Whereas the Fed will probably lower rates of interest within the coming weeks, September has traditionally been probably the most difficult month for shares.

Referred to as the September Impact, financial coverage choices and better buying and selling volumes following the top of the summer season usually result in this lackluster seasonality within the inventory market.

Usually sought out for defensive safety amid heightened market volatility, medical shares could also be of curiosity to buyers in September. To that time, buyers are likely to rebalance their portfolios in September which results in the spike in buying and selling volumes.

Balancing the portfolio with healthcare versus threat belongings that don’t supply important providers could also be on the forefront of buyers’ minds.

That stated, listed here are three high medical shares to hedge in opposition to the September Impact.

DaVita DVA

Zacks Rank #1 (Robust Purchase)

With its inventory hovering over +40% 12 months so far, DaVita has a robust purchase ranking because the main supplier of dialysis providers to sufferers affected by persistent kidney failure in the USA.

Regardless of the YTD rally, DaVita’s inventory nonetheless trades at 15.1X ahead earnings and is on the optimum stage of lower than 1X gross sales. Correlating with such, DaVita checks an “A” Zacks Model Scores grade for Worth.

Picture Supply: Zacks Funding Analysis

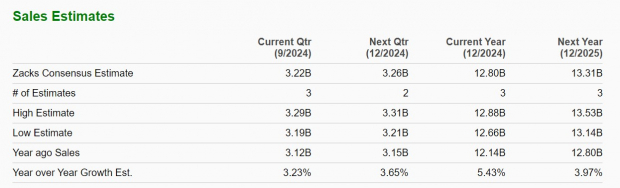

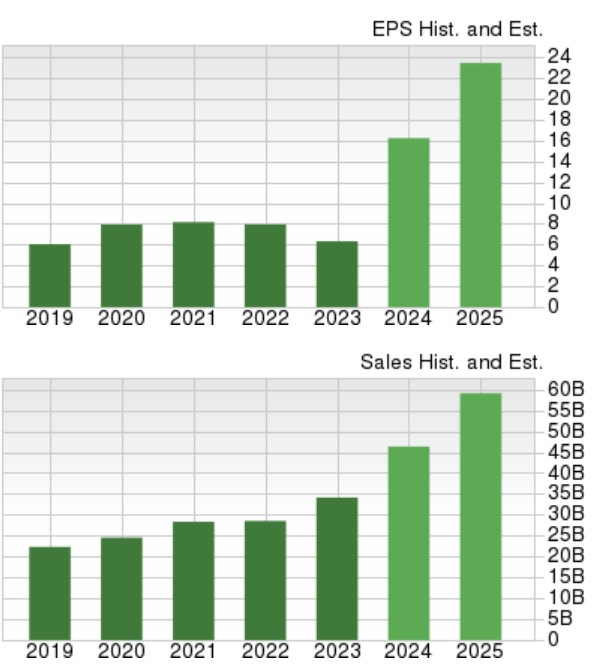

Moreover, DaVita is projected to put up regular progress on its high line in fiscal 2024 and FY25 with projections edging north of $13 billion.

Picture Supply: Zacks Funding Analysis

Extra intriguing is DaVita’s elevated profitability with double-digit EPS progress within the forecast. Plus, FY24 and FY25 EPS estimates have risen 4% and 11% within the final 30 days respectively.

Picture Supply: Zacks Funding Analysis

HCA Healthcare HCA

Zacks Rank #1 (Robust Purchase)

Predicated on its enticing valuation and the development of constructive earnings estimate revisions, HCA Healthcare’s inventory has additionally soared over 40% YTD and retains a robust purchase ranking. HCA is the nation’s largest operator of non-governmental acute care hospitals and lands an “A” Zacks Model Scores grade for Worth as nicely.

Buying and selling at an inexpensive 17.5X ahead earnings a number of, HCA’s EPS is now projected to increase 18% this 12 months to $22.50 versus $19.01 per share in 2023. Even higher, FY25 EPS is forecasted to rise one other 9%. Reassuringly, FY24 and FY25 EPS estimates have continued to rise during the last quarter and are barely up within the final month.

Picture Supply: Zacks Funding Analysis

Seeing an uptick in admissions and emergency room visits throughout Q2, HCA’s inventory trades at 1.4X gross sales with its engaging high line enlargement set to proceed. HCA’s whole gross sales are anticipated to extend 9% in FY24 and are slated to rise one other 5% in FY25 to $74.25 billion.

Picture Supply: Zacks Funding Analysis

Eli Lilly LLY

Zacks Rank #2 (Purchase)

Rounding out the checklist is Eli Lilly which has been one of many market’s high performers this 12 months because of constructive sentiment surrounding its modern drug pipeline. The pharmaceutical big continues to handle a large market of Kind 2 diabetics with its GLP-1 medicine for the remedy of each diabetes and weight problems.

Picture Supply: Zacks Funding Analysis

Constructing on what had been a considerably untapped market with reference to weight reduction medicine, Ely Lilly is projected to put up excessive double-digit high and backside line progress in FY24 and FY25. This continues to help the premium Eli Lilly instructions concerning its valuation metrics together with the truth that earnings estimate revisions for LLY have soared during the last 30 days.

Picture Supply: Zacks Funding Analysis

Backside Line

Amid elevated market volatility these high medical shares will likely be worthy of consideration. That is very true when guarding in opposition to the potential September Impact as rising earnings estimate revisions proceed to recommend extra upside for DaVita, HCA Healthcare, and Eli Lilly’s inventory.

7 Finest Shares for the Subsequent 30 Days

Simply launched: Consultants distill 7 elite shares from the present checklist of 220 Zacks Rank #1 Robust Buys. They deem these tickers “Most Doubtless for Early Value Pops.”

Since 1988, the total checklist has crushed the market greater than 2X over with a median acquire of +23.7% per 12 months. So remember to give these hand picked 7 your instant consideration.

Eli Lilly and Company (LLY) : Free Stock Analysis Report

DaVita Inc. (DVA) : Free Stock Analysis Report

HCA Healthcare, Inc. (HCA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.