With the summertime upon us, numerous travel-related supplies are positioned to increase with pent up-demand remaining from the pandemic.

Several of the recipients consist of airline companies, cruise liner, travel bureau, resorts, as well as holiday leasings. These travel-related business are adding to the solid efficiency of the premier Zacks Recreation as well as Leisure Providers Sector which remains in the leading 23% of over 250 Zacks sectors.

Year to date the Zacks Recreation as well as Leisure Industries cumulative complete return consisting of rewards is +29% to conveniently cover the S&P 500’s +14% as well as about match the Nasdaq’s solid efficiency.

Allow’s have a look at 3 highly-ranked supplies in the market that presently flaunt a Zacks Ranking # 1 (Solid Buy).

Picture Resource: Zacks Financial Investment Research Study

Bluegreen Vacations ( BVH)

Beginning is Bluegreen Vacations which is a holding firm that runs as a trip possession business. Bluegreen’s markets as well as markets holiday possession rate of interests as well as takes care of hotels in recreation as well as metropolitan locations.

What attracts attention regarding Bluegreen supply is its price-to-earnings evaluation at 8.3 X onward profits regardless of shares of BVH currently up +37% YTD. This is factor to think Bluegreen’s solid efficiency might proceed as BVH still trades at a substantial discount rate to the market standard of 21.7 X as well as perfectly underneath the S&P 500’s 20.1 X.

Picture Resource: Zacks Financial Investment Research Study

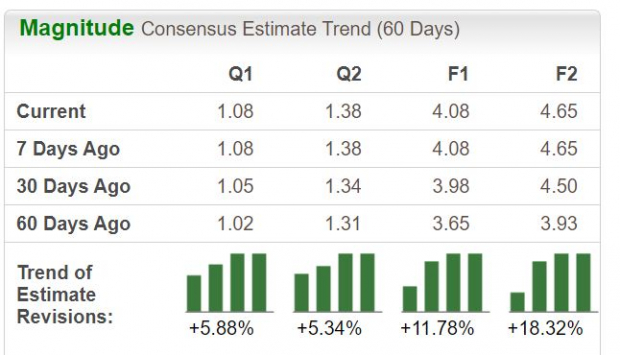

Moreover, profits quotes have actually trended greater over the last 60 days using additional assistance. Trading at $34 a share, Bluegreen’s profits are currently anticipated to climb up 17% this year as well as dive an additional 14% in FY24 at $4.65 per share.

Picture Resource: Zacks Financial Investment Research Study

Royal Caribbean Cruises ( RCL)

Taking the crown amongst cruise ship linings is Royal Caribbean. Raised reservations amidst stifled need remaining from the pandemic is beginning to repeat the cruise ship business’s large profits possibility.

Along with its Zacks Ranking # 1 (Solid Buy) Royal Caribbean likewise has an “A” Design Ratings quality for Development. In relationship to solid reserving need, Royal Caribbean’s monetary 2023 profits quotes have actually risen 46% over the last 60 days with FY24 EPS approximates climbing 21%.

Picture Resource: Zacks Financial Investment Research Study

Royal Caribbean’s pandemic respite lags it with yearly profits currently predicted to escalate to $4.71 per share contrasted to a modified loss of -$ 7.50 a share in 2022. And also, monetary 2024 profits are anticipated to climb up an additional 44% at $6.79 per share.

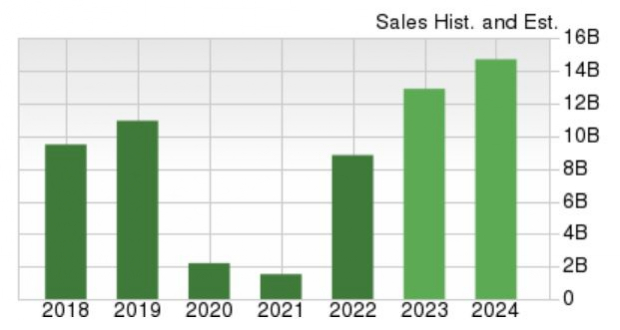

A lot more notably, this year’s awaited sales of $13.13 billion would certainly be up 48% from in 2015 as well as likewise overshadow 2019 pre-pandemic sales of $10.95 billion by 20%. At $94 a share, Royal Caribbean’s P/E evaluation of 19.8 X onward profits is sitll listed below the market standard as well as the standard.

Picture Resource: Zacks Financial Investment Research Study

Trip.com ( TCOM)

Completing the listing is traveling solution business Trip.com. Based in Shanghai, Trip.com is a feasible alternative to obtain direct exposure to high traveling need in as well as out of China.

With China resuming its economic situation previously in the year, Trip.com is back on the course to being among the extra identifiable worldwide on the internet traveling business. Trip.com’s item offerings consist of trips, discount rate resorts, as well as train tickets together with solution assistance as well as evaluations.

Especially, profits are anticipated to skyrocket 334% this year at $1.26 per share contrasted to EPS of $0.29 in 2022. Financial 2024 profits are predicted to jump an additional 56% at $1.96 per share.

Picture Resource: Zacks Financial Investment Research Study

Comparable to Royal Caribbean, Trip.com’s top-line recuperation is fascinating. Sales are anticipated to climb up 88% this year to $5.53 billion as well as go beyond 2019 pre-pandemic sales of $5.12 billion.

While Trip.com’s P/E evaluation of 29.3 X is over the market as well as standard, the business might begin to regulate a costs once again for its traveling solutions as well as procedures in among the globe” s most heavily populated nations.

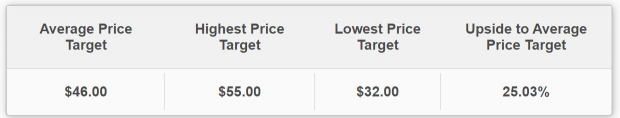

Keeping that being claimed, jewelry approximate modifications have actually likewise trended greater throughout the quarter as well as the ordinary Zacks Cost Target recommends 25% upside from existing degrees of around $36 a share.

Picture Resource: Zacks Financial Investment Research Study

Profits

With these travel-related business garnishing much energy as we proceed via the summertime currently seems a suitable time to purchase their supplies. Increasing profits quotes have actually remained to validate traveling need stays high as well as Bluegreen, Royal Caribbean, as well as Trip.com’s supply seem positioned for even more gains.

The New Gold Thrill: Exactly How Lithium Batteries Will Make Millionaires

As the electrical lorry transformation increases, capitalists have a possibility to target substantial gains. Numerous lithium batteries are being made & & need is anticipated to enhance 889%.

Download the brand-new FREE report revealing 5 EV battery stocks set to soar.

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Trip.com Group Limited Sponsored ADR (TCOM) : Free Stock Analysis Report

Bluegreen Vacations Holding Corporation (BVH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as point of views shared here are the sights as well as point of views of the writer as well as do not always show those of Nasdaq, Inc.