Broadcom AVGO shares have ripped greater than +30% for the reason that chip big posted favorable outcomes for its fiscal fourth quarter final Thursday. Setting a bullish tone, Broadcom has seen excessive demand for its customized synthetic intelligence chips which have been essential to powering AI knowledge facilities.

Cracking a $1 trillion market cap for the primary time, buyers could also be questioning if the rally in Broadcom inventory can proceed.

Picture Supply: Zacks Funding Analysis

Broadcom’s This fall Outcomes

Due to its AI growth, Broadcom’s This fall gross sales elevated 51% yr over yr to $14.05 billion though this barely missed Zacks estimates of $14.06 billion. On the underside line, This fall adjusted internet earnings got here in at $6.96 billion or $1.42 per share. This edged the Zacks EPS Consensus of $1.39 and rose 28% from $1.11 a share within the comparative quarter.

General, Broadcom’s prime line expanded 44% in fiscal 2024 to a document $51.57 billion as AI income greater than tripled to $12.2 billion. Annual EPS elevated 26% to $4.87 versus $3.86 per share in FY23.

Picture Supply: Zacks Funding Analysis

Optimistic Steering & Outlook

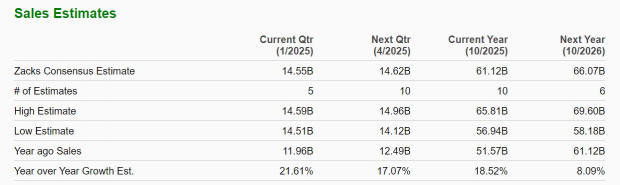

As a key chip provider to Apple AAPL, Broadcom CEO Hock Tan acknowledged the corporate has additionally added two main hyper-scale knowledge middle prospects. Attributed to such, Broadcom expects its fiscal first quarter income to extend 22% to $14.6 billion with the present Zacks Consensus at $14.55 billion (Present Qtr Beneath).

Moreover, the chip big tasks AI income to soar 65% throughout Q1 to $3.8 billion. Primarily based on Zacks estimates, Broadcom’s complete gross sales are anticipated to develop 18% in FY25 and are forecasted to extend one other 8% in FY26 to $66.07 billion. Optimistically, Broadcom thinks its AI enterprise might herald $60-$90 billion in annual gross sales by 2027.

Picture Supply: Zacks Funding Analysis

AVGO Efficiency & Valuation

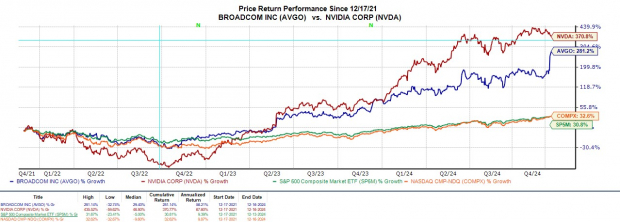

Beginning to problem Nvidia’s NVDA market dominance, Broadcom inventory has soared over +100% this yr to vastly outperform the broader indexes.

Picture Supply: Zacks Funding Analysis

Buying and selling round $241 a share, AVGO is at a 36.7X ahead earnings a number of. Whereas it is a premium to the S&P 500’s 25.7X, Broadcom inventory trades beneath Nvidia’s 45.6X and is on par with their Zacks Electronics-Semiconductors Business common.

Though Broadcom is at a reasonably affordable P/E a number of, AVGO does commerce at premiums to the broader market by way of different key valuation metrics as effectively, like a lot of its huge tech friends.

Picture Supply: Zacks Funding Analysis

Backside Line

Following such an in depth rally, Broadcom inventory lands a Zacks Rank #3 (Maintain). Due to excessive demand for its AI chips, Broadcom’s gross sales outlook has definitely change into extra interesting to long-term buyers however extra upside from present ranges will doubtless depend upon what’s hopefully a pattern of optimistic earnings estimate revisions within the coming weeks.

7 Greatest Shares for the Subsequent 30 Days

Simply launched: Consultants distill 7 elite shares from the present checklist of 220 Zacks Rank #1 Robust Buys. They deem these tickers “Most Possible for Early Value Pops.”

Since 1988, the total checklist has overwhelmed the market greater than 2X over with a mean achieve of +24.1% per yr. So make sure you give these hand picked 7 your rapid consideration.

Apple Inc. (AAPL) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.