Monetary outcomes from Netflix NFLX are much more anticipated today on condition that the streaming providers big not supplies steering for its subscriber development. Nonetheless, Netflix sits on the high of the hill with reference to streaming subscribers with over 260 million customers on the finish of 2023.

Even higher, Netflix inventory has soared +26% 12 months to this point to barely high Disney’s DIS +25% whereas blowing away the struggling performances of a lot of its different streaming opponents similar to Paramount World PARAA, and Warner Bros. Discovery WBD.

Nevertheless, let’s see if it is time to purchase Netflix shares as its Q1 report approaches after market hours on Thursday, Apri 18.

Picture Supply: Zacks Funding Analysis

Q1 Preview

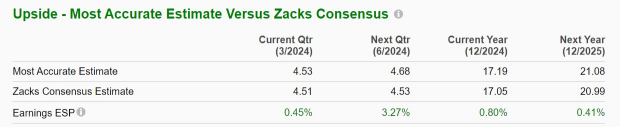

In line with Zacks estimates, first quarter gross sales from Netflix are anticipated to be up 13% to $9.26 billion. The Zacks Consensus requires a 56% enhance in Q1 earnings to $4.51 per share versus $2.88 a share within the comparative quarter.

Extra intriguing, the Zacks ESP (Anticipated Shock Preidciation) signifies Netflix might surpass its backside line expectations with the Most Correct Estimate having Q1 EPS at $4.53 and barely above the Zacks Consensus.

Picture Supply: Zacks Funding Analysis

Streaming Estimates

Attributed to a less expensive different service with paid promoting, subscriber development has stored Netflix in entrance of Disney Plus amongst different upcoming streaming providers.

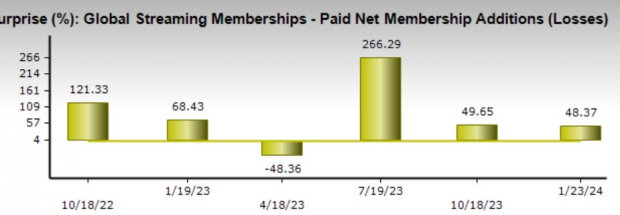

Primarily based on Zacks estimates, Netflix is believed to have added 5.73 million international paid memberships through the first quarter. This could be a really stelar 227% enhance from the 1.75 million paid subscribers Netflix added throughout Q1 2023. Most not too long ago, Netflix added a stunning 13.12 million paid subscribers throughout This autumn which beat estimates of 8.84 million by 48%.

Picture Supply: Shutterstock

Checking Netflix’s P/E Valuation

Netflix shares presently commerce at 36.2X ahead earnings which is nicely under a five-year excessive of 114.9X and a slight low cost to the median of 49.7X. Plus, annual earnings are projected to soar 42% in fiscal 2024 to $17.05 per share in comparison with $12.03 a share final 12 months. Higher nonetheless, FY25 EPS is projected to climb one other 23%.

Picture Supply: Zacks Funding Analysis

Backside Line

Given an unbelievable YTD rally to over $600 a share, Netflix inventory presently lands a Zacks Rank #3 (Maintain). Regardless of NFLX being extra moderately valued, reaching or exceeding Q1 expectations shall be important to reconfirming the corporate’s expansive development trajectory.

Free Report – The Bitcoin Revenue Phenomenon

Zacks Funding Analysis has launched a Particular Report that can assist you pursue huge earnings from the world’s first and largest decentralized type of cash.

No ensures for the longer term, however previously three presidential election years, Bitcoin’s returns had been as follows: 2012 +272.4%, 2016 +161.1%, and 2020 +302.8%.

Zacks predicts one other vital surge. Click on under for Bitcoin: A Tumultuous But Resilient Historical past.

Download Now – Today It’s FREE >>

Netflix, Inc. (NFLX) : Free Stock Analysis Report

The Walt Disney Company (DIS) : Free Stock Analysis Report

Warner Bros. Discovery, Inc. (WBD) : Free Stock Analysis Report

Paramount Global (PARAA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.