Friday’s blended jobs report prolonged the broader selloff in markets this week with September identified to be essentially the most risky month of the yr.

Amid heightened market volatility buyers might wish to contemplate a number of insurance coverage shares which have made their manner onto the coveted Zacks Rank #1 (Robust Purchase) record.

Particularly, three of those extremely ranked insurance coverage shares hail from the Zacks Insurance coverage-Property and Casualty Trade which is at the moment within the high 18% of over 250 Zacks industries.

Contemplating insurance coverage companies are usually steady on account of their necessity, these high shares even have beta ratios beneath the popular degree of 1.0 which suggests they need to be much less risky than the broader market.

Heritage Insurance coverage HRTG

Offering private residential insurance coverage for single-family householders and condominium homeowners, Heritage Insurance coverage’s inventory stands out with an general “A” VGM Zacks Fashion Scores grade for the mixture of Worth, Development, and Momentum.

Heritage has been a first-rate beneficiary of the broader trade’s improved outlook with the corporate increasing its industrial residential enterprise. This has led to robust natural progress with Heritage shares hovering over +100% yr so far however having a beta ratio of 0.97.

Picture Supply: Zacks Funding Analysis

Notably, HRTG is barely 8% from its 52-week excessive of just about $17 and has skyrocketed greater than 200% from its low of $4 during the last yr. Regardless of the unimaginable rally, HRTG trades at simply 8.4X ahead earnings with EPS anticipated to be up 10% in fiscal 2024 and projected to extend one other 18% in FY25 to $2.28 per share.

Moreover, during the last 30 days, earnings estimate revisions for FY24 and FY25 have soared 33% and 26% respectively.

Picture Supply: Zacks Funding Analysis

ProAssurance PRA

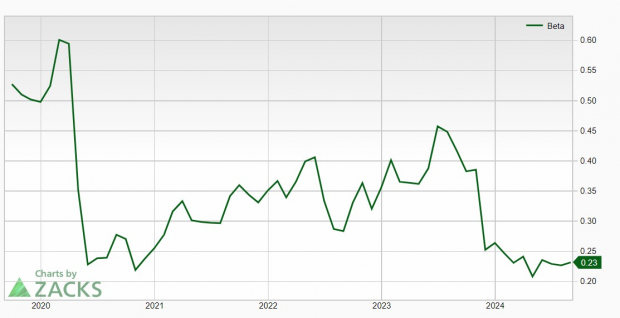

Checking in with a beta of simply 0.23 is ProAssurance, a holding firm whose subsidiaries present skilled legal responsibility insurance coverage merchandise to physicians and dentists amongst different healthcare suppliers.

Picture Supply: Zacks Funding Analysis

As instructed in its very low beta ratio, ProAssurance shares ought to have minimal draw back danger from present ranges and have already made the case for being oversold contemplating its elevated profitability. Extra importantly, PRA now trades beneath $15 and at a much more cheap 23.1X ahead earnings a number of with excessive double-digit EPS progress within the forecast for FY24 and FY25.

Whereas it might be too quickly to say ProAssurance shares are certainly in oversold territory, PRA traded at a ahead earnings excessive of 322X earlier within the yr with a median of 41.2X. Plus, earnings estimates have soared 52% within the final month for FY24 with FY25 EPS estimates spiking 16%.

Picture Supply: Zacks Funding Analysis

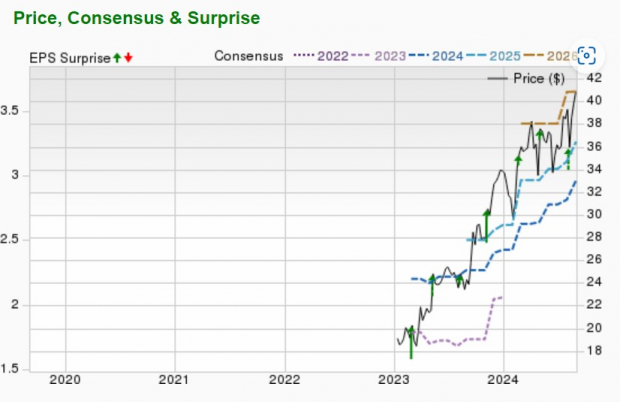

Skyward Specialty Insurance coverage (SKWD)

Rounding out the record is Skyward Specialty Insurance coverage Group which went public final yr as an insurance coverage holding firm that engages in underwriting industrial property and casualty insurance coverage coverages.

Close to its 52-week excessive at round $40, Skyward’s inventory has a beta ratio of 0.60 and has soared 77% from a one-year low of $22.97 final September. Most intriguing is that Skyward’s high and backside strains are anticipated to extend by double-digits in FY24 and FY25 with EPS estimates persevering with to development larger during the last 60 days.

Picture Supply: Zacks Funding Analysis

Even higher, Skyward’s inventory trades at 14X ahead earnings which is roughly on par with the trade common and properly beneath the S&P 500’s 23.1X. It’s additionally noteworthy that Skyward has exceeded earnings expectations in each quarter because it went public with SKWD up greater than +100% since its IPO.

Picture Supply: Zacks Funding Analysis

Backside Line

Rising earnings estimate revisions are an awesome signal these highly-ranked insurance coverage shares might have extra short-term upside. Low beta ratios and cheap valuations additional counsel now is a perfect time to purchase with insurance coverage shares usually seen as defensive investments.

Solely $1 to See All Zacks’ Buys and Sells

We’re not kidding.

A number of years in the past, we shocked our members by providing them 30-day entry to all our picks for the overall sum of solely $1. No obligation to spend one other cent.

Hundreds have taken benefit of this chance. Hundreds didn’t – they thought there have to be a catch. Sure, we do have a cause. We would like you to get acquainted with our portfolio providers like Shock Dealer, Shares Underneath $10, Know-how Innovators,and extra, that closed 228 positions with double- and triple-digit good points in 2023 alone.

ProAssurance Corporation (PRA) : Free Stock Analysis Report

Heritage Insurance Holdings, Inc. (HRTG) : Free Stock Analysis Report

Skyward Specialty Insurance Group, Inc. (SKWD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.