Regardless of a number of hiccups, the S&P 500 bull market is not slowing down. The inventory index most frequently used to reference the U.S. large-cap inventory market has climbed over 20% by means of 2024 as of this writing.

However not each firm has participated equally within the present market rally. Only a handful of the most important corporations available in the market have pushed the overwhelming majority of returns for the S&P 500. Because of this, the index has change into more and more concentrated with the majority of the worth in just some shares.

Over 20% of the 500-company index’s worth comes from simply three shares — Apple, Microsoft, and Nvidia. The highest-10 shares account for round 35% of the index, essentially the most because the Sixties.

Whereas the most important corporations are getting larger quicker than the remainder of the market, it is value noting that rising market focus is unsustainable. In some unspecified time in the future, the megacap shares driving the market right now will take a again seat to smaller corporations. And one market indicator suggests an enormous change is coming.

Picture supply: Getty Pictures.

U.S. cash provide is accelerating

U.S. money supply can have far-reaching impacts on enterprise and investor conduct. When a enterprise has simpler entry to low-cost capital, it will possibly develop so much quicker. However when cash provide is tight, smaller corporations wrestle to develop and reap the benefits of enterprise alternatives. In the meantime, bigger, deep-pocketed corporations can seize these alternatives whereas dealing with much less competitors.

In response to information gathered by J.P. Morgan‘s European Quantitative Technique head, Khuram Chaudhry, there’s a correlation between a lower in cash provide progress and an increase in inventory market focus. The alternative can also be true. When money-supply progress accelerates, smaller corporations can outperform, resulting in much less focus available in the market.

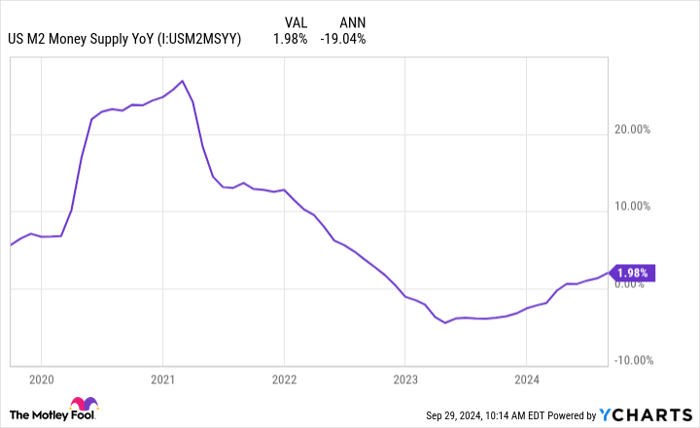

After a number of years of slowing progress, even some declines, U.S. money-supply progress is accelerating. The pattern is predicted to proceed. This is how we acquired right here.

Amid the onset of the COVID-19 pandemic in 2020, the Federal Reserve set the low finish of its goal federal funds rate to 0%. In the meantime, the federal government despatched out stimulus checks to households to be able to prop up the economic system. The consequence was a surge in a measure of the U.S. cash provide referred to as M2 cash provide. M2 contains money in circulation, deposit accounts, money market accounts, and certificates of deposit. Principally, if you happen to can simply entry the funds to pay for items and providers, it is included in M2.

US M2 Money Supply YoY information by YCharts.

Cash provide grew extraordinarily shortly in 2020, and it continued to develop shortly in 2021, though it could not probably sustain the torrid tempo from a number of stimulus checks and a sudden slash in rates of interest. Inflation was beginning to change into a problem for a lot of households, and it will definitely grew to become clear the Fed wanted to tighten the screws on the cash provide.

Amid tightening insurance policies from the Fed in 2022, M2 money-supply progress began to sluggish shortly. By the tip of the yr, progress went into damaging territory because the Fed continued to boost rates of interest. Provide shrank all through all of 2023 and into the primary quarter of 2024 even after the Fed halted its rate of interest hikes.

However M2 cash provide is lastly rising once more. Not solely that, however progress is accelerating shortly. In April, M2 cash provide elevated about 0.6% yr over yr. That climbed to 1.3% in June, and it reached 2% in its most-recent studying for August. Whereas M2 stays beneath the height money-supply ranges of 2022, we’re beginning to see larger liquidity available in the market.

As talked about, cash provide ought to proceed rising shortly transferring ahead. The Federal Reserve simply instituted its first rate of interest lower since 2020, a 0.5 proportion level lower. Two extra cuts might come by the tip of the yr, and we might see charges drop greater than 1 proportion level subsequent yr as effectively.

That can make it cheaper to borrow, rising the full quantity of capital obtainable to smaller corporations. Because of this, smaller shares may lead the subsequent leg up within the present bull market.

One of the best ways to take a position as money-supply progress accelerates

Probably the most easy solution to put money into shares once you anticipate market focus to reverse is to purchase an equal-weight index fund. The Invesco S&P 500 Equal Weight ETF (NYSEMKT: RSP) is among the greatest within the trade, charging an annual-expense ratio of simply 0.2%.

With an equal-weight index fund, the fund supervisor invests the identical sum of money in every of the parts of the index. So, they’re going to put simply as a lot cash in Apple, Microsoft, and Nvidia as shares quantity 498, 499, and 500. That manner, if the bigger corporations underperform, it does not crush the index as a lot as the standard cap-weighted S&P 500.

After all, the alternative can also be true. If the megacaps proceed to outperform, the equal-weight index will underperform. That is been the case for a while now. Nonetheless, the equal-weight index traditionally produces very sturdy and extended intervals of outperformance as soon as focus lastly peaks. And we could also be nearing one other peak.

An alternative choice is to put money into small-cap shares. These shares aren’t represented within the S&P 500, however they face the identical challenges because the shares you will discover on the backside of the favored index. In truth, small-caps could have seen a good larger affect from high-interest charges, as many depend on floating-rate debt as an alternative of long-term fixed-rate bonds.

My most popular index for small-cap shares is the S&P 600, which tracks 600 of the smallest corporations within the U.S. market. The SPDR Portfolio S&P 600 Small Cap ETF (NYSEMKT: SPSM) has an expense ratio of simply 0.03%.

Similar to the S&P 500, the index has a profitability requirement for inclusion. Because of this, the S&P 600 tends to tilt towards value stocks. The profitability requirement can cut back the danger of investing in small-cap shares. And worthwhile companies with larger entry to capital are likely to change into extra worthwhile over time as an alternative of burning by means of money.

Regardless of the potential progress for small-cap shares going ahead, there is a large valuation discrepancy. The S&P 600 trades for simply 15.3 occasions ahead earnings, versus a ahead PE of 21.2 for the S&P 500. The large valuation hole between the indexes suggests the market does not respect the potential for worthwhile small caps to speed up earnings progress as money-supply progress accelerates.

Do you have to make investments $1,000 in Invesco S&P 500 Equal Weight ETF proper now?

Before you purchase inventory in Invesco S&P 500 Equal Weight ETF, take into account this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 best stocks for traders to purchase now… and Invesco S&P 500 Equal Weight ETF wasn’t considered one of them. The ten shares that made the lower might produce monster returns within the coming years.

Contemplate when Nvidia made this checklist on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $743,952!*

Inventory Advisor supplies traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 23, 2024

Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. JPMorgan Chase is an promoting associate of The Ascent, a Motley Idiot firm. Adam Levy has positions in Apple and Meta Platforms. The Motley Idiot has positions in and recommends Apple, JPMorgan Chase, Meta Platforms, and Nvidia. The Motley Idiot has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.