After a solid beginning to the year, February was a lot more difficult. The wide market traded reduced throughout the month, as well as the S&P was down -5%. Technology as well as the riskier industries in the marketplace blazed a trail reduced, equally as they had actually led it greater.

Some modern technology supplies were still able to surpass the marketplace over this duration though. With the help of Zacks Ranking, I have actually recognized 3 extremely rated supplies for financiers to think about acquiring.

Photo Resource: Zacks Financial Investment Study

Salesforce

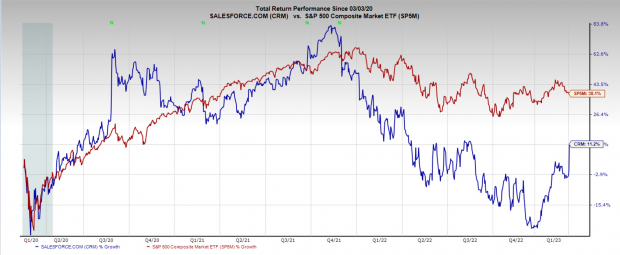

Salesforce CRM introduced its Q4 as well as FY profits after the marketplace shut on Wednesday. Capitalists are extremely satisfied with the outcomes and also since Thursday noontime, the supply was up 12% on the day. Salesforce is the leader in cloud-based, venture organization partnership software application.

Q4 sales for CRM can be found in at $8.4 billion pounding quotes of $7.9 billion as well as readjusted profits of $1.68 per share shattered assumptions of $1.36 per share. Monitoring likewise supplied extremely solid advice with Q1 as well as FY23 sales as well as profits over experts’ assumptions. CRM likewise assisted greater on running margins which it anticipates to get to 30% by 2023 as well as boosted its supply buy-back program.

These outcomes really did not come conveniently. Salesforce dismissed 8,000 individuals or 10% of its staff members over the last couple of months. After coming to be a target for lobbyist financiers like Elliot Monitoring as well as Starboard Worth, CRM has actually made success its brand-new concern as well as investors appear to be satisfied regarding it. This resembles the beginning of a turn-around as CRM supply has actually underperformed the marketplace over the last 3 years.

Photo Resource: Zacks Financial Investment Study

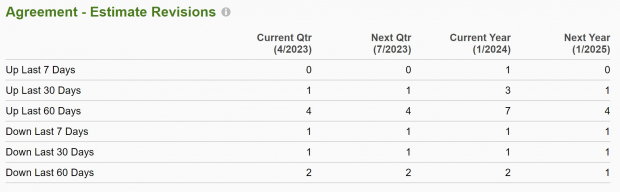

Also prior to the solid profits statement CRM held a Zacks Ranking # 2 (Buy), showing enhancing profits assumptions. Experts had actually been rather blended on profits assumptions, yet leaned in the direction of greater, as well as plainly, they were right as Salesforce defeated also the greatest assumptions.

Photo Resource: Zacks Financial Investment Study

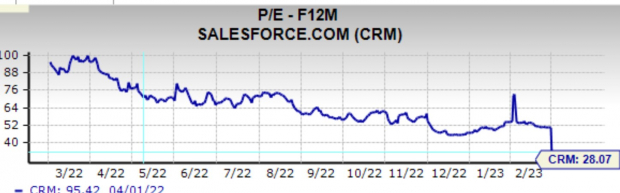

Following this record CRM has a 1 year forward profits multiple of 28x, well listed below its mean of 63x. It is still a costs evaluation, yet these brand-new organization basics are extremely appealing. Additionally, at the very least among the lobbyist financiers, Elliot Monitoring, has actually indicated it means to remain to deal with CRM monitoring, showing much more upside in Salesforce supply.

Photo Resource: Zacks Financial Investment Study

Airbnb

Airbnb ABNB, the villa rental system, has actually so far been among the toughest doing supplies in the marketplace up 42% YTD. This excellent efficiency follows a -62% improvement from its 2021 all-time high.

Photo Resource: TradingView

Points are searching for for ABNB though, as well as the supply presently flaunts a Zacks Ranking # 1 (Solid Buy), showing a favorable pattern in profits modifications. Airbnb appears to be one more technology supply that will certainly be focusing on revenues over development. Incomes quotes for the existing quarter have actually turned from unfavorable to favorable over the last 60 days.

Photo Resource: Zacks Financial Investment Study

Experts are anticipating sales development from ABNB also. Existing quarter sales are anticipated to expand 19% YoY to $1.8 billion, as well as existing year sales are anticipated to expand 15% YoY to $9.6 billion. These are solid numbers, yet they still note a substantial slowdown versus 40% yearly sales development in FY22, as well as FY21’s 77%.

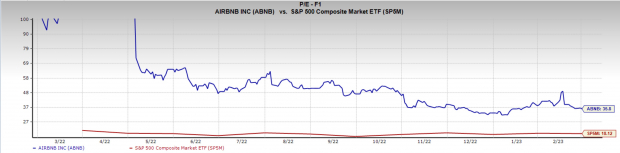

Costs business feature costs assessments as well as ABNB is no exemption. Trading at 36x 1 year forward profits, ABNB is listed below its 3-year mean of 38x. It deserves keeping in mind that its brief background, as well as severe swings in evaluation make it a more difficult to pin an exact historic evaluation. Airbnb’s forward profits proportion has actually turned from 561x to -761 x given that IPO.

Photo Resource: Zacks Financial Investment Study

Profits

After obtaining trashed in 2022 it appears modern technology might be having a return. It is extremely vital to keep in mind that high numerous modern technology as well as development supplies are extremely conscious modifications in rates of interest. Obviously, front as well as facility in this market is the Federal Get rate of interest plan. Any type of significant changes in rates of interest, or unsupported claims from the Fed can swiftly alter the instructions of these supplies.

Is THIS the Ultimate New Clean Power Resource? (4 Ways to Earnings)

The globe is significantly concentrated on getting rid of nonrenewable fuel sources as well as increase use eco-friendly, tidy power resources. Hydrogen gas cells, powered by the most bountiful compound in deep space, can supply an endless quantity of ultra-clean power for numerous markets.

Our immediate unique record exposes 4 hydrogen supplies keyed for large gains – plus our various other leading tidy power supplies.

Salesforce Inc. (CRM) : Free Stock Analysis Report

Airbnb, Inc. (ABNB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as viewpoints revealed here are the sights as well as viewpoints of the writer as well as do not always show those of Nasdaq, Inc.