US CPI KEY TAKEAWAYS:

- US expectations: 2.6% y/y headline inflation, 3.3% y/y “” inflation

- The is prone to lower rates of interest by 25bps whatever the inflation studying, although a hotter-than-expected print may actually increase some questions.

- USD/CAD has damaged above the important thing 1.4100 space, opening the door for one more leg greater pending US CPI and the BOC assembly.

When is the US CPI report?

The US CPI report for November can be launched at 8:30ET (13:30 GMT) on Wednesday, December 11.

What are the US CPI Report Expectations?

Merchants and economists are projecting headline CPI to come back in at 2.6% y/y, with the core (ex-food and -energy) studying anticipated at 3.3% y/y.

US CPI Forecast

The Fed, as all the time, is concentrated on each sustaining full employment (combined outcomes on that entrance after Friday’s report confirmed extra jobs created than anticipated however a deterioration within the ) and inflation, which has stubbornly stalled within the 3% vary after a steep decline in 2022 and 2023. Nonetheless, the vast majority of Fed audio system in latest weeks have indicated that the central financial institution is on observe to chop rates of interest by 25bps on the upcoming December assembly, even when that perspective isn’t essentially unanimous at this level.

As many readers know, the Fed technically focuses on a special measure of inflation, , when setting its coverage, however for merchants, the CPI report is at the very least as vital as a result of it’s launched weeks earlier. Because the chart beneath reveals, the year-over-year measure of US CPI has resumed its decline from the 2022 peak in latest months, although economists expect it to bump again as much as 2.6% this month:

Supply: TradingView, StoneX

Because the chart above reveals, the “Costs” part of the PMI reviews – a key main indicator for CPI itself – has held its personal within the mid-50 area, indicating “sticky” worth pressures at a agency degree.

Crucially, the opposite key part to look at on the subject of US CPI is the so-called “base results,” or the affect that the reference interval (on this case, 12 months) has on the general determine. Final November’s 0.1% m/m studying will drop out of the annual calculation after this week’s studying, opening the door for a rise within the headline year-over-year CPI studying so long as the month-over-month studying is available in greater than that.

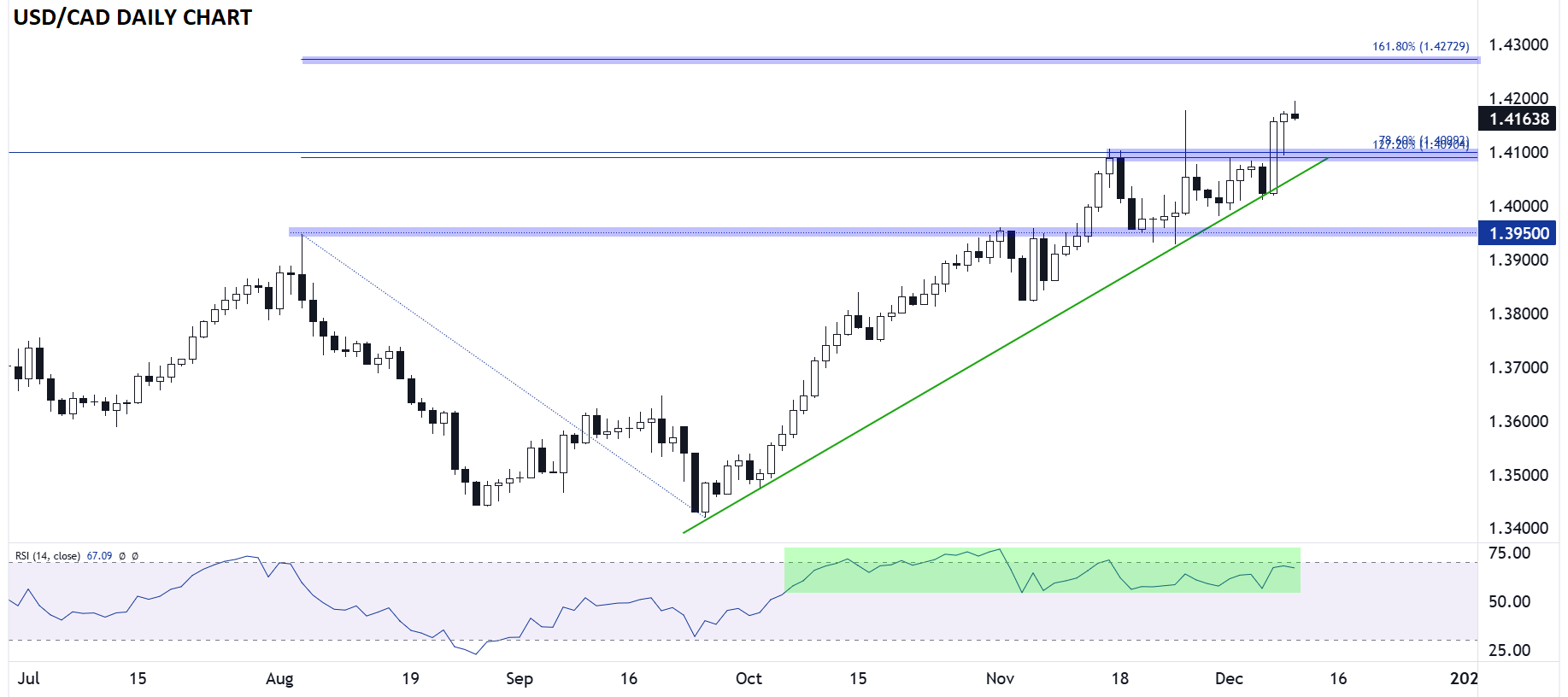

US Greenback Technical Evaluation – USD/CAD Each day Chart

Supply: StoneX, TradingView

Turning our consideration to the , is in a very fascinating spot forward of the US inflation report and a Financial institution of Canada assembly lower than two hours later. The pair has been in an uptrend since mid-September and eventually broke above confluent Fibonacci resistance close to 1.41 on Friday.

After retesting that degree and seeing a robust bounce on Monday, the technical bias stays to the topside for a possible continuation towards the following Fibonacci degree of curiosity slightly below 1.4300. In the meantime, solely an enormous reversal to interrupt beneath 1.4100 and the rising pattern line round 1.4050 would erase the near-term bullish bias.