Capitalists are constantly in search of ingenious firms that can remain to adjust to present times, fads, and also technical breakthroughs.

Following week’s revenues schedule will certainly include 2 such firms that financiers might intend to take into consideration acquiring.

Agilent Technologies ( A)

Lots of firms out of the Zacks Computer system and also Innovation field are ingenious in nature, and also Agilent Technologies stands apart hereof with the business readied to report its financial first-quarter revenues on Tuesday, February 28.

Agilent is thought about an initial tools maker (OEM) with a lengthy background in interactions, electronic devices, semiconductor, examination and also dimension, life scientific researches, and also chemical evaluation sectors.

Following its offshoot from Hewlett Packard ( HPE), Agilent released its IPO in 1999 and also in the last few years has actually remained to expand its study and also screening services right into brand-new end markets.

Agilent supply presently sporting activities a Zacks Ranking # 2 (Buy) with revenues quotes alterations trending a little greater throughout the quarter which has actually been unusual for several technology supplies in the middle of greater rising cost of living.

Picture Resource: Zacks Financial Investment Research Study

Q1 Sneak Peek & & Expectation

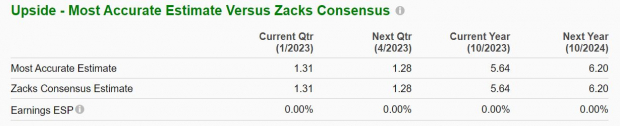

Agilent’s Q1 revenues are predicted at $1.31 per share, up 8% year over year. The Zacks Expected Shock Forecast (ESP) suggests Agilent must get to revenues assumptions with one of the most Precise Price quote additionally having Q1 EPS at $1.31. On the leading line, first-quarter sales are anticipated to be $1.69 billion, up 1% YoY.

Picture Resource: Zacks Financial Investment Research Study

Agilent’s yearly revenues are currently anticipated to climb 8% in FY23 and also dive an additional 10% in FY24 to $6.20 per share. On the leading line, Sales are anticipated to be up 1% in FY23 and also surge an additional 7% in FY24 to $7.46 billion.

Efficiency & & Assessment

Agilent has a solid background, and also its leading and also profits development continues to be excellent which is extremely interesting with its Electronic devices– Screening Devices Market additionally in the leading 43% of over 250 Zacks Industries.

Moreover, Agilent supply is up +6% over the in 2014 to mainly exceed the S&P 500’s -10% and also the Nasdaq -17%. Also much better, considering that dilating from Hewlett Packard in 1999, Agilent shares are up +234% and also near the efficiency of t he wider indexes to largley outperform HPE supply.

Picture Resource: Zacks Financial Investment Research Study

Agilent supply additionally trades magnificently from a historic assessment viewpoint at $142 a share and also 25.3 X ahead revenues which is near the market standard and also perfectly listed below its decade-long high of 41.6 X and also near to the typical of 24.5 X.

Sterling Facilities ( STRL)

Out of the Industrial Products field, Sterling Facilities is a cutting-edge design business whose supply is interesting prior to its fourth-quarter record on Monday, February 27. Sterling supply is bordering towards greater highs with its Design– R and also D Providers Market presently in the leading 22% of all Zacks Industries.

The driver of E-Infrastructure, Structure, and also Transport Solutions additionally sporting activities a Zacks Ranking # 2 (Buy) entering into its quarterly launch with revenues quotes trending greater for the business’s financial 2023 as it finishes up FY22.

The climbing revenues quotes might proceed as Sterling revealed on Thursday that it was granted a huge website advancement task for the Hyundai Design America EV battery center in the state of Georgia.

Picture Resource: Zacks Financial Investment Research Study

Q4 Sneak Peek & & Expectation

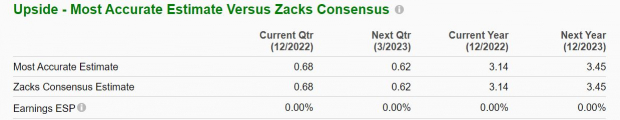

The Zacks Agreement for Sterling’s Q4 revenues is $0.68 per share, up 84% from EPS of $0.37 in the previous year quarter. The Zacks Shock Forecast suggests Sterling must reach its quarterly revenues assumptions with one of the most Precise Price quote additionally at $0.68 a share. Sales for the quarter are anticipated to be up 9% YoY at $439.10 million.

Picture Resource: Zacks Financial Investment Research Study

In general, Sterling revenues are currently anticipated to climb up 46% to $3.14 a share for FY22 contrasted to EPS of $2.15 in 2021. And also, Financial 2023 revenues are anticipated to leap an additional 10% to $3.45 per share. Sales are currently predicted to stand out 21% for FY22 and also be practically level in FY23 at $1.93 billion.

Efficiency & & Assessment

The leading and also profits development of Sterling is extremely eye-catching, specifically when thinking about STRL’s solid efficiency considering that it went public in 2001, currently up an impressive +4,704% to squash the efficiencies of the wider indexes.

Picture Resource: Zacks Financial Investment Research Study

A lot more interesting for financiers is that Sterling supply is up +29% over the in 2014 proceeding its controling efficiency which has actually additionally outmatched the wider indexes. Sterling supply presently has an “A” Design Ratings quality for both Development & & Worth. Trading at $37 per share and also simply 10.7 X ahead revenues, shares of STRL profession well listed below its decade-long high of 298.8 X and also perfectly underneath the typical of 12.6 X.

Profits

Capitalists will definitely intend to maintain Agilent Technologies (A) and also Sterling Facilities (STRL) on their radars as there might still be lots of benefit and also chance in these ingenious firms. This will certainly be specifically real if they have the ability to give solid quarterly records and also favorable advice.

7 Ideal Supplies for the Following one month

Simply launched: Specialists boil down 7 elite supplies from the present checklist of 220 Zacks Ranking # 1 Solid Buys. They regard these tickers “More than likely for Very Early Cost Pops.”

Because 1988, the complete checklist has actually defeated the marketplace greater than 2X over with a typical gain of +24.8% annually. So make sure to offer these carefully picked 7 your instant interest.

Agilent Technologies, Inc. (A) : Free Stock Analysis Report

Sterling Infrastructure, Inc. (STRL) : Free Stock Analysis Report

Hewlett Packard Enterprise Company (HPE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights and also point of views revealed here are the sights and also point of views of the writer and also do not always show those of Nasdaq, Inc.