On Tuesday, Taiwan Semiconductor Manufacturing Firm Restricted TSM, or TSMC, noticed its shares contact a document excessive in Taipei following good points amongst its key prospects, corresponding to NVIDIA Company NVDA. TSMC’s shares have surged 99.3% this 12 months, and the inventory is ready for its strongest annual efficiency since 1999, because of the thriving generative synthetic intelligence (AI) market.

Picture Supply: Zacks Funding Analysis

Provided that TSMC inventory is primed for achievement, is it a great inventory to purchase within the new 12 months? Let’s discover out –

TSMC Plans to Launch New Chip Expertise in 2025

TSMC is producing its cutting-edge 2-nanometer (nm) chips and is predicted to introduce them in 2025. The 2nm chips will attain full-scale manufacturing in 2026, with its pre-order demand surpassing that of 3nm and 5nm chips.

The 2nm chips characteristic nanosheet transistor expertise that enhances the effectivity stage. They’re designed to eat 25-30% much less power, increase battery life and curtail prices. So, together with continued demand for the current 3nm chips, the upcoming next-generation chip will increase the TSMC inventory subsequent 12 months.

TSMC Sees A number of Progress Prospects

TSMC not solely produces chips for graphic processing unit firms like NVIDIA but in addition smartphone chips for gamers like Apple Inc. AAPL and QUALCOMM Included QCOM. Each Apple and QUALCOMM just lately witnessed an uptick in smartphone gross sales, a constructive sign for TSMC.

TSMC additionally manufactures customized chips for Marvell Expertise, Inc. MRVL and Broadcom Inc. AVGO. Each firms have already positioned orders with TSMC to satisfy the rising demand for customized AI chips. TSMC’s diversified partnerships, subsequently, cut back the dependence on NVIDIA, providing varied progress prospects that favor the inventory subsequent 12 months.

Semiconductor Market Progress Advantages TSMC Inventory

The worldwide semiconductor market is estimated to generate $2 trillion and extra in revenues by 2032 at a CAGR of just about 15%, in keeping with Priority Analysis. Equally, McKinsey expects the worldwide semiconductor market to surpass annual revenues of $1 trillion by the tip of 2030.

The rising semiconductor market is a tailwind for the TSMC inventory subsequent 12 months because it’s the biggest semiconductor foundry with a 62% market share. Furthermore, TSMC’s rivals are struggling. Intel Company INTC, for example, is spinning off its foundry enterprise and lowering capital expenditures.

TSM Inventory to Purchase Hand Over Fist

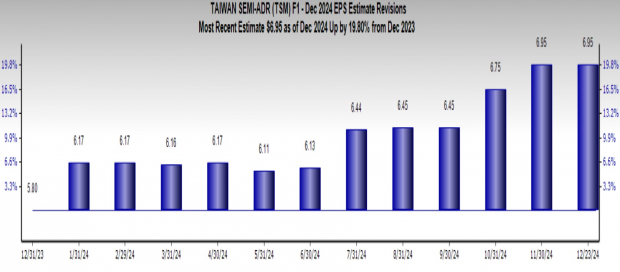

With the TSMC inventory destined to scale upward within the new 12 months banking on superior chip expertise, a diversified enterprise mannequin, and market dominance, it absolutely is a compelling purchase. Because of this, TSMC’s earnings per share are projected to extend by 19.8% in comparison with final 12 months, with a Zacks Consensus Estimate of $6.95.

Picture Supply: Zacks Funding Analysis

Brokers additionally assume that the TSMC inventory will rise within the close to time period, elevating the common short-term value goal to $226.14 from the final closing value of $197.21 and setting the very best goal at $250, an upside of 26.8%.

Picture Supply: Zacks Funding Analysis

TSMC inventory for the time being has a Zacks Rank #2 (Purchase) (learn extra: 3 Reasons to Buy TSM Stock Besides 54% Q3 Net Profits Surge).

You’ll be able to see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

Zacks Naming High 10 Shares for 2025

Wish to be tipped off early to our 10 high picks for the whole lot of 2025?

Historical past suggests their efficiency might be sensational.

From 2012 (when our Director of Analysis Sheraz Mian assumed accountability for the portfolio) by way of November, 2024, the Zacks High 10 Shares gained +2,112.6%, greater than QUADRUPLING the S&P 500’s +475.6%. Now Sheraz is combing by way of 4,400 firms to handpick one of the best 10 tickers to purchase and maintain in 2025. Don’t miss your probability to get in on these shares after they’re launched on January 2.

Be First to New Top 10 Stocks >>

Intel Corporation (INTC) : Free Stock Analysis Report

QUALCOMM Incorporated (QCOM) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Marvell Technology, Inc. (MRVL) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

Taiwan Semiconductor Manufacturing Company Ltd. (TSM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.