charges elevated yesterday by roughly 4 bps to shut at 4.23% following a stronger-than-expected report.

The report neglected wholesome, in my opinion, with the layoffs in October decrease and the variety of quits shifting larger.

One would suppose that if folks stop their jobs, they’ve discovered a greater one. right this moment, we are going to get ADP at 8:15 AM ET and ISM providers at 10 AM. In fact, who can neglect that we are going to get Jay right this moment at 1:40 PM ET?

In fact, you’d by no means know that Powell was talking right this moment in a Q&A session with a 1Day at 8.3, however hey, this a market with no worries.

If I needed to guess, by the point Powell speaks right this moment, the VIX 1Day will probably be within the mid-teens, and by the point we get to Thursday’s shut, will probably be within the low 20s, forward of the job report. So, this little interval of tranquility might be passing for now.

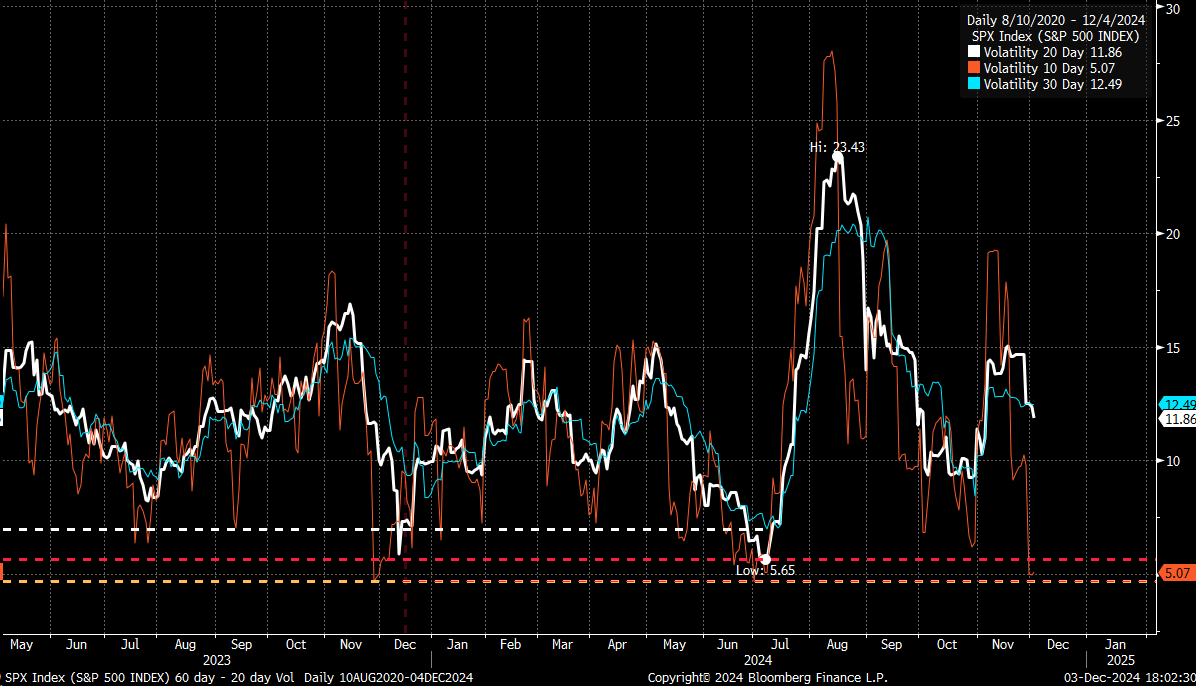

In fact, with the 10-day realized volatility at 5, all it can take is 31 bps or so within the to maneuver realized volatility larger and a transfer larger than 75 bps to maneuver the 20-day realized volatility larger.

Volatility is volatility, and so whether or not the market rises or falls, realized volatility is because of improve. The final time I spotted volatility was this low was again in mid-July.

The final time was at its present ranges and strengthening was on the finish of July and starting of August, forward of a jobs report.

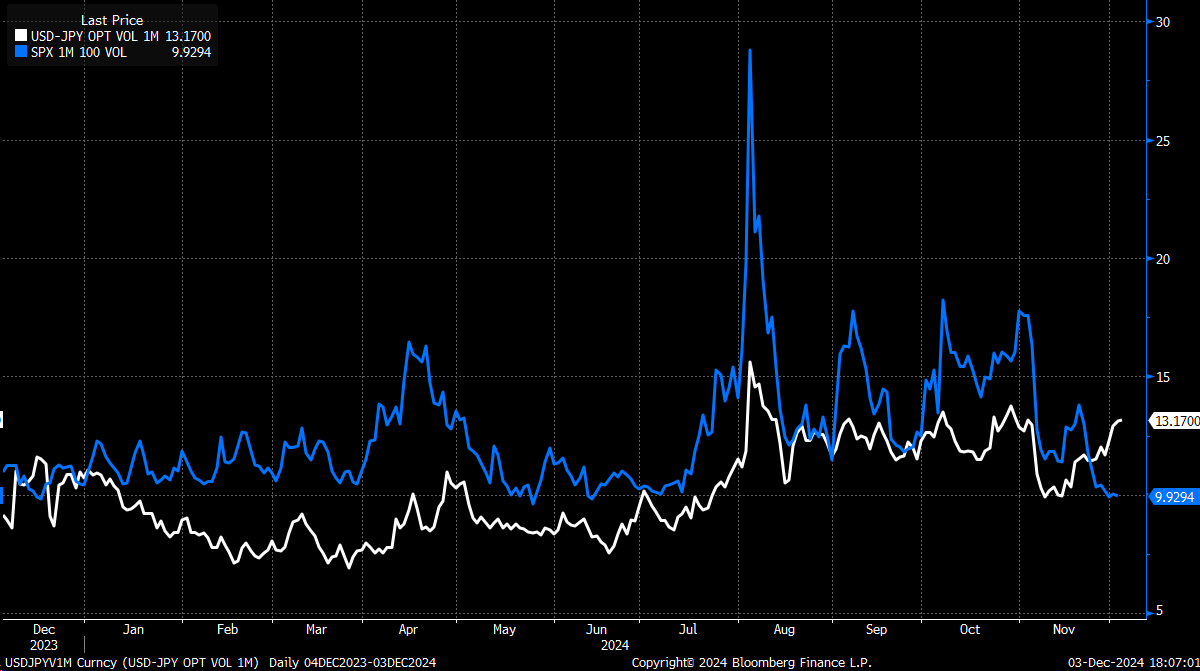

And possibly implied volatility is because of go larger anyway. 1-month implied volatility for the USD/JPY has undoubtedly been rising, and it trades proper together with the IV of the S&P 500. Proper now, the 2 look like on separate paths.

So, I’d guess that total volatility is because of an increase from these present ranges, and doubtlessly by rather a lot.

Anyway, I’ve nothing extra to say.

However as my 10-year-old daughter informed me on Sunday when boarding the Lengthy Island Rail Street heading into Manhattan: “Thoughts The Hole, Dad.”