Over time, Lululemon’s LULU inventory has been a Wall Road darling as a result of firm’s reputation and development as a number one athletic attire retailer with a really loyal buyer base.

Nonetheless, LULU has now dropped -46% 12 months up to now with the decline sparked by lower-than-expected steering for fiscal 2024. On this regard, Lululemon expects 10%-11% internet income development this 12 months which is definitely stable growth however fell under many analysts’ lofty expectations.

That mentioned, let’s see if it’s time to purchase or promote Lululemon’s inventory as Q1 earnings strategy after-market hours on Wednesday, June 5.

Picture Supply: Zacks Funding Analysis

Q1 Expectations

As proven within the Worth, Consensus & Shock chart above, Lululemon has surpassed earnings expectations for 15 consecutive quarters however the firm’s subpar outlook following its most up-to-date This fall report in March triggered LULU to plummet.

Amid lingering issues of softer client spending, Lululemon’s Q1 gross sales are nonetheless thought to have are available at $2.2B based mostly on Zacks estimates which might characterize a ten% enhance from $2B a 12 months in the past. Plus, Q1 earnings are anticipated to rise 4% to $2.38 per share.

Historic Efficiency & Valuation

Assuming Lululemon continues to pump out sound development regardless of loftier expectations, looking on the firm’s historic efficiency however most significantly its valuation could also be important for traders to purchase in at this juncture.

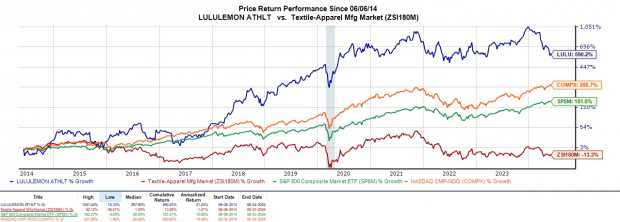

Going again 5 years, LULU remains to be up +75% and has monstrous beneficial properties of virtually +600% over the past decade which has crushed its Zacks Textile-Attire Market’s -13% whereas impressively topping the S&P 500’s +181% and even the Nasdaq’s +289%.

Picture Supply: Zacks Funding Analysis

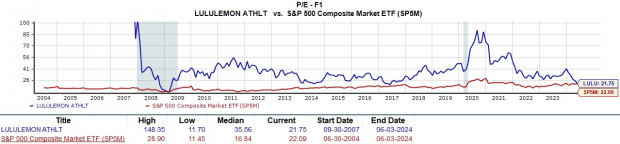

Extra intriguing, Lululemon is buying and selling at its most cost-effective ahead earnings a number of because the firm went public in 2007 at 21.7X. That is properly under its historic P/E peak of 148.3X and a 38% low cost to the historic median of 35.5X.

Picture Supply: Zacks Funding Analysis

Takeaway

It could be tempting to purchase Lululemon’s inventory at present ranges because the attire large is anticipating low double-digit proportion development on its high and backside traces in FY24 whereas buying and selling at its most cheap P/E valuation ever.

Sadly, LULU lands a Zacks Rank #4 (Promote) as EPS estimates for FY24 have continued to say no over the past quarter and are barely down within the final week.

5 Shares Set to Double

Every was handpicked by a Zacks professional because the #1 favourite inventory to realize +100% or extra in 2024. Whereas not all picks might be winners, earlier suggestions have soared +143.0%, +175.9%, +498.3% and +673.0%.

A lot of the shares on this report are flying below Wall Road radar, which offers a terrific alternative to get in on the bottom ground.

Today, See These 5 Potential Home Runs >>

lululemon athletica inc. (LULU) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.