Quarterly outcomes from House Depot HD and Disney DIS highlighted this week’s earnings lineup regardless of the broader market taking a breather following an in depth presidential election rally.

Nevertheless, each had been capable of exceed earnings expectations making it a worthy subject of whether or not it is time to purchase inventory in these historic American enterprises.

House Depot’s Q3 Overview: Seeing an incremental enhance from hurricane-related renovations, House Depot reported Q3 gross sales of $40.21 billion on Tuesday. This elevated 6% from $37.71 billion in Q3 2023 and handed estimates of $39.36 billion. Notably, House Depot has crushed high line estimates in three of its final 4 quarterly stories posting a median gross sales shock of 0.9%.

On the underside line, Q3 EPS of $3.78 dipped from $3.81 within the prior interval however beat the Zacks Consensus of $3.64 by almost 4%. Because the world’s largest dwelling enchancment retailer, House Depot has exceeded earnings expectations for 19 consecutive quarters courting again to August of 2020. The corporate has posted a median earnings shock of two.27% during the last 4 quarters.

Picture Supply: Zacks Funding Analysis

Disney’s This fall Overview: Reporting outcomes for its fiscal fourth quarter on Thursday, Disney additionally noticed a 6% high line improve with This fall gross sales at $22.57 billion versus $21.24 billion a yr in the past. Regardless of barely lacking This fall gross sales estimates of $22.59 billion, Disney’s This fall EPS of $1.14 beat expectations of $1.09.

Extra spectacular, Disney’s earnings spiked 39% from $0.82 a share within the comparative quarter because of cost-saving initiatives, significantly amongst its streaming companies. Delivering its second straight quarterly revenue for its streaming enterprise, Disney+ subscribers got here in at 123 million topping Zacks estimates of 120 million though this was down from 150 million within the prior-year quarter. That mentioned, mixed streaming customers got here in at 200.6 million when together with ESPN+ and Hulu which retains Disney firmly within the second spot behind Netflix NFLX with regard to complete streamers.

The media conglomerate has crushed earnings expectations for eight straight quarters with a median EPS shock of 13.56% in its final 4 quarterly stories. Disney has exceeded high line estimates in two of the final 4 quarters with a median gross sales shock of 0.33%.

Picture Supply: Zacks Funding Analysis

Monitoring DIS & HD:

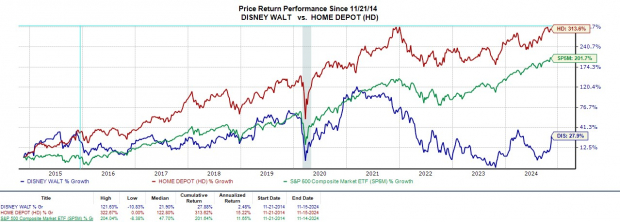

Value Efficiency

Seeing a pointy post-earnings rally, Disney’s inventory is now up +27% this yr to edge the S&P 500’s +25% and House Depot’s +17%. From a historic perspective, it has been extra rewarding to maintain House Depot shares within the portfolio. HD is sitting on features of over +300% within the final decade which has topped the benchmark’s +200% with DIS up a subpar +28% throughout this era.

Picture Supply: Zacks Funding Analysis

Valuation Comparability

Whereas House Depot’s inventory has had a transparent edge by way of value efficiency, Disney shares have stood out by way of valuation. DIS trades at 21.4X ahead earnings which is a pleasing low cost to the benchmark’s 25.2X with HD at 27X.

Moreover, Disney trades effectively under its decade-long excessive of 134.4X ahead earnings and is on par with its decade-median of 21.3X. As for House Depot, HD trades barely beneath its personal decade-long excessive of 28.1X ahead earnings however above the median of 21.5X. Reassuringly, Disney and House Depot each commerce close to the optimum degree of lower than 2X gross sales.

Picture Supply: Zacks Funding Analysis

DIS & HD Dividends

Following a three-year hiatus, Disney reinstated its dividend on the finish of 2023 and at the moment has a 0.82% annual yield. With its dividend remaining intact since 1987, HD has a transparent edge right here in addition to House Depot’s payout is at 2.22% to edge the S&P 500’s common of 1.2%

Picture Supply: Zacks Funding Analysis

Takeaway

Persevering with their spectacular streaks of surpassing earnings expectations, Disney and House Depot inventory each land a Zacks Rank #3 (Maintain). Extra upside could largely rely upon the pattern of earnings estimate revisions within the coming weeks with House Depot exhibiting the canny capability to reward traders over time whereas Disney’s return to progress has change into very compelling.

Should-See: Photo voltaic Shares Poised to Skyrocket

The photo voltaic trade stands to bounce again as tech corporations and the economic system transition away from fossil fuels to energy the AI growth.

Trillions of {dollars} can be invested in clear vitality over the approaching years – and analysts predict photo voltaic will account for 80% of the renewable vitality growth. This creates an outsized alternative to revenue within the near-term and for years to come back. However it’s a must to decide the precise shares to get into.

Discover Zacks’ hottest solar stock recommendation FREE.

The Home Depot, Inc. (HD) : Free Stock Analysis Report

The Walt Disney Company (DIS) : Free Stock Analysis Report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.