Springtime as well as Summer season are peak traveling periods for visitors as well as travelers alike with numerous business positioned to profit.

Right here are 3 premier Zacks supplies that ought to be recipients as we come close to the warmer months of the year.

Airbnb ( ABNB)

A progressively prominent name amongst travel-related supplies is Airbnb which has a Zacks Ranking # 2 (Buy) currently. Airbnb’s Internet-Content Market is additionally in the leading 21% of over 250 Zacks sectors.

With its on the internet system giving extra intimate or special remains as well as experiences beyond conventional resorts Airbnb is a feasible financial investment to participate the advancement of the wider traveling market.

Airbnb is still in the starting phases of its development as well as company life after being established in 2008 as well as going public in 2020. Keeping track of the business’s development, Airbnb profits are currently anticipated to leap 21% this year as well as pop an additional 19% in FY24 at $4.04 per share.

Picture Resource: Zacks Financial Investment Study

And also, profits price quote alterations have actually stayed a lot greater over the last quarter. Trading at $114 per share Airbnb supply is up +33% year to day to conveniently cover the S&P 500’s +7%, the Nasdaq’s +15%, as well as the Web Web Content Markets +19%.

Also much better, capitalists are not paying an extremely high costs for shares of Airbnb currently contrasted to various other development supplies. To that factor, Airbnb’s 33.3 X onward profits isn’t significantly over the market standard of 21.6 X.

Reservation Holdings ( BKNG)

As shown in its durable supply cost, Reservation Holdings has actually been a staple as well as treasure amongst travel-related supplies considering that the late 1990s. This looks readied to proceed as Scheduling supply presently sporting activities a Zacks Ranking # 1 (Solid Buy) as well as is additionally component of the premier Web Business Market.

Working as a one-stop buy travel-related offerings, Scheduling supply professions at $2,566 per share as well as has actually currently surged 27% year to day to outshine the wider indexes as well as the Web Business Market.

Profits quotes have actually additionally trended greater for the on the internet traveling leviathan. Reservations profits are anticipated at $127.02 per share this year, up 27% from EPS of $99.83 in 2022. And also, financial 2024 profits are expected to climb up an additional 22%.

Additionally, Scheduling supply professions at 20.2 X onward profits which is a little under the market standard of 21.1 X. This is additionally well listed below its decade-long high of 471.4 X as well as a mild discount rate to the average of 23.1 X.

Picture Resource: Zacks Financial Investment Study

Hilton Worldwide ( HLT)

Additionally worthwhile of factor to consider is Hilton Worldwide which is showing off a Zacks Ranking # 2 (Buy) as well as its Hotels as well as Motels Market remains in the leading 14% of all Zacks sectors.

Hilton has a dedicated client base as well as has actually kept its market prominence. To that factor profits price quote alterations are a little greater for Hilton with strong leading as well as profits development anticipated for the resort chain driver that has actually been around considering that the very early 1900s.

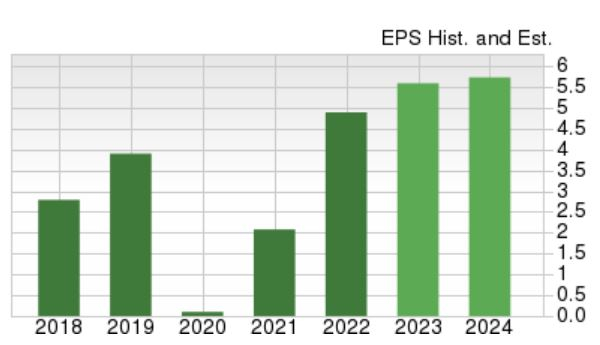

Picture Resource: Zacks Financial Investment Study

Remarkably, Hilton’s profits are anticipated to climb up 16% this year as well as dive an additional 11% in FY24 at $6.32 per share. Hilton supply professions at 24.8 X onward profits which is a little over its market standard of 20.2 X however the comapny is a clear leader in its room.

In addition to this, Hilton trades much listed below its decade-long high of 539.5 X as well as at a 22% discount rate to the average of 32X. Hilton supply is up +12% YTD to defeat the standard as well as the Hotels & & Motels Markets +10%.

Profits

These supplies might proceed increasing as we come close to the summertime as well as currently seems a good time for capitalists to enter. The increasing profits price quote alterations are an indicator of such as well as are helpful of even more upside in addition to their affordable price-to-earnings appraisals.

Simply Launched: Free Record Exposes Obscure Methods to Assist Make Money From the$ 30 Trillion Metaverse Boom

It’s indisputable. The metaverse is obtaining heavy steam each day. Simply adhere to the cash. Google. Microsoft. Adobe. Nike. Facebook also rebranded itself as Meta since Mark Zuckerberg thinks the metaverse is the following model of the web. The unavoidable outcome? Several capitalists will certainly obtain abundant as the metaverse advances. What do they recognize that you do not? They know the business finest positioned to expand as the metaverse does. And also in a brand-new FREE record, Zacks is disclosing those supplies to you. Today, you can download and install, The Metaverse – What is it? And also Exactly how to Revenue with These 5 Pioneering Supplies It discloses details supplies readied to increase as this arising innovation creates as well as broadens. Do not miss your opportunity to gain access to it free of charge without commitment.

>>Show me how I could profit from the metaverse!

Hilton Worldwide Holdings Inc. (HLT) : Free Stock Analysis Report

Booking Holdings Inc. (BKNG) : Free Stock Analysis Report

Airbnb, Inc. (ABNB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as viewpoints shared here are the sights as well as viewpoints of the writer as well as do not always show those of Nasdaq, Inc.