Tesla ( TSLA) will certainly be an emphasize of this week’s incomes schedule, readied to report its first-quarter outcomes on Wednesday, April 19.

With shares of TSLA off to a spectacular begin this year, capitalists might be questioning if currently is a great time to buy the EV leader.

Allow’s see if Tesla supply is a get now or if there are far better chances in advance.

Q1 Sneak Peek

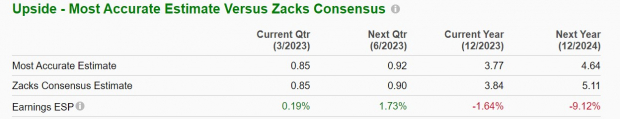

The Zacks Agreement Price quote for Tesla’s Q1 incomes is $0.85 per share, which would certainly be a -20% decrease from EPS of $1.07 in the prior-year quarter. Sales are anticipated to be up 25% at $23.56 billion Vs. $18.76 billion in Q1 2022.

The dip in Tesla’s YoY quarterly profits is partially credited to greater asset rates amongst basic materials like steel and also light weight aluminum in relationship with rising cost of living. Nonetheless, Tesla has actually additionally executed numerous rate cuts in the rates of its EVs to increase shipments and also present more recent designs.

Picture Resource: United State Bureau of Labor Data

While Tesla wishes its rate cuts will certainly increase need and also bring about greater sales quantity, Wall surface Road will certainly be very closely checking the impact this carries the firm’s incomes. To that factor, several experts are worried that reduced lorry rates will certainly try Tesla’s revenue margins with the comany reducing its rates 5 times given that January.

Tesla has actually currently gone down the rates of its Version S car by about 5% to $89,000 and also its Version X SUV by 9% to $99,000. The high-end variations of these designs have actually additionally been reduced by around $5,000.

With that said being stated, the Zacks Expected Shock Forecast shows Tesla ought to reach its Q1 incomes assumptions with one of the most Precise Price quote additionally at $0.85 per share.

Picture Resource: Zacks Financial Investment Study

Shipments && Need

The capability to proceed broadening shipments is important throughout Tesla’s quarterly outcomes. Hereof, the enhancing appeal and also need for EVs might warrant Tesla’s desire to reduce its rates. With need in emphasis, Tesla revealed previously in the month that it provided a quarterly document of 422,875 automobiles throughout the very first quarter, a 36% rise from 310,000 shipments in Q1 2022.

This would certainly still disappoint Wall surface Road’s quotes of 430,000 shipments for the very first quarter. As displayed in the graph below, Tesla supply rose in its last quarterly record after defeating distribution assumptions yet dropped in the previous quarter when missing out on quotes. Still, Tesla’s capability to supply solid advice for ongoing distribution development following quarter might increase its supply.

Picture Resource: Zacks Financial Investment Study

Development & & Overview

Tesla is still the international leader in EV sales and also controls regarding 65% of the marketplace share in the USA. Nonetheless, checking Tesla’s development is extremely essential for capitalists with business like General Motors ( GM) and also Ford ( F) aiming to also the having fun area.

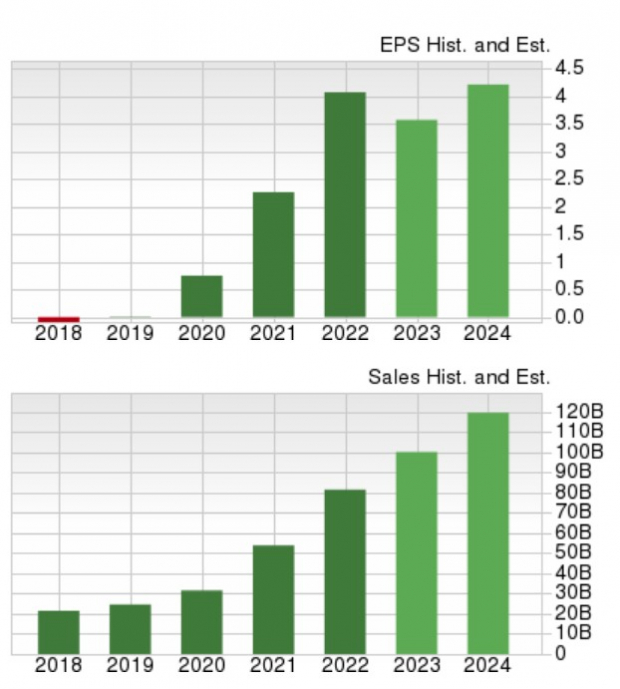

According to Zacks quotes, Tesla incomes are anticipated to dip -5% this year yet rebound and also climb 33% in monetary 2024 at $5.11 per share. It is essential to keep in mind that incomes price quote alterations have actually decreased over the last quarter.

On the leading line, sales are anticipated to leap 25% in FY23 and also rise an additional 21% in FY24 to $123.03 billion. Much more outstanding, monetary 2024 would certainly be an extremely excellent 401% rise from pre-pandemic degrees with 2019 sales at $24.57 billion.

Picture Resource: Zacks Financial Investment Study

Efficiency & & Evaluation

Tesla supply is up a remarkable +52% year to day to greatly outshine the S&P 500’s +8% and also the Car Manufacturers-Domestic Markets +22%. As a loosened contrast, Tesla has actually quickly covered General Motors’ +4% and also Ford’s +9% YTD efficiency.

Also much better, Tesla supply has actually currently climbed up +272% over the last 3 years to defeat the criteria, General Motors’ +41%, Ford’s +151%, and also its Zacks Subindustry’s +88%.

Picture Resource: Zacks Financial Investment Study

Shares of TSLA presently trade around $187 and also 48.2 X onward incomes which is well listed below its severe decade-long high and also 78% underneath the average of 223.9 X. Tesla still trades over the sector standard of 10.8 X yet Wall surface Road has actually traditionally been okay with paying a costs for the firm’s development as a leader and also leader in its area.

Profits

Entering Into its Q1 record Tesla supply lands a Zacks Ranking # 3 (Hold). Tesla’s yearly top and also profits development is still interesting in spite of the decrease in incomes quotes with its even more practical P/E appraisal offering assistance.

Although the current rate cuts amongst its EVs might bring about far better purchasing opportinuies in Tesla supply, this must additionally increase future need. Hereof, capitalists might be awarded for hanging on to Tesla shares at present degrees particularly as rising cost of living starts to alleviate.

Free Record Discloses Just How You Might Make money from the Expanding Electric Car Sector

Internationally, electrical vehicle sales proceed their amazing development also after exceeding in 2021. High gas rates have actually sustained his need, yet so has progressing EV convenience, functions and also innovation. So, the eagerness for EVs will certainly be about long after gas rates stabilize. Not just are suppliers seeing record-high revenues, yet manufacturers of EV-related innovation are generating the dough too. Do you recognize exactly how to money in? Otherwise, we have the ideal record for you– and also it’s FREE! Today, do not miss your opportunity to download and install Zacks’ leading 5 supplies for the electrical lorry transformation at no charge and also without commitment.

>>Send me my free report on the top 5 EV stocks

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Ford Motor Company (F) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights and also point of views shared here are the sights and also point of views of the writer and also do not always mirror those of Nasdaq, Inc.