A number of customer staples supplies deserve factor to consider amongst the Zacks Food-Miscellaneous Market which is presently in the leading 15% of over 250 Zacks markets.

Most of these food firms are appealing as they use excellent returns along with the possibility for near-term benefit in their supplies. Allow’s take a glimpse at a few of the names standing apart in the market currently.

Solid Worth

Sporting a Zacks Ranking # 2 (Buy), Kellogg ( K) supply is appealing in regards to worth trading at 16.1 X onward incomes. This is well under the Food-Miscellaneous Market standard of 18.1 X and also the S&P 500’s 19.8 X.

And also, incomes price quotes are somewhat up over the last 60 days. Kellogg’s incomes are anticipated to dip -2% this year yet increase 5% in FY24 at $4.32 per share. Kellogg supplies financiers a charitable reward return of 3.56% and also well over the criteria’s 1.49% standard.

Picture Resource: Zacks Financial Investment Research Study

Likewise standing apart in regards to appraisal is Kraft Heinz ( KHC) which sporting activities a Zacks Ranking # 1 (Solid Buy). Climbing incomes price quotes are beginning to make Kraft supply look underestimated at $37 a share and also simply 12.8 X onward incomes.

Picture Resource: Zacks Financial Investment Research Study

Kraft jewelry are currently predicted to be up 3% this year and also increase an additional 3% in FY24 at $2.99 per share. A lot more excellent, Kraft has actually defeated incomes assumptions for 16 successive quarters and also has a 4.33% reward return.

Picture Resource: Zacks Financial Investment Research Study

Steady Development

Touchdown a Zacks Ranking # 2 (Buy) Nestle ( NSRGY) is just one of the a lot more appealing supplies in the Food-Miscellanous Market in regards to development. Double-digit top-line development is anticipated this year with sales predicted to leap 10% at $105.31 billion.

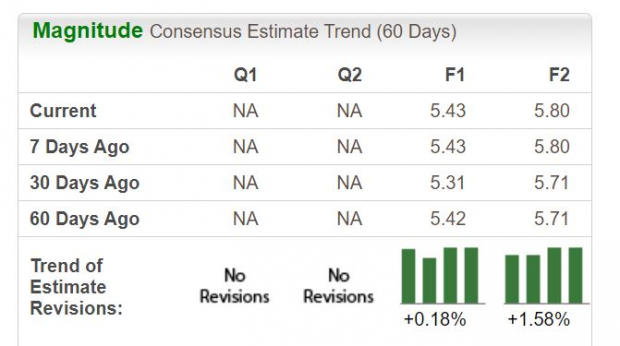

Broadening as the international leader in coffee (Nescafe) and also mineral water (Perrier) Nestle’s incomes are anticipated to increase 8% in financial 2023 and also broaden an additional 7% in FY24 at $5.80 per share. At 21.8 X onward incomes, Nestle’s P/E appraisal is practical thinking about EPS price quotes have actually trended greater and also its 2.36% reward return appropriates for revenue candidates.

Picture Resource: Zacks Financial Investment Research Study

Takeaway

Rewarding individual financiers with their soaring returns these customer food supplies looked positioned to relocate higher too. Currently the premier Zacks Food-Miscellaneous Market supplies a wealth of possibility with these being 3 instances of such.

4 Oil Supplies with Huge Benefits

Worldwide need for oil is via the roofing system … and also oil manufacturers are battling to maintain. So although oil costs are well off their current highs, you can anticipate huge benefit from the firms that provide the globe with “black gold.”

Zacks Financial investment Research study has actually simply launched an immediate unique record to assist you rely on this fad.

In Oil Market ablaze, you’ll find 4 unforeseen oil and also gas supplies placed for huge gains in the coming weeks and also months. You do not wish to miss out on these referrals.

Download your free report now to see them.

Kellogg Company (K) : Free Stock Analysis Report

Nestle SA (NSRGY) : Free Stock Analysis Report

Kraft Heinz Company (KHC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights and also viewpoints revealed here are the sights and also viewpoints of the writer and also do not always show those of Nasdaq, Inc.