Huge tobacco producers Altria Group MO and Philip Morris Worldwide (PM) have seen their shares soar over +30% this 12 months.

With each shares providing profitable dividends and buying and selling close to 52-week highs they might definitely be catching traders’ consideration. That stated, let’s see if it’s time to purchase Philip Morris or Altria’s inventory for larger highs.

Picture Supply: Zacks Funding Analysis

Elevated Profitability

Complimenting Philip Morris and Altria’s market place as tobacco producers has been the adoption of smoke-free merchandise.

That is additionally aiding their growth into Europe amongst different worldwide markets with heated non-burn tobacco, vapor, and oral nicotine merchandise resulting in elevated profitability. Correlating with such, it’s noteworthy that the Zacks Tobacco Trade is at present within the prime 10% of over 250 Zacks industries.

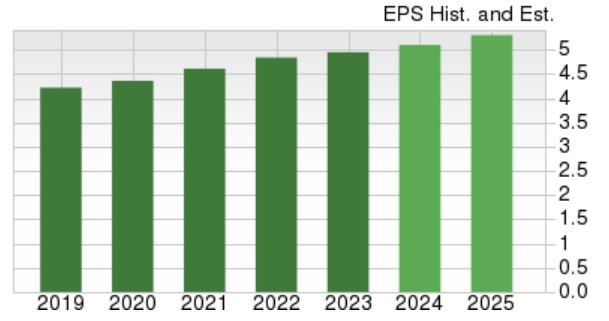

Primarily based on Zacks estimates, Altria’s annual earnings at the moment are anticipated to be up 3% in fiscal 2024 and are projected to rise one other 4% in FY25 to $5.30 per share. Plus, FY25 EPS projections would symbolize 25% development from pre-pandemic ranges with Altria’s earnings at $4.22 per share in 2019.

Picture Supply: Zacks Funding Analysis

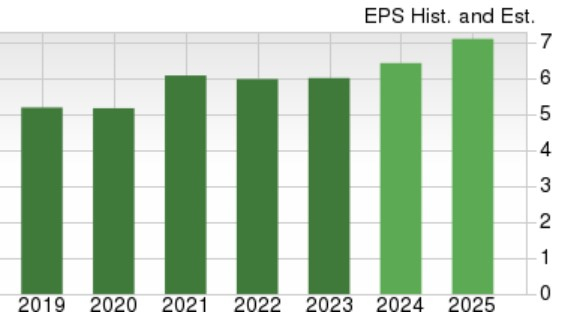

Turning to Philip Morris, its backside line is anticipated to develop 7% this 12 months with annual earnings slated to extend one other 10% in FY25 to $7.10 per share. Even higher, FY25 EPS projections for Philip Morris would replicate 37% post-pandemic development with earnings at $5.19 a share in 2019.

Picture Supply: Zacks Funding Analysis

Valuation Comparability

Buying and selling round $54, Altria’s inventory is at a ten.6X ahead earnings a number of which is a slight low cost to the business common of 12.7X. At $125, Philip Morris shares commerce at 19.5X ahead earnings, a premium to the business and Altria however beneath the S&P 500’s 23.2X.

Picture Supply: Zacks Funding Analysis

Profitable Dividends

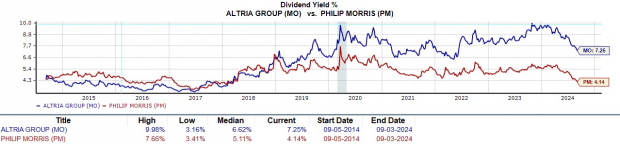

The sizable dividends these massive tobacco producers supply have saved traders intrigued concerning Philip Morris and Altria’s stronger earnings outlook.

Whereas Philip Morris has the sting in the meanwhile concerning its bottom-line growth, Altria’s annual dividend yield of seven.25% bolsters its extra reasonably priced valuation. This trumps the business common of 5.74% and Philip Morris at 4.14% though each tobacco giants have yields that tower over the S&P 500’s 1.28% common.

Moreover, Altria is taken into account a Dividend King with the corporate elevating its payout for greater than 50 consecutive years.

Picture Supply: Zacks Funding Analysis

Backside Line

Attributed to its extra enticing earnings outlook, Philip Morris Worldwide’s inventory sports activities a Zacks Rank #2 (Purchase) with Altria Group touchdown a Zacks Rank #3 (Maintain).

Earnings estimate revisions for FY24 have remained larger for Philip Morris as effectively whereas Altria’s have barely declined. Nevertheless, each of those massive tobacco shares stay viable long-term investments contemplating their attractive dividends and affordable valuations.

5 Shares Set to Double

Every was handpicked by a Zacks knowledgeable because the #1 favourite inventory to achieve +100% or extra in 2024. Whereas not all picks will be winners, earlier suggestions have soared +143.0%, +175.9%, +498.3% and +673.0%.

Many of the shares on this report are flying below Wall Avenue radar, which gives an ideal alternative to get in on the bottom ground.

Today, See These 5 Potential Home Runs >>

Altria Group, Inc. (MO) : Free Stock Analysis Report

Philip Morris International Inc. (PM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.