ways to Earnings)

The globe is significantly concentrated on getting rid of nonrenewable fuel sources as well as increase use eco-friendly, tidy power resources. Hydrogen gas cells, powered by the most bountiful material in deep space, might supply an endless quantity of ultra-clean power for several sectors.

Our immediate unique record exposes 4 hydrogen supplies topped for large gains – plus our various other leading tidy power supplies.

Cal-Maine Foods, Inc. (CALM) : Free Stock Analysis Report

Bunge Limited (BG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as point of views shared here are the sights as well as point of views of the writer as well as do not always mirror those of Nasdaq, Inc.