- USD/JPY, gold, and crude oil anticipated to see heightened volatility round US election outcomes

- Coverage variations between Democrats and Republicans on vitality, commerce, and financial coverage are key market drivers

- A Republican “pink wave” might enhance USD/JPY, whereas a cut up Congress could stress the pair decrease

- Crude oil worth outlook hinges on US greenback strikes and potential shifts in vitality and coverage

- Danger of kneejerk promoting in gold beneath pink or blue sweep of Congress

Overview

, , and are poised for potential excessive volatility across the US election. This stems from the stark variations in vitality, commerce, overseas relations, and financial insurance policies between Democrats and Republicans, in addition to the uncertainty over whether or not both social gathering can take full management of Congress, which might affect the implementation of their coverage agenda.

This be aware focuses on attainable market reactions to eventualities more likely to set off huge market strikes, serving to merchants align these outcomes with key technical ranges.

USD/JPY: Crimson or Blue Waves Amplify Volatility Danger

As a market that’s been strongly correlated with the US rate of interest outlook for a number of years, USD/JPY screens as one of many simpler FX pairs to evaluate the way it could react.

As outlined within the launched over the weekend, listed here are the outcomes that would get USD/JPY shifting:

Republican pink wave (Trump victory, Senate/Home Republican-controlled): USD/JPY probably rallies because the Treasury curve steepens, given the upper likelihood of expansionary fiscal coverage.

Democrat blue wave (Harris victory, Senate/Home Democrat-controlled): USD/JPY upside, however not as sturdy as a Republican sweep given pre-election coverage indicators.

Trump victory, cut up Congress: Coverage gridlock might sluggish progress, weaken inflation, and improve probabilities of extra Fed easing. Treasury yields are more likely to fall, pulling USD/JPY decrease.

Harris victory, cut up Congress: Most bearish final result for USD/JPY given chance of sizeable falls in US Treasury yields.

Supply: TradingView

USD/JPY has entered consolidation mode on the weekly chart after breaking a number of key technical resistance ranges, though it’s notable that momentum stays with the bulls with RSI (14) and MACD persevering with to pattern increased.

You may see how influential 151.95 stays for USD/JPY with the value now discovering help there after being capped under it for therefore lengthy beforehand. 150.90 and the 50-week shifting common are different key help ranges close by.

In a situation of a Republican pink wave, there’s a significant threat USD/JPY might retest the multi-decade highs round 162 given the chance that increased US Treasury yields could draw capital into the . Even a Democratic blue wave might ship upside given expansionary fiscal coverage could gas stronger progress in an already strong US economic system, lowering the necessity for the Federal Reserve to chop rates of interest additional.

A cut up Congress might even see USD/JPY draw back materialise, even with Trump as President, limiting the flexibility to introduce each tax cuts AND tariffs given he’ll want Congressional approval to push by way of the previous. However, even then, draw back could also be restricted to the excessive 140s contemplating momentum the US economic system is carrying.

Trump Sweep Bearish for Crude Costs

Crude oil is one other market that is attention-grabbing forward of the election, not solely due to the home US vitality coverage issues but in addition the US greenback affect.

Although Trump is an oil fanatic, telling a rally in Detroit in October that “we’ll frack, frack, frack and drill, child, drill,” the prospect of a Crimson wave screens as bearish contemplating the prospect of elevated provide and greenback energy doesn’t bode effectively for costs.

Some could argue that given his observe document throughout his first Presidential time period, Trump could try a fast resolution to de-escalate tensions within the Center East, additional lowering the geopolitical threat premium constructed into the crude worth.

Different election eventualities display as much more impartial for the crude worth, though a cut up congress might present modest upside given the chance of a softer US greenback.

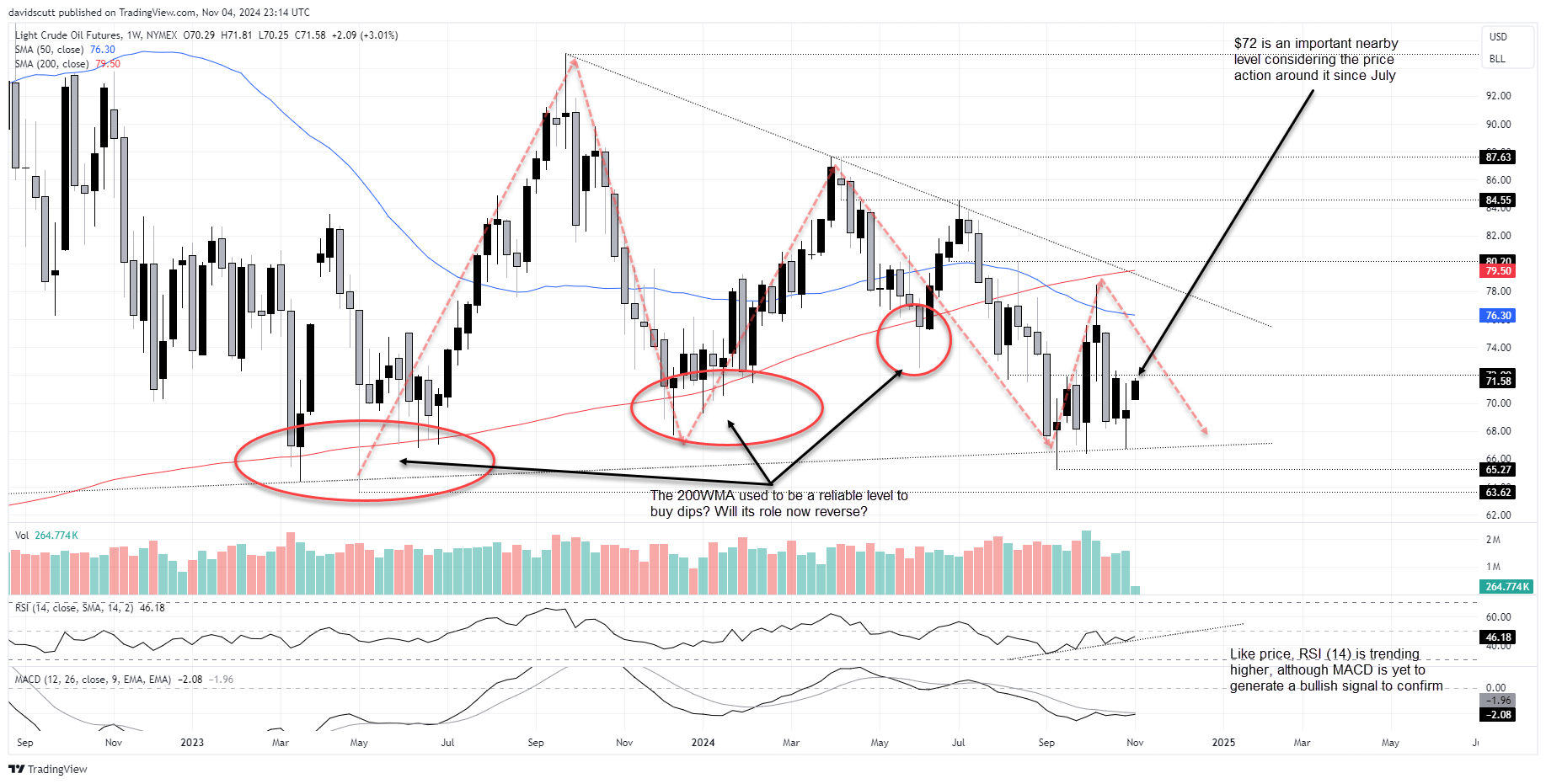

Supply: TradingView

For the volatility seen within the WTI crude worth just lately, the weekly chart does an excellent job of slicing by way of the noise to offer a stronger sign.

The worth continues to coil in a triangle sample courting again a few years, with dips persevering with to be purchased in the direction of and marginally under $66 per barrel. On the topside, downtrend resistance courting again to September 2023 continues to thwart bullish breakout makes an attempt, sitting this week round $79 per barrel.

In between, $72 has acted as a pivot degree just lately, usually examined however hardly ever damaged. The 200-week shifting common is one other degree to maintain on the radar, performing as a dependable location to purchase dips under for a number of years prior to cost breaking and shutting under it July. Will it now act as a dependable degree to promote? It hasn’t been examined since, however it’s price monitoring.

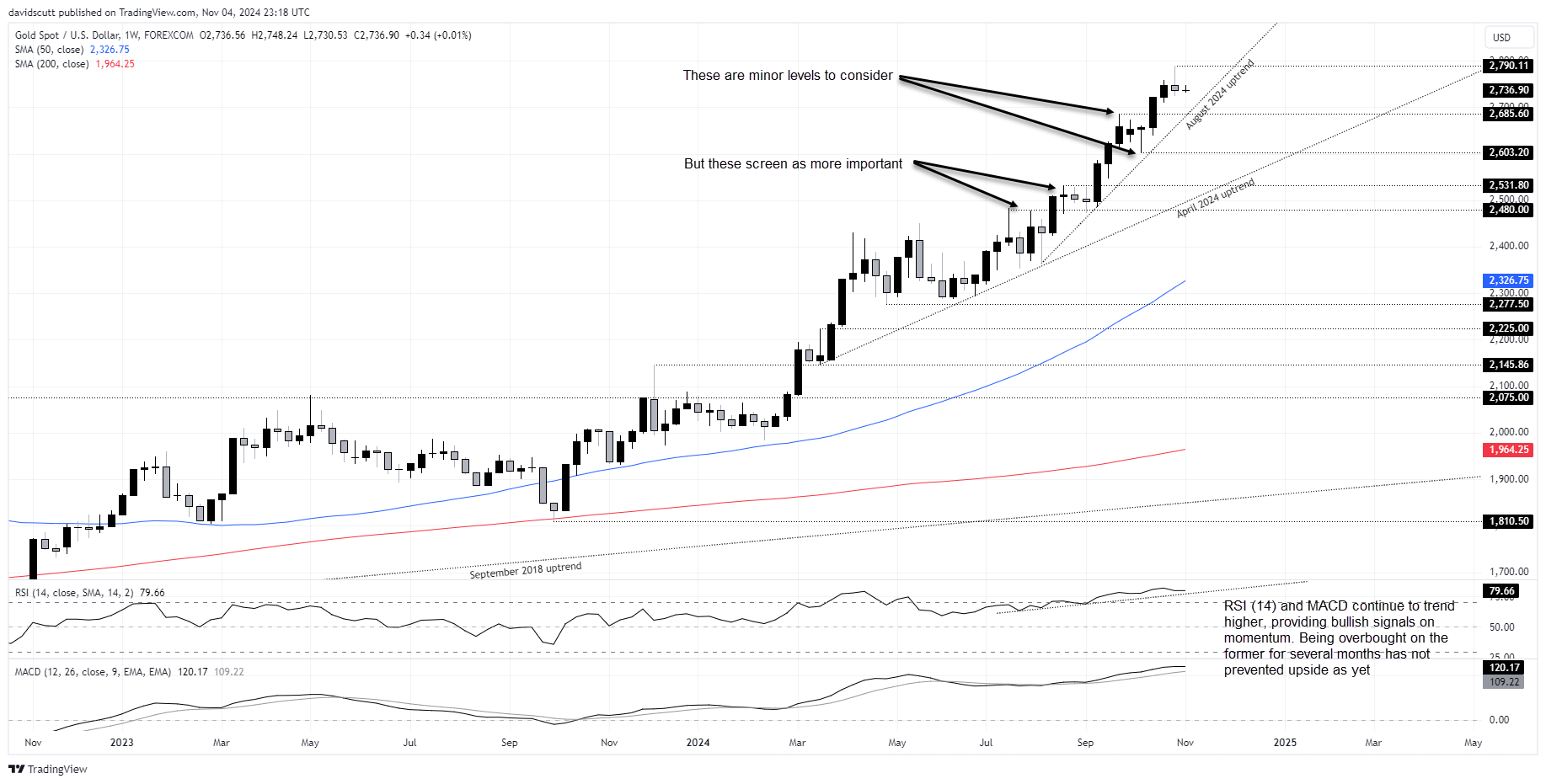

Gold’s Resilience to Increased USD, Charges Put to the Take a look at

Gold has been largely resistant to US greenback energy and better US rates of interest over current years, deviating considerably from the pattern seen for big intervals previous to the pandemic. It appears nothing however bullish on the weekly timeframe with worth and momentum indicators persevering with to pattern increased.

Supply: TradingView

There’s nobody election situation that looms as notably bearish for the gold worth over the longer-term, despite the fact that a pink wave is more likely to spark greenback energy and better US rates of interest. If that have been to happen we might see kneejerk promoting, particularly if accompanied by excessive volatility in different asset lessons that would immediate liquidations to cowl losses elsewhere. A Democratic blue wave might additionally spark near-term draw back, though probably lower than a Republican sweep.

A cut up Congress ought to be deemed a continuation of the established order, placing the emphasis again on different components together with worth motion.