- Trump’s recession remarks rattled markets, however warning indicators had been already in place.

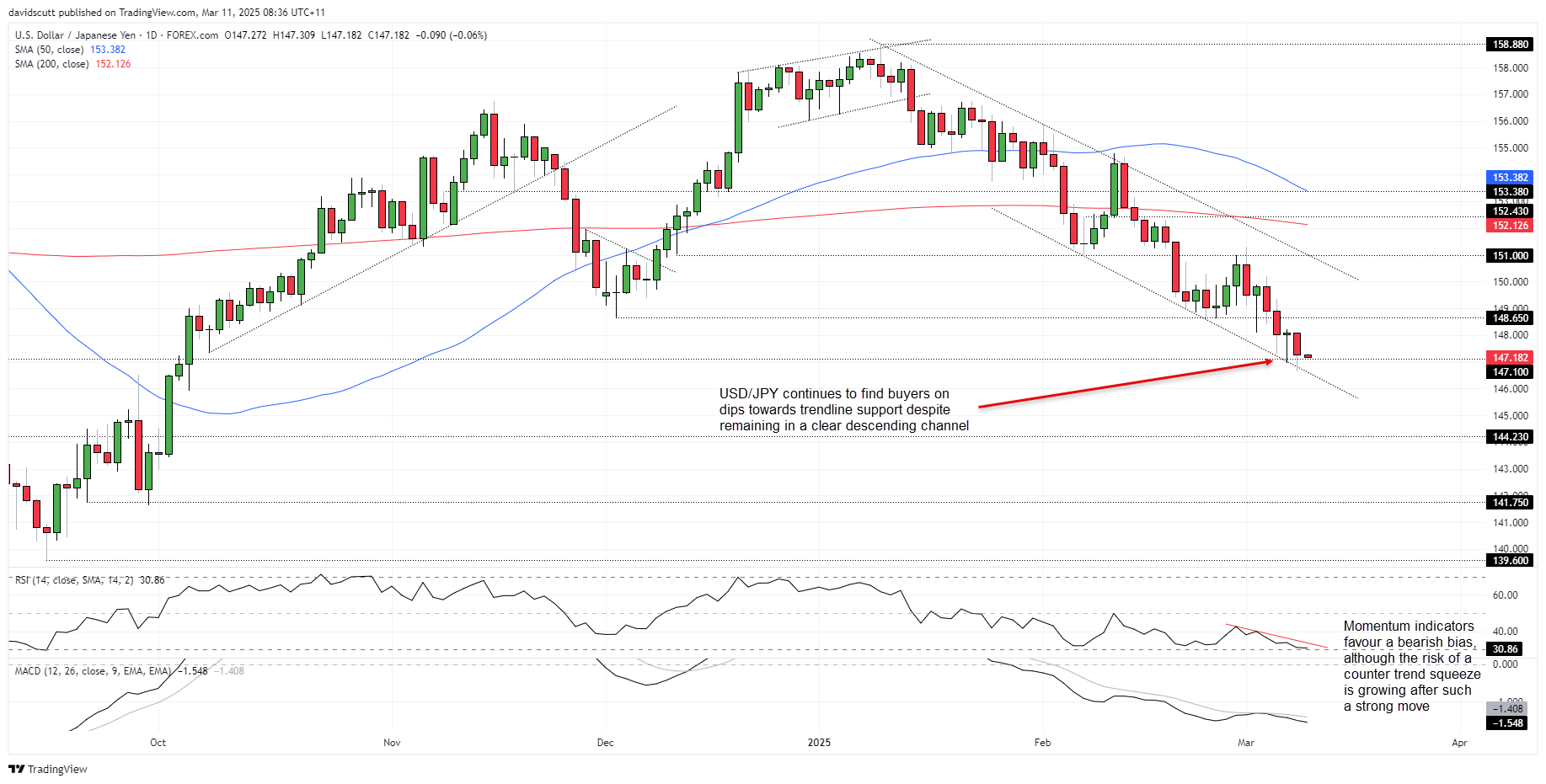

- USD/JPY holds trendline help, however draw back dangers stay.

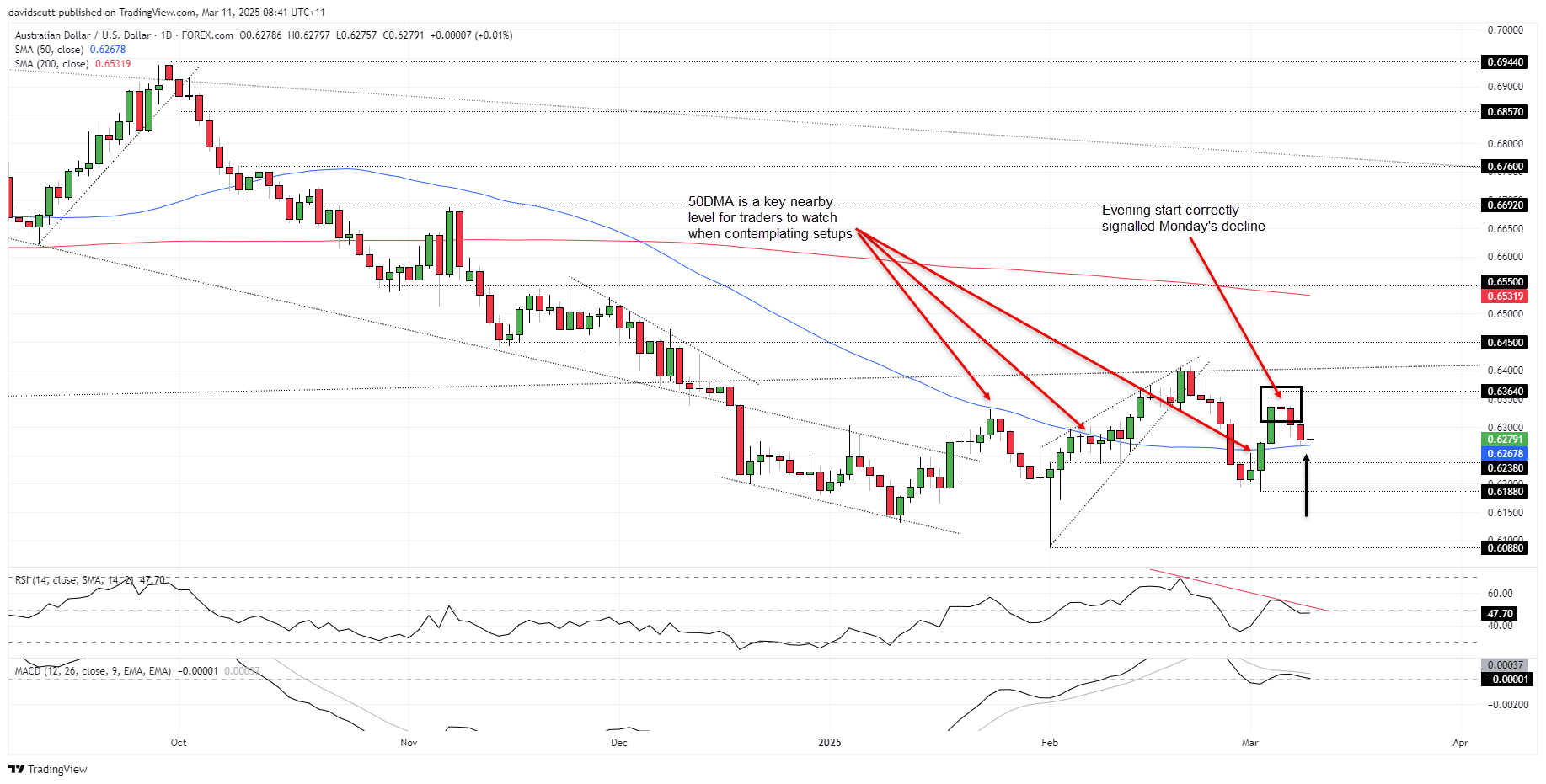

- AUD/USD weakens, testing key transferring common as momentum stays bearish.

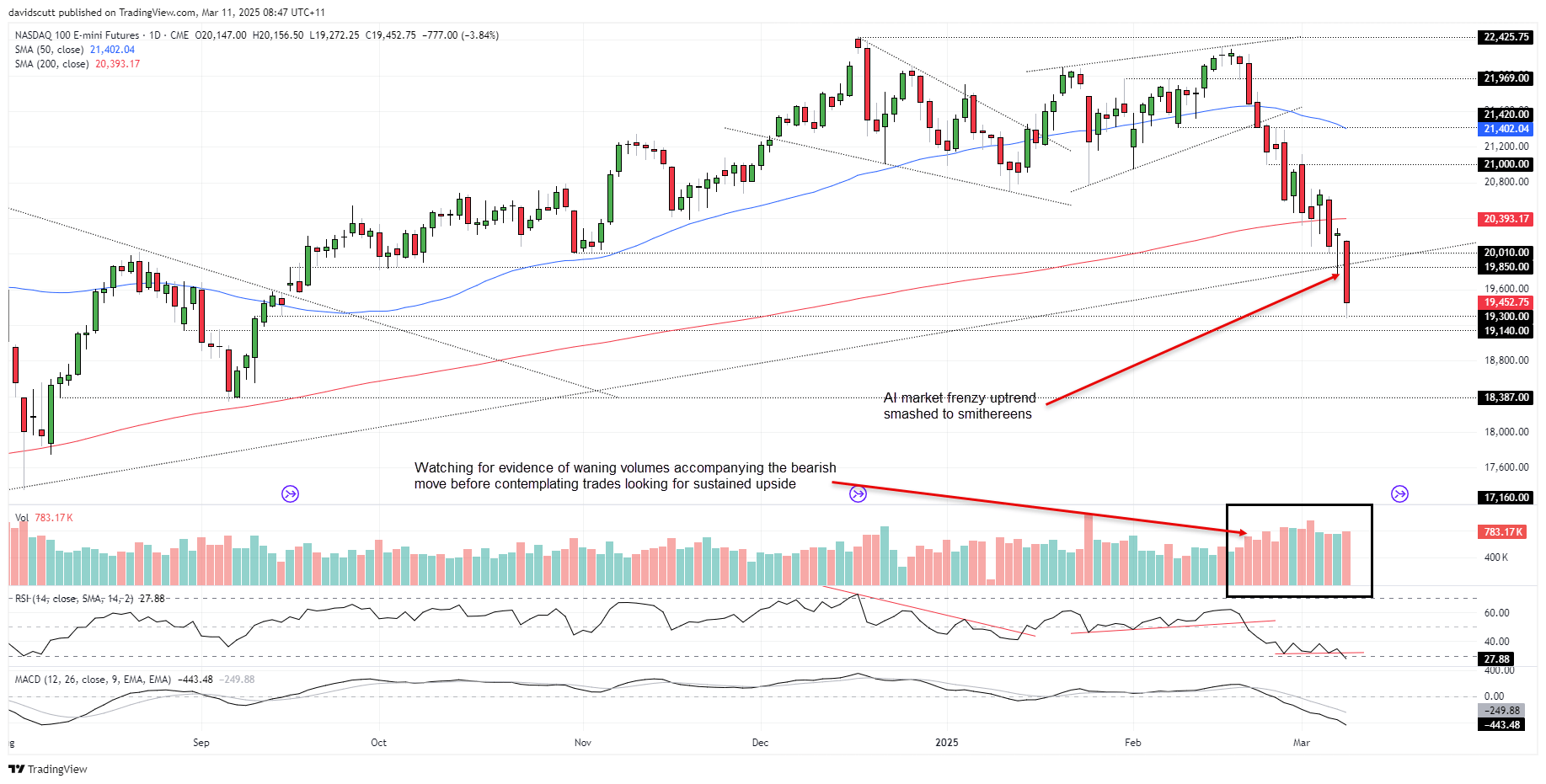

- Nasdaq 100 cracks long-term uptrend—AI mania unwind or only a correction?

US recession fears rattled markets on Monday, with US President Donald Trump’s remarks cited because the spark behind a pointy unwind in riskier belongings.

Talking on Fox Information, Trump averted ruling out a recession, as a substitute suggesting the economic system is in a “interval of transition” as his administration pushes main coverage modifications. “I hate to foretell issues like that. There’s a interval of transition as a result of what we’re doing may be very large. We’re bringing wealth again to America.”

The feedback recommend he’s extra tolerant of near-term financial weak point than many had assumed, very similar to his early strategy to the inventory market in his second time period. Gone are the each day social media posts cheering Dow data, and there’s little signal he intends to shift course to stabilise more and more risky markets.

Recession Indicators Flashing Amber

Whereas many pointed to Trump’s remarks because the set off for the danger rout, the warning indicators had been flashing properly earlier than. Citigroup’s U.S. financial shock index has been adverse since mid-February, signalling a gentle stream of weaker-than-expected knowledge even with lowered expectations. The Atlanta Fed GDPNowcast mannequin factors to an annualised first-quarter progress of -2.4%, reflecting not simply tariff uncertainty however broader cracks forming within the labour market. Hardly the form of backdrop that instils confidence.

The charts reinforce the rising unease, with Fed funds futures now pricing in additional than three full 25bp fee cuts in 2025. The / Treasury curve slipped into adverse territory earlier this month, suggesting bond merchants are bracing for a slowdown. The MOVE index—basically the bond market’s model of the —has surged to its highest degree because the final presidential election, highlighting rising uncertainty.

Supply: TradingView

So sure, Trump’s feedback could have been the spark, however the gas had been sitting there for weeks. Encouragingly for merchants, the response throughout some markets appeared extra technical than purely elementary, suggesting positioning performed a job.

FX: Watching USD/JPY and AUD/USD as Threat Sentiment Wobbles

is price watching as we speak in Asia, given its hyperlinks to danger urge for food through yen carry trades, particularly because it bottomed properly earlier than U.S. fairness futures throughout the North American session. If it begins to slip once more, it might be an indication that pressured liquidations in riskier asset courses could also be on the best way.

Supply: TradingView

For now, USD/JPY stays locked in a descending channel, bouncing off trendline help on Monday, mirroring Friday’s worth motion. That and close by horizontal help are the speedy draw back ranges to look at, with a break beneath opening the door for a transfer in the direction of 146 and even 144.23. On the topside, 148 has capped countertrend strikes just lately, with 148.65 the following layer of resistance after that. RSI (14) and MACD stay firmly bearish, favouring promoting rallies and draw back breaks.

Supply: TradingView

No surprises seeing weaker to begin the week, with the three-candle night star sample accomplished Friday appropriately signalling additional promoting on Monday. AUD/USD has been monitoring the 50DMA intently in latest months, so the truth that Monday’s slide stalled there may be noteworthy. Beneath, 0.6238 and 0.6188 have been in play over the previous month. On the topside, 0.6300 could supply some resistance, however the extra attention-grabbing degree is the swing excessive of 0.6364 from March 6. Momentum indicators stay firmly bearish, reinforcing the near-term draw back bias.

Nasdaq 100: AI Unwind or Only a Correction?

dominated the headlines after the bodily index posted its largest one-day drop since 2022, slicing by uptrend help courting again to early 2023—when the AI mania actually took off. Given final week’s break beneath the 200DMA, it raises the query: Are we witnessing the unwind of AI euphoria? With latest worth motion and rising competitors from China, the items are falling into place for some form of reset.

Supply: TradingView

The early 2023 uptrend sits round 19,900 as we speak, making it and former horizontal help at 19,850 key near-term ranges on the topside. Beneath, the value bounced off minor help at 19,300 in a single day, with one other minor degree at 19,140 sitting slightly below. A break of the latter might see bears push for a retest of 18,387. Each RSI (14) and MACD are flashing bearish alerts, though the latter is now in oversold territory on the each day timeframe—suggesting that whereas the bias stays tilted to the draw back, the danger of a countertrend squeeze is rising after latest heavy falls.