- USD/JPY surge pushed by stronger US greenback, larger yields

- Gold below strain as rising charges dent demand

- Fed fee cuts unsure post-election fiscal outlook

- Key ranges for USD/JPY, gold to look at within the close to time period

Overview

The Japanese yen () and gold () value had been hit exhausting by Donald Trump’s thumping victory within the US presidential election, driving a wave of power and considerably larger US Treasury yields because the Republicans closed in on a Congressional clear sweep. Now that the uncertainty surrounding the election has handed, this word will study the implications for USD/JPY and gold as we method year-end.

US Treasury Yields React to Expansionary Fiscal Outlook

Amid the large strikes in inventory and FX markets in response to the election end result, some of the underappreciated market strikes was the numerous selloff within the US Treasury market. With Trump’s fiscal plans being extremely expansionary, together with the removing or discount of company and private taxes, the prospect of sooner financial development, larger inflation, and bigger fiscal deficits pushed yields larger throughout all the US rate of interest curve.

The chart under tracks the motion in US , , and Treasury yields since September, with the underside pane exhibiting the change over the previous 24 hours.

Supply: TradingView

Whereas yields hit contemporary multi-month highs throughout all tenors, the selloff on the lengthy finish of the curve was essentially the most pronounced as traders demanded elevated compensation given the prospect of upper inflation and higher Treasury issuance.

Inflationary Surroundings Anticipated

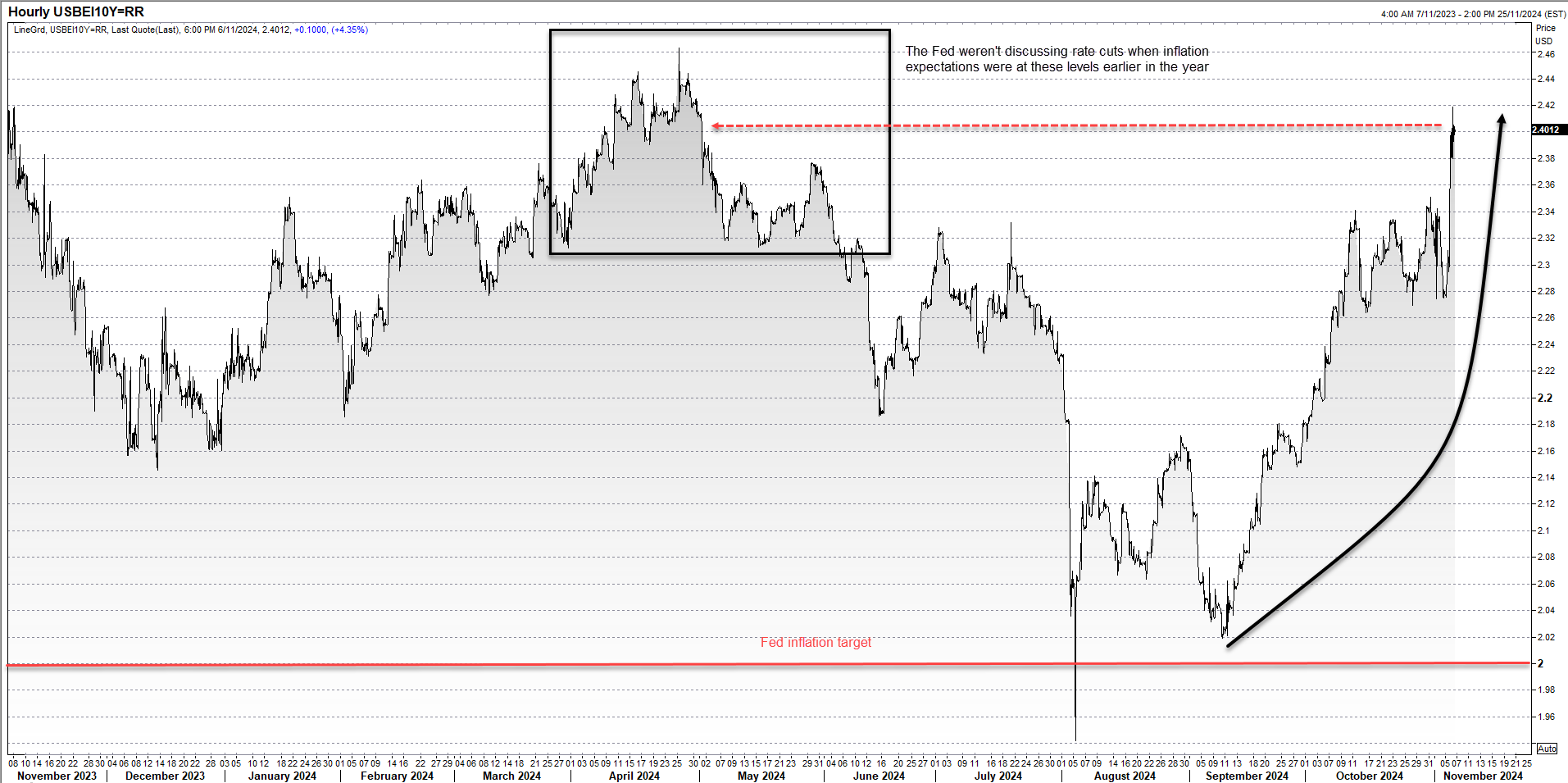

Merchants count on stronger inflation, as seen within the US inflation breakevens, which measure market views on common annual inflation over a set interval. They spiked on the election end result with the 10-year fee, proven under, pushing again to ranges the place policymakers on the Federal Reserve had been beforehand reluctant to decide to fee cuts.

Supply: Refintiv

Fed Fee Minimize Bets Slashed

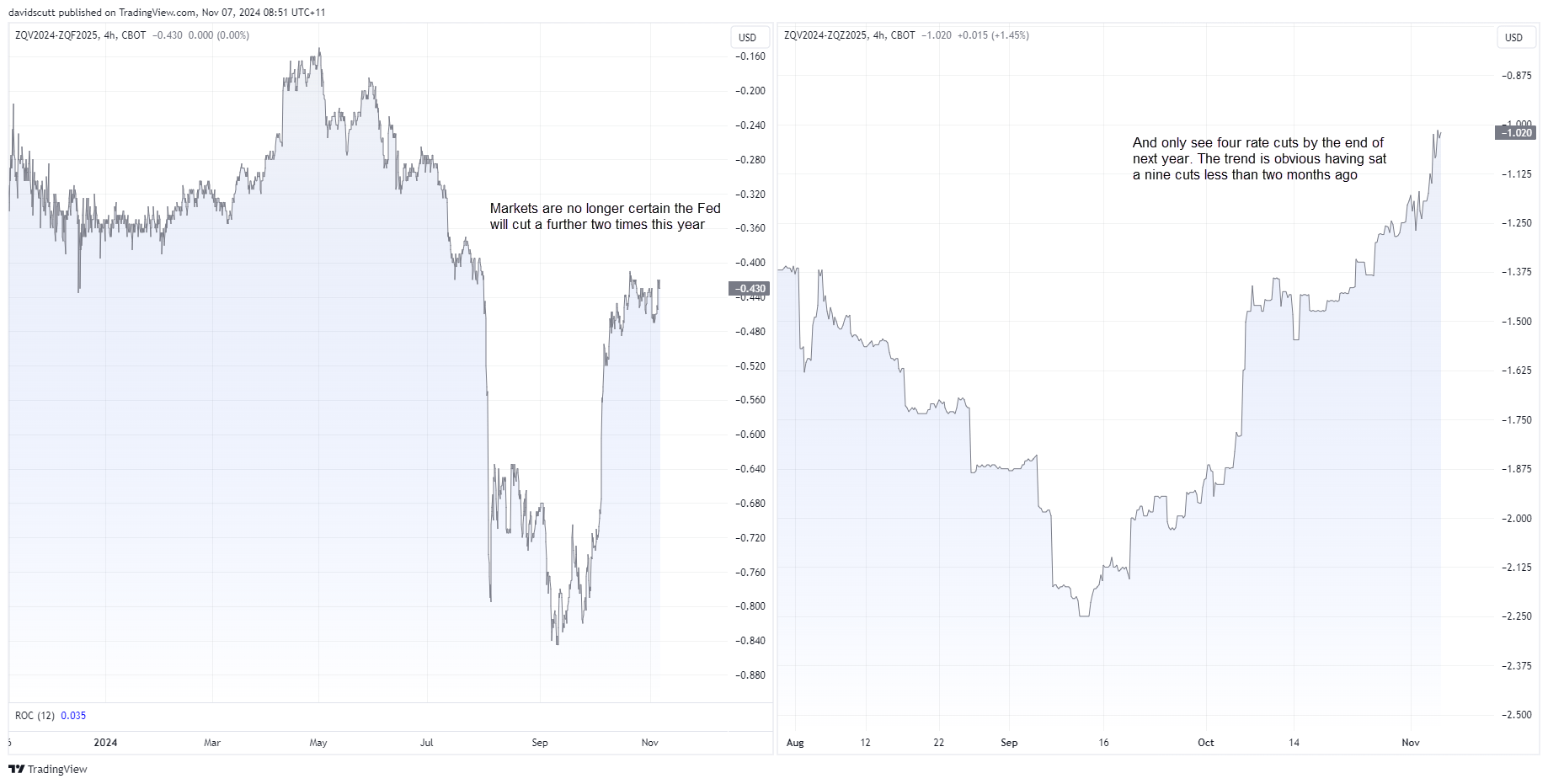

Whereas a Trump presidency and possible Republican clear sweep is unlikely to derail a fee minimize from the Fed tomorrow with markets practically totally priced for a 25-point transfer, trying additional forward, doubts are creeping in in regards to the scale of easing the Fed might want to ship.

The following chart examines the form of the Fed funds futures curve between two dates to evaluate how in a single day borrowing prices are anticipated to evolve. The left-hand chart measures expectations for the remaining two conferences this yr, implying solely round a 70% probability of one other 25-point transfer in December.

Trying from now till the top of subsequent yr, simply 4 25-point cuts are anticipated. That determine stood at 9 across the time when the Fed minimize charges in September.

Contemplating the power the US economic system was exhibiting even earlier than the election end result, it’s debatable whether or not the economic system will want any fee cuts if main fiscal stimulus is on the best way.

Supply: TradingView

USD/JPY Surge Might Show Exhausting to Cease Close to-Time period

For monetary belongings providing low or no yields which can be valued towards the US greenback, the quickly altering fee outlook has probably critical ramifications for USD/JPY and gold.

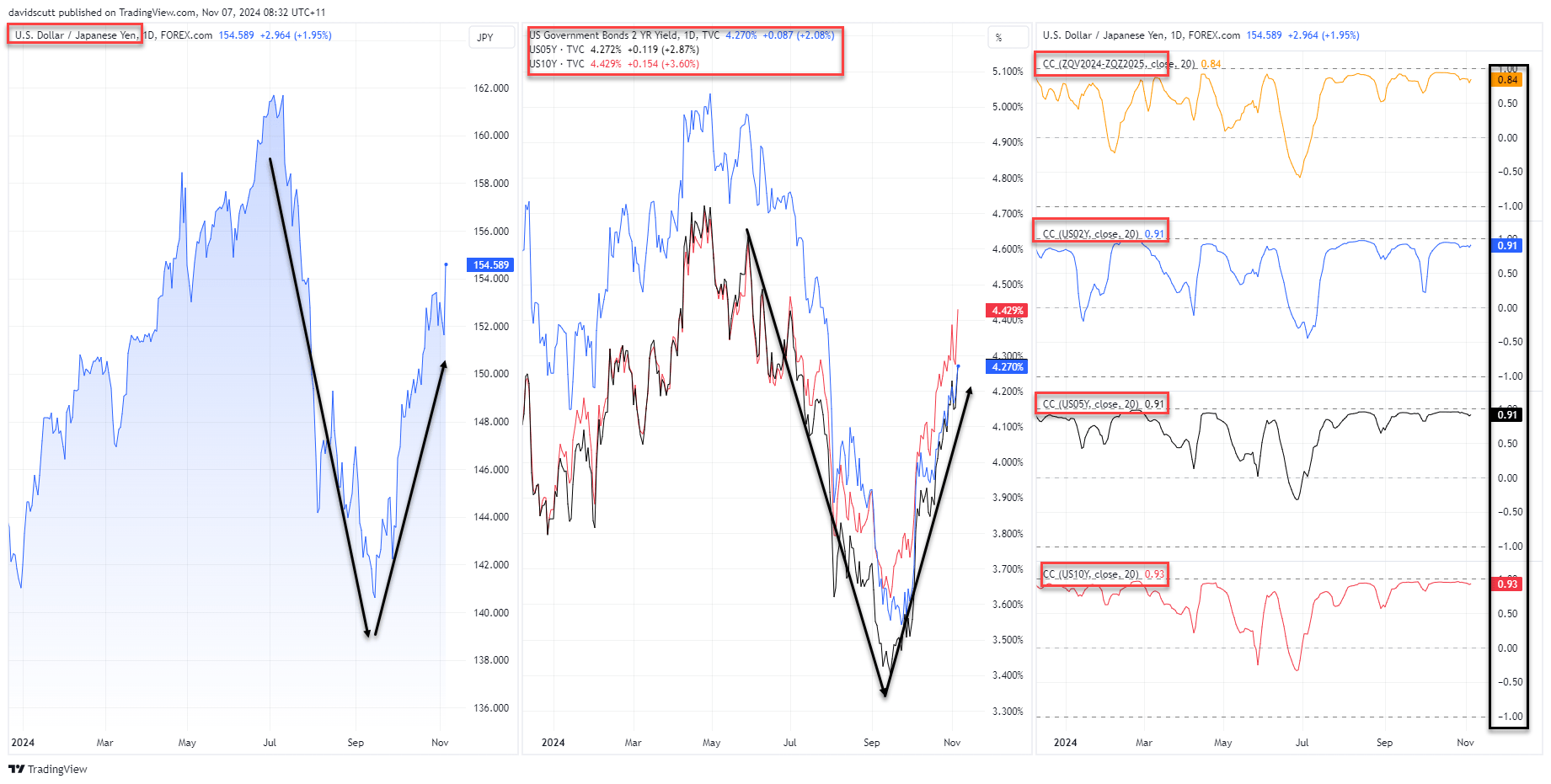

The evaluation under reinforces this, exhibiting from left to proper the each day chart for USD/JPY, US Treasury yields, and the rolling 20-day correlation between each. Whether or not we’re speaking Fed fee cuts, quick or long-term Treasury yields, correlation coefficient scores ranging between 0.84 and 0.93 emphasise the significance of the US rate of interest outlook on USD/JPY actions.

Actually, you don’t even want the correlation evaluation to know the connection – it’s visually apparent. And if we do see an additional discount in Fed fee minimize pricing, which appears to be the chance, that factors to upside dangers for USD/JPY.

Supply: TradingView

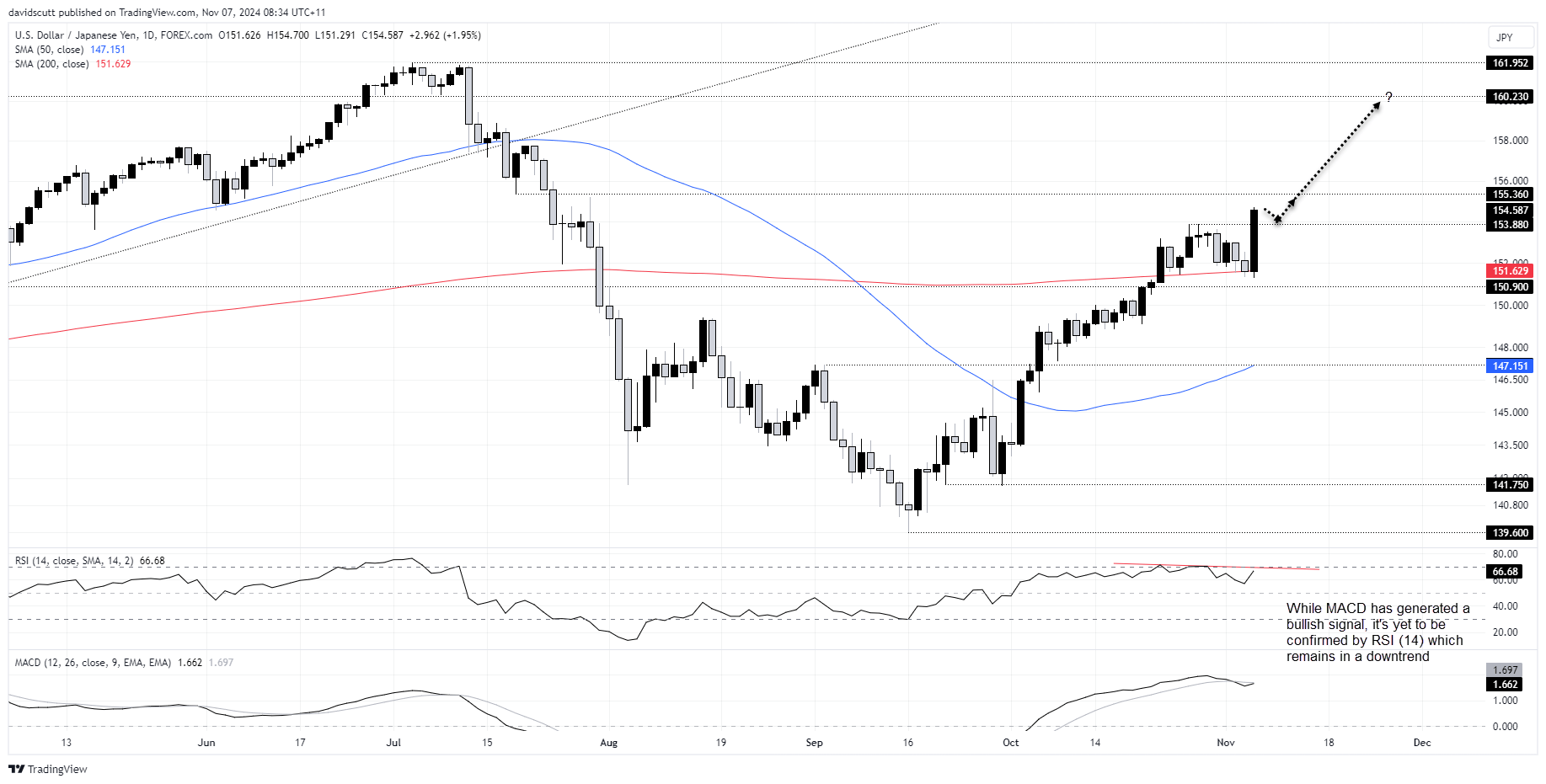

Having simply damaged above the October highs following the election end result, the query now could be how far the transfer can lengthen. 155.36 may very well be a goal for bulls, a minor degree that acted as assist and resistance earlier this yr. The value consolidated both aspect of 157.70 in July, though which will mirror the place the 50-day transferring common was on the time. Keep watch over it. Past that, 160.23 is a significant degree, simply earlier than the multi-decade peak of 161.95.

Whereas the MACD has generated a contemporary bullish sign, it’s but to be confirmed by RSI (14), which stays in a modest downtrend. If we had been to see a pullback after the rally across the election, consumers might step in round 153.88. That’s one potential setup merchants would possibly think about, permitting for a cease to be positioned under the extent for defense. The following draw back degree to look at is the 200-day transferring common, though reaching that might seemingly require a steep and unlikely reversal in US Treasury yields.

Supply: TradingView

Gold Hammered, However for How A lot Longer?

Gold suffered one among its largest each day declines in years on Wednesday, buckling below the burden of a stronger greenback and sharply larger US yields. Nonetheless, it’s held up towards these headwinds for a lot of the previous two years, which raises the query: how lengthy will this newest unwinding final?

Supply: TradingView

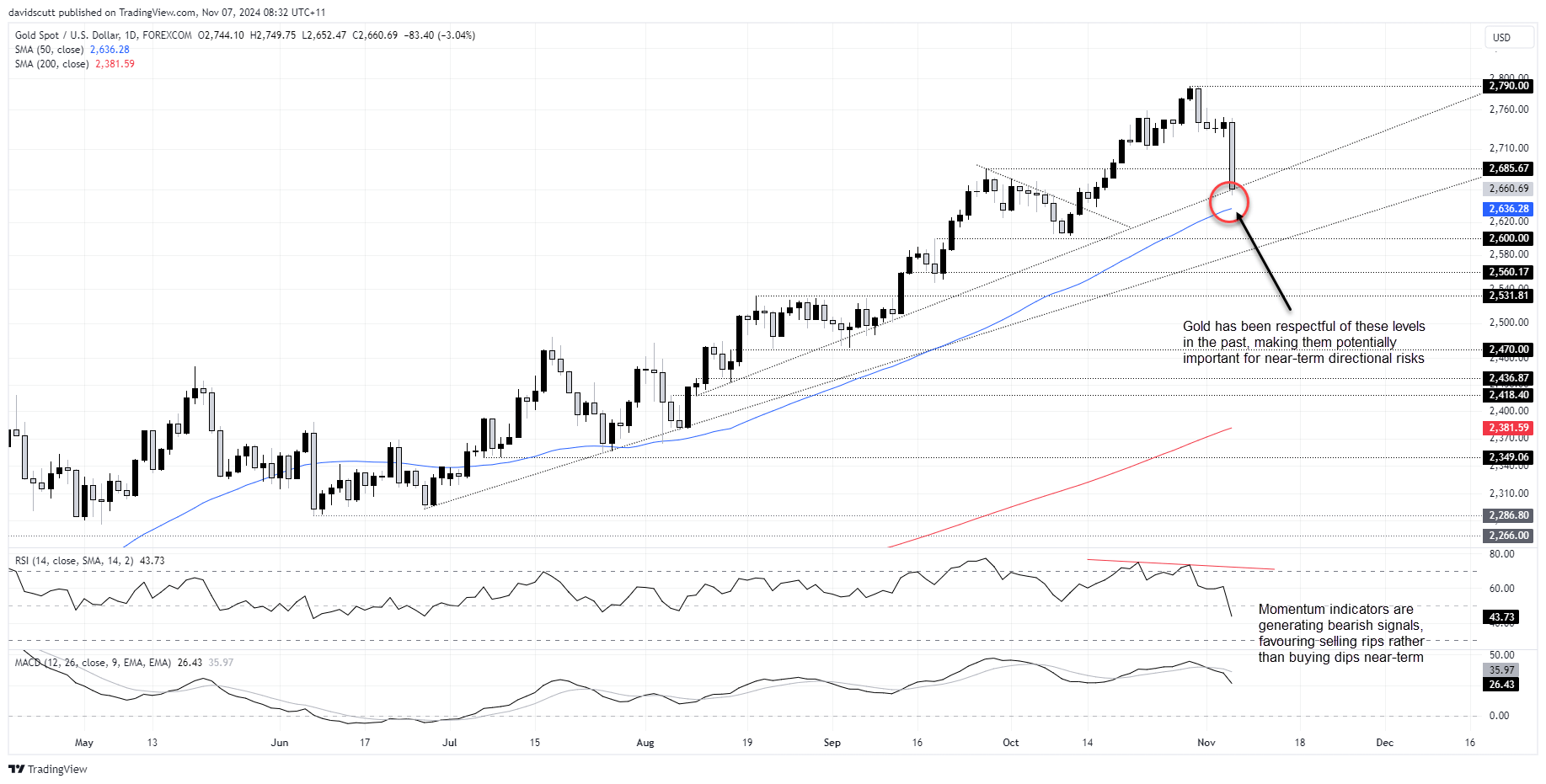

Whereas yesterday’s each day candle was ugly for bulls, it’s notable the rout stopped on the uptrend established in August. With RSI (14) and MACD each offering bearish indicators, there’s an honest probability we may see additional promoting as we speak, probably retesting the 50-day transferring common, one other degree that’s been revered prior to now.

Whereas momentum indicators favor promoting pops moderately than shopping for dips within the close to time period, let the worth motion information you on what to do.

Beneath the 50-day transferring common, $2600, the uptrend established in June, $2560.17, and $2531.81 are ranges to look at. If the worth bounces as we speak, $2685.67 may present a setup for both bears or bulls relying on the preliminary interplay. Earlier than the most recent rout, presents had been famous above $2740, with the report excessive of $2790 being the following topside goal after that.