Expecting following week’s profits schedule, a couple of expert system (AI) concentrated firms are readied to launch their quarterly outcomes.

With ChatGPT triggering capitalists and also customers intrerest in current months, the AI boom remains to obtain heavy steam complying with the extraordinary spike in shares of Nvidia ( NVDA) today. After defeating Q1 top and also profits assumptions on Wednesday, Nvidia supply has actually seen a prolonged rally with the firm increasing its Q2 earnings assistance because of solid need for its AI chips.

This has numerous capitalists drooling for various other supplies that use direct exposure to the future of the AI world. To that note, right here are 2 such supplies that capitalists will certainly wish to see as profits strategy.

Picture Resource: Zacks Financial Investment Research Study

Dell Technologies ( DELL)

Capitalists will absolutely wish to take notice of Dell Technologies’ first-quarter record on Thursday, June 1. The renowned modern technology services firm is quickly making the press right into expert system. Actually, Dell is partnered with Nvidia on its generative AI endeavor Task Helix.

Task Helix will certainly aid companies with making use of AI designs to supply far better client service, market knowledge, and also business study to name a few abilities. Hereof, Dell has actually produced a profile of Validated Styles for AI to streamline the IT facilities and also give faster and also much deeper understandings. Along with AI, Dell has actually lately released brand-new solutions and also services to enhance its cybersecurity profile.

Q1 Sneak Peek: In spite of the appealing AI advancements, Dell is handling a harder operating setting primarily credited to weak need for Computers and also web servers.

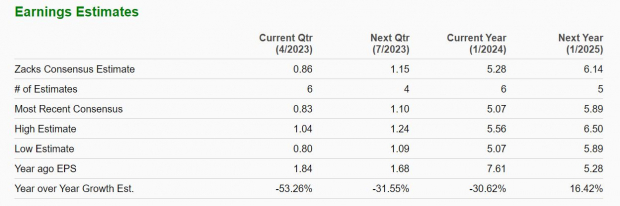

First-quarter profits are forecasted at $0.86 per share, which would certainly be a -53% decrease from EPS of $1.84 in a challenging to complete versus prior-year quarter. On the leading line, Q1 sales are anticipated to be $20.20 billion, down -22% from a year back.

With that said being stated, Dell has actually surpassed profits assumptions in 4 successive quarters and also covered sales quotes in its last 2 quarterly records.

Picture Resource: Zacks Financial Investment Research Study

Yearly profits are currently anticipated to go down -30% in Dell’s present monetary 2024 at $5.28 per share complying with a solid year that saw EPS at $7.61 in FY23. Nonetheless, monetary 2025 profits are forecasted to rebound and also leap 16% at $6.14 per share. Sales are anticipated to be down -16% in FY24 however rebound and also increase 5% in FY25 to $90.53 billion.

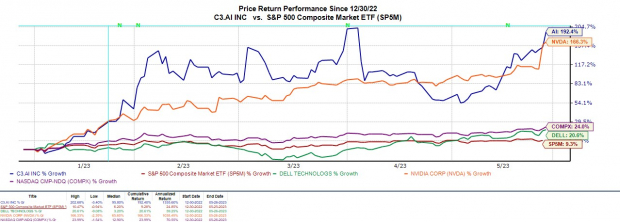

Dell supply is up +20% this year to cover the S&P 500’s +9% and also the IT Solutions Martkets’ +7% while somewhat routing the Nasdaq’s +24%.

Picture Resource: Zacks Financial Investment Research Study

C3.ai ( AI)

As a venture expert system software application firm, Wall surface Road will certainly be keeping track of C3.ai’s development and also expectation in its monetary fourth-quarter record on Wednesday, May 31.

Established In 2009, C3 is concentrated on increasing electronic change with the firm creating and also running large AI, anticipating evaluation, and also IoT applications. C3 released its IPO in 2020 and also seems gradually however definitely on its method to going across the earnings line as the AI change acquires energy.

Q4 Sneak Peek: The Zacks Agreement for C3’s Q4 profits is -$ 0.17 per share, up from a modified EPS loss of -$ 0.21 in Q4 2022. Fourth-quarter sales are anticipated to be basically level YoY at $72.32 million.

A lot more appealing, C3 has actually defeated profits assumptions for 8 successive quarters and also covered sales quotes in its last 2 quarterly records.

Picture Resource: Zacks Financial Investment Research Study

C3’s yearly profits are currently forecasted at -$ 0.46 per share, which would certainly be a substantial rise from a modified loss of -$ 0.73 a share in 2022. Financial 2024 profits are anticipated to proceed relocating closer to the black at -$ 0.33 a share. Also much better, sales are currently anticipated to increase 5% this year and also climb one more 19% in FY24 to $317.18 million.

With much positive outlook in the marketplace bordering expert system, C3 supply has actually increased +192% YTD to also leading Nvidia’s +166% together with Dell and also the wider indexes.

Picture Resource: Zacks Financial Investment Research Study

Profits

Entering into their quarterly records next week, Dell and also C3 supply both land a Zacks Ranking # 3 (Hold). Their quarterly quotes aren’t frustrating, however surpassing assumptions and also providing favorable assistance might make DELL and also C3 supply rally.

With market belief high up on expert system, Dell and also C3 supplies deserve holding in the meantime as both firms have actually ended up being really appealing longer-term financial investments.

5 Supplies Ready To Dual

Each was handpicked by a Zacks professional as the # 1 favored supply to obtain +100% or even more in 2021. Previous suggestions have actually skyrocketed +143.0%, +175.9%, +498.3% and also +673.0%.

The majority of the supplies in this record are flying under Wall surface Road radar, which gives a wonderful possibility to participate the first stage.

Today, See These 5 Potential Home Runs >>

Dell Technologies Inc. (DELL) : Free Stock Analysis Report

C3.ai, Inc. (AI) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights and also viewpoints shared here are the sights and also viewpoints of the writer and also do not always show those of Nasdaq, Inc.