Having beneficiant dividends, the improved earnings outlook for a number of transportation shares has turn out to be enticing.

Moreover, these prime transportation shares have beta ratios underneath the popular danger degree of lower than 1.0, suggesting they need to be much less risky than the broader market.

C.H. Robinson Worldwide CHRW

Coveting a Zacks Rank #1 (Sturdy Purchase) is third-party logistics operator C.H. Robinson Worldwide. Seeing regular prime line progress with gross sales projections edging towards $18 billion, C.H. Robinson’s elevated profitability may be very attractive as nicely.

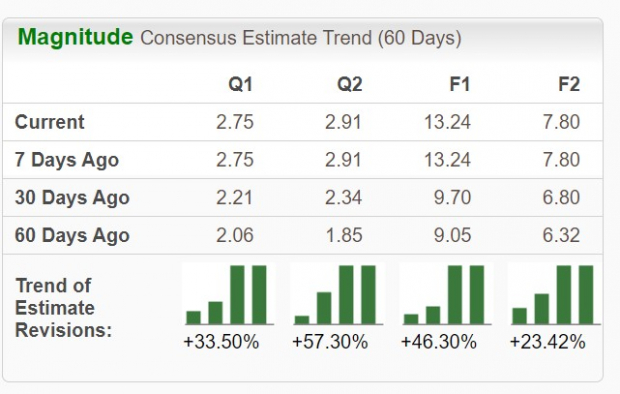

Annual earnings are anticipated to soar 25% in fiscal 2024 and are projected to extend one other 12% in FY25 to $4.62 per share. Extra intriguing is that over the past 60 days, FY24 and FY25 EPS estimates have soared 15% and 11% respectively.

Picture Supply: Zacks Funding Analysis

Correlating with the development of optimistic earnings estimate revisions, it’s noteworthy that C.H. Robinson’s Zacks Transportation-Companies Trade is within the prime 35% of over 250 Zacks industries.

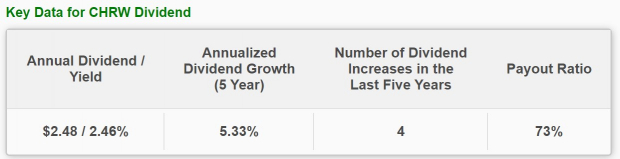

CHRW additionally gives a 2.46% annual dividend yield that tops the S&P 500’s 1.31% common whereas a lot of its business friends don’t supply a payout.

Picture Supply: Zacks Funding Analysis

Euroseas ESEA

Additionally sporting a Zacks Rank #1 (Sturdy Purchase) is Euroseas which operates within the dry cargo, dry bulk, and container transport markets. Euroseas’ Zacks Transportation-Delivery Trade is within the prime 41% of all Zacks industries with EPS estimates hovering over the past 60 days as the corporate continues to capitalize on improved market charges.

Picture Supply: Zacks Funding Analysis

Whereas Euroseas’ backside line is of course anticipated to contract after a document 12 months that noticed EPS at $14.98, ESEA nonetheless trades at a particularly low cost P/E a number of of three.2X with rising earnings estimates providing additional assist.

Picture Supply: Zacks Funding Analysis

Attributed to its elevated profitability, Euroseas at present has a 5.61% annual dividend that towers over the benchmark and is close to its strong business common of 5.85%.

Picture Supply: Zacks Funding Analysis

Cool Firm CLCO

Sporting a Zacks Rank #2 (Purchase) is Cool Firm which makes the case for being undervalued at 5.7X ahead earnings. Already worthwhile, Cool Firm went public in 2022 as an operator of fuel-efficient liquified pure gasoline carriers and in addition belongs to the Zacks-Delivery Trade.

Buying and selling simply over $10, Cool Firm’s inventory has a 14% dividend that definitely attracts the eye of earnings buyers. Extra reassuring is that Cool Firm has a really low beta ratio of 0.43 with a decent nit 52-week vary of $10.07-$14.04.

Picture Supply: Zacks Funding Analysis

Like Euroseas, Cool Firm’s backside line can be anticipated to dip after a document 12 months however earnings estimates for FY24 have risen 9% within the final 30 days with FY25 EPS estimates up 8%.

Picture Supply: Zacks Funding Analysis

Backside Line

Rising earnings estimate revisions are an ideal signal that the elevated chance of those prime transportation shares will certainly proceed. This largely suggests extra upside from their present ranges and definitely makes now a super time to purchase contemplating the enticing dividends they provide.

5 Shares Set to Double

Every was handpicked by a Zacks professional because the #1 favourite inventory to realize +100% or extra in 2024. Whereas not all picks may be winners, earlier suggestions have soared +143.0%, +175.9%, +498.3% and +673.0%.

A lot of the shares on this report are flying underneath Wall Avenue radar, which supplies an ideal alternative to get in on the bottom flooring.

Today, See These 5 Potential Home Runs >>

C.H. Robinson Worldwide, Inc. (CHRW) : Free Stock Analysis Report

Euroseas Ltd. (ESEA) : Free Stock Analysis Report

Cool Company Ltd. (CLCO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.