As a reminder that U.S. markets are closed on Monday for Martin Luther King Day, buyers will probably be looking forward to Tuesday’s (Jan 21) buying and selling session, which options This autumn outcomes from Netflix NFLX.

Being one of many headline names of subsequent week’s earnings lineup, let’s see if it’s time to purchase Netflix inventory for extra upside with NFLX up over +70% within the final yr.

Picture Supply: Zacks Funding Analysis

Netflix This autumn Expectations

Netflix’s This autumn gross sales are thought to have elevated 14% to $10.12 billion, in comparison with $8.83 billion within the comparative quarter. Extra spectacular, the streaming large’s This autumn EPS is anticipated to climb 98% to $4.19 versus $2.11 per share a yr in the past.

Netflix is slated to spherical out fiscal 2024 with a 15% enhance in complete gross sales at $38.86 billion, and a 64% spike in annual earnings with estimates at $19.77 per share versus EPS of $12.03 in 2023.

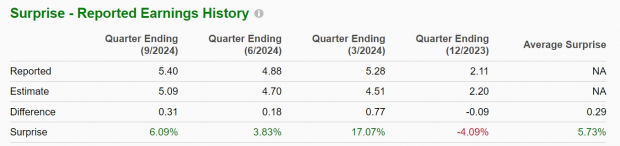

Notably, Netflix has exceeded gross sales estimates for 5 consecutive quarters and has surpassed earnings expectations in three of its final 4 quarterly reviews with a median EPS shock of 5.73%.

Picture Supply: Zacks Funding Analysis

Netflix Subscriber Progress

Holding on to the title of streaming king forward of Disney DIS, Netflix is anticipated to have added over 7 million subscribers throughout This autumn to $287.48 million complete subscriptions. This could be a ten% spike from the $260.28 million subscribers the corporate had on the finish of Q3 2024.

Monitoring Netflix’s Valuation

Trading round $860 a share, NFLX is at a 35.6X ahead earnings a number of which is a premium to the benchmark S&P 500’s 22.2X with Disney at 19X.

Contemplating Netflix inventory has impressively outperformed the broader market and Disney shares in recent times, it’s noteworthy that NFLX does commerce properly under its five-year excessive of 88.5X ahead earnings and a slight low cost to the median of 37.4X throughout this era.

Picture Supply: Zacks Funding Analysis

Backside Line

Forward of its This autumn report subsequent week, Netflix inventory lands a Zacks Rank #3 (Maintain). Whereas NFLX tends to pop after favorable quarterly outcomes, Netflix’s This autumn report might want to reconfirm its engaging development trajectory after an in depth rally over the past yr.

Simply Launched: Zacks High 10 Shares for 2025

Hurry – you possibly can nonetheless get in early on our 10 prime tickers for 2025. Handpicked by Zacks Director of Analysis Sheraz Mian, this portfolio has been stunningly and persistently profitable. From inception in 2012 by means of November, 2024, the Zacks High 10 Shares gained +2,112.6%, greater than QUADRUPLING the S&P 500’s +475.6%. Sheraz has combed by means of 4,400 corporations lined by the Zacks Rank and handpicked one of the best 10 to purchase and maintain in 2025. You may nonetheless be among the many first to see these just-released shares with monumental potential.

Netflix, Inc. (NFLX) : Free Stock Analysis Report

The Walt Disney Company (DIS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.