Common Mills GIS inventory is up +15% this 12 months and buyers could also be questioning if the buyer meals big can proceed to reward its shareholders.

Capable of exceed prime and backside line expectations for its fiscal first quarter on Wednesday, let’s see if it is time to purchase Common Mills inventory for extra upside.

Picture Supply: Zacks Funding Analysis

Common Mills Q1 Outcomes

Common Mills reported Q1 gross sales of $4.84 billion which was down from $4.9 billion within the comparative quarter however beat estimates of $4.78 billion by 1%. On the underside line, Q1 EPS of $1.07 beat expectations of $1.05 a share by 2% though this dipped from earnings of $1.09 per share a 12 months in the past.

Notably, Common Mills had beforehand anticipated its Q1 outcomes to be under the corporate’s full-year targets because of difficult internet gross sales and margin comparisons. Nonetheless, Common Mills acknowledged it took a major step in reshaping its portfolio for stronger development and chance. Correlating with such, Common Mills introduced the proposed sale of its North American Yogurt enterprise to French firms Lactalis and Sodiaal for $2.1 billion.

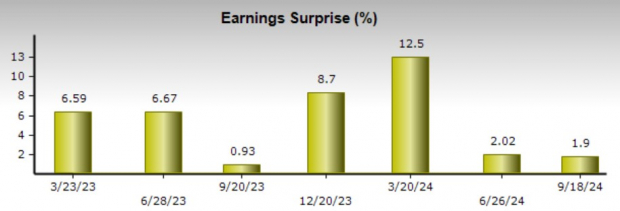

It’s additionally noteworthy that Common Mills has surpassed the Zacks EPS Consensus for 11 consecutive quarters posting a mean earnings shock of 6.28% in its final 4 quarterly reviews.

Picture Supply: Zacks Funding Analysis

Common Mills Earnings Per Share Steering

Regardless of what Common Mills has described as an unsure macroeconomic backdrop for shoppers throughout its core markets, the corporate reaffirmed its fiscal 2025 EPS steering.

Common Mills nonetheless expects FY25 EPS to be down 1% or up 1% in fixed foreign money which falls according to the Zacks Consensus. Primarily based on Zacks estimates, Common Mills’ EPS is projected to rebound and rise 5% in FY26 to $4.72.

Picture Supply: Zacks Funding Analysis

How GIS Inventory Valuation Compares

Buying and selling round $75 a share, Common Mills inventory is at a 16.7X ahead earnings a number of which is a pleasing low cost to the S&P 500’s 23.7X.

GIS additionally trades beneath its Zacks Meals-Miscellaneous Trade common of 17.7X ahead earnings with a number of of its notable friends being Kraft Heinz KHC and Mondelez Worldwide MDLZ.

Picture Supply: Zacks Funding Analysis

Takeaway

Following its favorable Q1 outcomes, Common Mills inventory lands a Zacks Rank #3 (Maintain). Though the value efficiency of GIS has been spectacular this 12 months, the pattern of earnings estimate revisions within the coming weeks could largely dictate which course the inventory goes from right here.

This may increasingly definitely be the case contemplating Common Mills’ warning of broader financial issues for its shoppers regardless of its engaging valuation suggesting GIS stays a viable long-term funding.

7 Finest Shares for the Subsequent 30 Days

Simply launched: Specialists distill 7 elite shares from the present checklist of 220 Zacks Rank #1 Robust Buys. They deem these tickers “Most Probably for Early Value Pops.”

Since 1988, the complete checklist has overwhelmed the market greater than 2X over with a mean acquire of +23.7% per 12 months. So make sure to give these hand picked 7 your speedy consideration.

General Mills, Inc. (GIS) : Free Stock Analysis Report

Mondelez International, Inc. (MDLZ) : Free Stock Analysis Report

Kraft Heinz Company (KHC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.