The hopes of a much less hawkish Fed as well as reduced rates of interest might supercharge the wider real estate market as well as 2 popular supplies supplying direct exposure to the room are KB House ( KBH) as well as Zillow Team ( ZG).

With KB House as well as Zillow supply off to solid begins this year, allow’s see if it’s time for capitalists to get right into their rallies.

Efficiency Summary

Home loan prices continuted to reach their highest degree in twenty years after increasing over 7% in October as well as influencing several business in the wider real estate market.

This definitely had a sick impact on KB Houses’ supply in 2015 as one of the biggest as well as most identifiable homebuilders in the USA. Likewise, shares of Zillow Team were immersed in volatility with the business being the biggest on the internet realty as well as home-related supplier in the nation.

Nevertheless, KB House as well as Zillow supplies were much more resistant than one could have visualized as well as are having solid efficiencies thus far this year. Year to day, Zillow supply has actually skyrocketed +34% Vs. KB House’s +26% with both outshining the S&P 500’s +4%.

Also much better, KB House supply is still up +121% over the last 3 years to conveniently cover the criteria as well as Zillow’s +20%.

Photo Resource: Zacks Financial Investment Study

Appraisal

With such remarkable year-to-date efficiencies, checking Zillow as well as KB Houses’ appraisal will certainly be very important. Both supplies presently trade around $40 a share.

Nevertheless, Zillow supply is still 24% from its 52-week high as well as professions at 37.4 X ahead profits. In contrast, KB House supply lately strikes its 52-week highs as well as is still trading at simply 8.8 X ahead profits. KB House additionally trades 92% listed below its years high of 115X as well as at a mild price cut to the typical of 10.9 X.

Photo Resource: Zacks Financial Investment Study

Also much better, KB Residence’ price-to-earnings appraisal is well listed below the S&P 500’s 18.3 X as well as on the same level with the Structure Products-Home Builders market standard. While Zillow supply is over the criteria’s P/E appraisal as well as the Internet-Services market standard of 27.7 X it does trade far more practical than its severe years highs as well as the typical of 437.4 X.

Development & & Expectation

Keeping an eye on the development of both business will certainly assist make clear if capitalists need to be paying a costs for Zillow supply as well as if KB Houses’ reduced P/E appraisal is a deal.

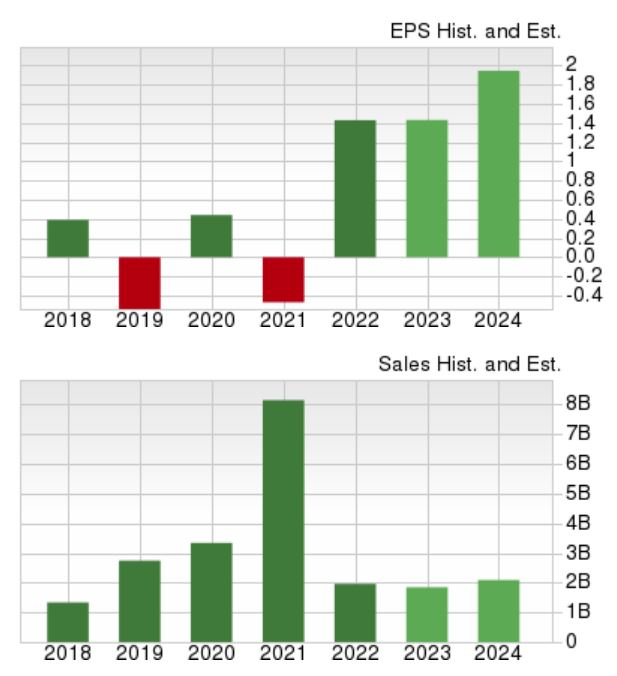

Considering Zillow, profits are anticipated to dip – 21% in financial 2023 however rebound as well as climb up 55% in FY24 at $1.74 per share. Nevertheless, profits price quote alterations have actually trended down for both FY23 as well as FY24 throughout the quarter.

Sales are anticipated to go down -71% this year to $1.85 billion contrasted to $6.18 billion in 2022. Financial 2024 profits are anticipated to maintain as well as increase 13% to $2.09 billion.

Photo Resource: Zacks Financial Investment Study

Rotating to KB House, profits are predicted to go down -50% this year at $4.52 per share after excellent development in 2022 with EPS at $9.12 mostly credited to the business’s stockpile regardless of inflationary worries influencing future service.

Still, financial 2024 profits are anticipated to rebound 15% at $5.21 per share. Also much better, profits price quotes have actually begun to increase once again after the business blasted its first-quarter profits assumptions recently.

On the leading line, sales are currently anticipated to be down -22% this year and after that increase 3% in FY24 to $5.57 billion.

Photo Resource: Zacks Financial Investment Study

Profits

Presently, KB House (KBH) supply sporting activities a Zacks Ranking # 2 (Buy) with Zillow Team (ZG) touchdown a Zacks Ranking # 3 (Hold). Both business stay practical financial investments for direct exposure to the wider real estate market as well as need to have strong development as inflationary worries start to relieve.

Keeping that being claimed, KB Houses might currently get on this trajectory as well as capitalists need to think about getting KBH supply as the business’s P/E appraisal is eye-catching together with the increasing profits price quotes. Zillow supply might have much more upside from its present degrees also, as well as hanging on to ZG shares might be fulfilling however there may be much better getting chances in advance.

Zacks Names “Solitary Best Choose to Dual”

From hundreds of supplies, 5 Zacks professionals each have actually selected their favored to increase +100% or even more in months ahead. From those 5, Supervisor of Research study Sheraz Mian hand-picks one to have one of the most eruptive advantage of all.

It’s an obscure chemical business that’s up 65% over in 2015, yet still economical. With unrelenting need, rising 2022 profits price quotes, as well as $1.5 billion for buying shares, retail capitalists might enter at any moment.

This business might match or exceed various other current Zacks’ Supplies Ready To Dual like Boston Beer Firm which soared +143.0% in little bit greater than 9 months as well as NVIDIA which expanded +175.9% in one year.

Free: See Our Top Stock And 4 Runners Up

KB Home (KBH) : Free Stock Analysis Report

Zillow Group, Inc. (ZG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as point of views shared here are the sights as well as point of views of the writer as well as do not always show those of Nasdaq, Inc.