As we begin profits period a couple of premier Zacks supplies have actually currently reported today. Amongst them, Fastenal ( QUICKLY) supply is one for financiers to think about.

Allow’s see if it’s time to get shares of Fastenal after reporting its monetary first-quarter profits today.

Short Introduction

Fastenal runs out the Zacks Retail and also Wholesale industry and also its Structure Products-Retail Market is presently in the leading 10% of over 250 Zacks sectors. One of the most well-known firms in the room consist of House Depot ( HD) and also Lowe’s ( LOW).

When It Comes To Fastenal, the business is a nationwide wholesale representative of commercial and also building and construction materials that is called a crucial vendor of nuts and also screws. Headquartered in Minnesota, Fastenal disperses its items via company-owned shops mainly situated in The United States and Canada.

Picture Resource: Zacks Financial Investment Study

Q1 Testimonial

Fastenal defeated its first-quarter profits assumptions by 6% with EPS at $0.52. This was a 10% rise from the previous year quarter. Sales a little covered quarterly price quotes at $1.86 billion, up 5% from Q1 2022.

Fastenal pointed out 89 brand-new onsite places that were included throughout Q1 as development vehicle drivers for the business. Since March 31, Fastenal had 1,674 energetic websites which stood for a 16% YoY rise with the business mentioning day-to-day sales expanded approximately 20% from the prior-year quarter.

Operating capital additionally attracted attention at $388.5 million, climbing up 69% from Q1 2022. This was greatly credited to worldwide supply chains stabilizing leading to the decrease of functioning resources being utilized to sustain development.

Picture Resource: Zacks Financial Investment Study

Efficiency & & Assessment

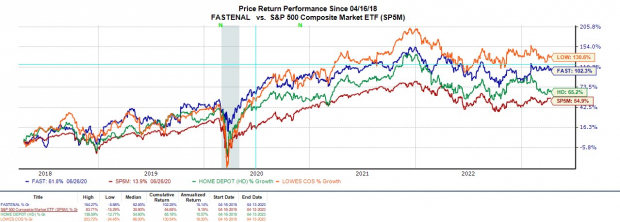

Fastenal supply is up +8% year to day to a little cover the S&P 500 and also outperform House Depot’s -9% and also Lowe’s practically level efficiency. Extra remarkable, shares of FAST are up +102% over the last 5 years to conveniently cover the standard and also House Depot while just tracking Lowe’s +130%.

Picture Resource: Zacks Financial Investment Study

Trading around $51 per share, Fastenal supply professions at 27X onward profits which is perfectly under its decade-long high of 40.7 X and also closer to the typical of 26.3 X. While financiers are paying a costs for Fastenal supply contrasted to the sector standard of 13.3 X and also the S&P 500’s 19X increasing profits price quotes have actually begun to supply assistance to the business’s P/E appraisal and also development.

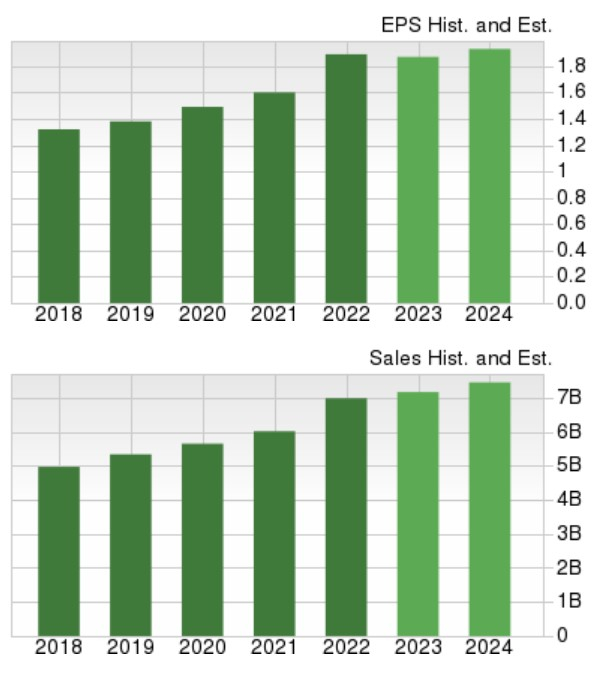

Development & & Expectation

Based upon Zacks price quotes, Fastenal profits are predicted to be up 3% in monetary 2023 and also increase an additional 6% in FY24 at $2.06 per share. Incomes approximate modifications have actually boosted a little over the last quarter and also this might proceed after the business’s strong Q1 record.

On the leading line, sales are anticipated to increase 5% in FY23 and also dive an additional 5% in FY24 to $7.77 billion. Financial 2024 would certainly stand for 46% development from pre-pandemic degrees with 2019 sales at $5.53 billion.

Picture Resource: Zacks Financial Investment Study

Takeaway

Fastenal supply presently sporting activities a Zacks Ranking # 2 (Buy) as profits price quotes have actually continued to be greater and also this ought to likely proceed after the business’s quelling first-quarter outcomes. Moreover, Fastenal’s Q1 record was assuring to Wall surface Road as it revealed rising cost of living is starting to relieve in addition to supply chain problems which can provide FAST shares an increase as we proceed via 2023.

Zacks Names “Solitary Best Select to Dual”

From countless supplies, 5 Zacks specialists each have actually picked their favored to escalate +100% or even more in months to find. From those 5, Supervisor of Research study Sheraz Mian hand-picks one to have one of the most eruptive advantage of all.

It’s an obscure chemical business that’s up 65% over in 2015, yet still economical. With unrelenting need, rising 2022 profits price quotes, and also $1.5 billion for buying shares, retail financiers can enter any time.

This business can measure up to or go beyond various other current Zacks’ Supplies Ready To Dual like Boston Beer Firm which soared +143.0% in little bit greater than 9 months and also NVIDIA which expanded +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Fastenal Company (FAST) : Free Stock Analysis Report

Lowe’s Companies, Inc. (LOW) : Free Stock Analysis Report

The Home Depot, Inc. (HD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights and also viewpoints revealed here are the sights and also viewpoints of the writer and also do not always mirror those of Nasdaq, Inc.