Crocs CROX inventory has highlighted this week’s earnings lineup after crushing Q1 earnings expectations on Tuesday. The footwear and attire chief has seen its inventory soar over +40% this yr to impressively outpace the broader indexes and lots of noteworthy friends akin to Guess GES and Ralph Lauren RL.

That stated, let’s see if it is nonetheless value holding or shopping for Crocs inventory after the corporate’s spectacular Q1 outcomes.

Picture Supply: Zacks Funding Analysis

Sturdy Q1 Outcomes

Crocs model progress stays compelling as Q1 gross sales rose 6% yr over yr to $938.63 million which beat estimates of $883.85 million by 6% as properly. Even higher was Crocs elevated profitability with earnings of $3.02 per share rising 16% from the prior yr quarter and crushing EPS estimates of $2.25 by 34%.

Extra spectacular, Crocs has now surpassed prime and backside line expectations for 16 consecutive quarters and has posted a mean earnings shock of 17% in its final 4 quarterly experiences.

Picture Supply: Zacks Funding Analysis

Development & Outlook

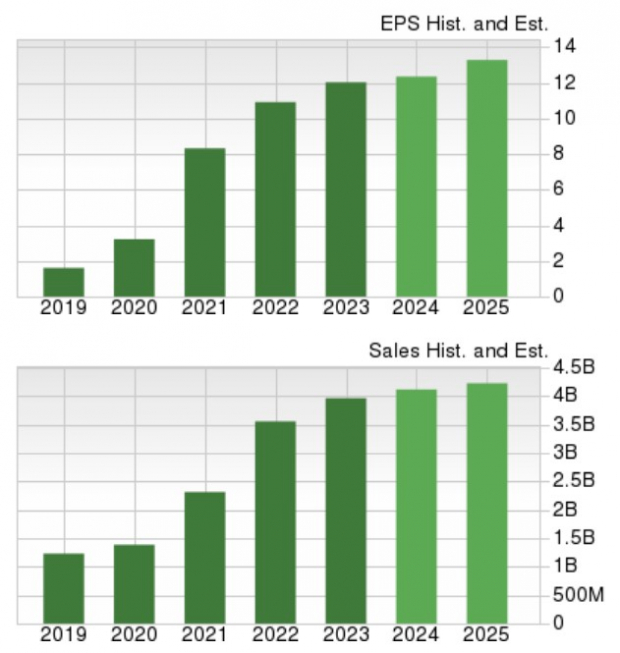

In accordance with Zacks estimates, Crocs’ annual earnings are actually anticipated to rise 3% in fiscal 2024 and are projected to broaden one other 9% in FY25 to $13.56 per share. Complete gross sales are forecasted to broaden 4% this yr and are anticipated to rise one other 6% in FY25 to $4.37 billion.

Picture Supply: Zacks Funding Analysis

Enticing P/E Valuation

Regardless of the unbelievable year-to-date rally in Crocs inventory, CROX nonetheless trades at simply 10.9X ahead earnings. This can be a slight low cost to the Zacks Textile-Attire Trade common of 12.5X and Ralph Lauren’s 14.8X whereas being simply above the P/E valuation of Guess at 9.1X.

Picture Supply: Zacks Funding Analysis

Backside Line

For the time being Crocs inventory lands a Zacks Rank #3 (Maintain). Given the corporate’s progress trajectory and valuation stays enticing, holding CROX could proceed to repay though there could possibly be higher shopping for alternatives after such a blazing begin to the yr.

High 5 Dividend Shares for Your Retirement

Zacks targets 5 well-established corporations with stable fundamentals and a historical past of elevating dividends. Extra importantly, they’ve the sources and can to possible pay them sooner or later.

Click on now for a Particular Report filled with unconventional knowledge and insights you merely received’t get out of your neighborhood monetary planner.

See our Top 5 now – the report is FREE >>

Crocs, Inc. (CROX) : Free Stock Analysis Report

Ralph Lauren Corporation (RL) : Free Stock Analysis Report

Guess?, Inc. (GES) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.