Market’s misplaced steam this week as Walmart WMT gave a cautious outlook after releasing its This autumn outcomes on Thursday.

With extra retail earnings set to supply perception into the energy of the buyer within the coming weeks, Wall Road will likely be anticipating Goal’s TGT This autumn report on Tuesday, March 4.

Walmart’s This autumn Outcomes

Walmart’s This autumn gross sales elevated 4% 12 months over 12 months to $180.55 billion versus $173.38 billion within the prior 12 months quarter. Edging This autumn gross sales estimates of $180 billion, CEO Douglas McMillon said Walmart continues to achieve market share throughout nations and earnings ranges.

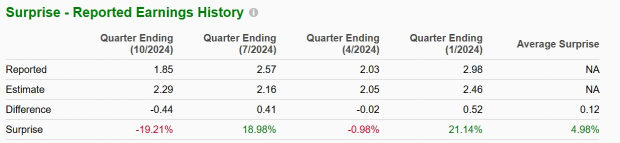

McMillon highlighted that Walmart’s revenue is rising quicker than its gross sales, with This autumn EPS of $0.66 rising 10% from $0.60 per share a 12 months in the past and topping expectations of $0.65. Nonetheless, whereas Walmart expects a comparatively steady working atmosphere this 12 months, the corporate nonetheless expects uncertainties associated to client habits and international financial and geopolitical circumstances. Nonetheless, Walmart has now reached or exceeded earnings expectations for 11 consecutive quarters with a mean EPS shock of seven.36% in its final 4 quarterly reviews.

Picture Supply: Zacks Funding Analysis

Goal’s This autumn Expectations

Primarily based on Zacks estimates, Goal’s This autumn gross sales are thought to have dipped 3% to $30.73 billion in comparison with $31.92 billion within the comparative quarter. Following a tougher-to-compete-against interval, Goal’s earnings are slated to drop to $2.24 per share from This autumn EPS of $2.98 a 12 months in the past.

Goal has exceeded backside line expectations in two of its final 4 quarterly reviews however most lately missed Q3 EPS expectations by 19%, with earnings at $1.85 a share and the Zacks Consensus at $2.29.

Picture Supply: Zacks Funding Analysis

Monitoring Walmart & Goal’s Outlook

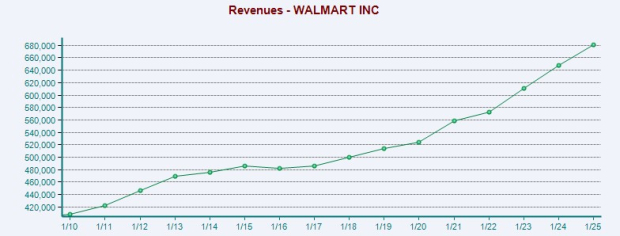

Rounding out its fiscal 2025, Walmart’s complete gross sales elevated 5% to $680.99 billion. Even higher, annual earnings rose 13% to $2.51 per share from EPS of $2.22 in FY24. Providing full-year FY26 steerage, Walmart expects its consolidated web gross sales to broaden by roughly 3-4%, which fell according to Zacks projections of $702.4 billion and simply over 3% development.

That stated, Walmart tasks FY26 EPS within the vary of $2.50-$2.60, which got here in under the present Zacks Consensus of $2.74 or 9% development.

Picture Supply: Zacks Funding Analysis

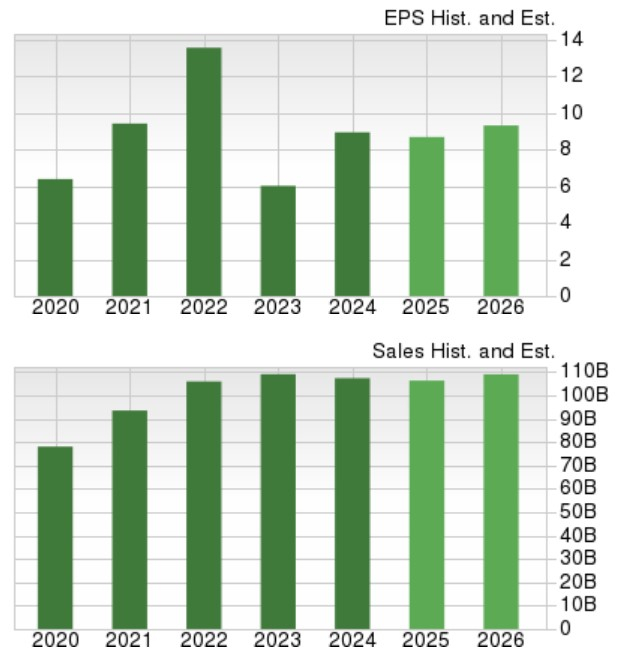

As for Goal, the corporate is anticipated to spherical out its FY25 with complete gross sales dipping roughly 1% to $106.38 billion, based mostly on Zacks estimates. Goal’s annual earnings are slated to lower 3% to $8.69 per share from EPS of $8.94 in FY24.

Optimistically, Goal’s prime line is projected to stabilize and enhance 2% in FY26 to $109.09 billion. Moreover, annual earnings are forecasted to rebound and rise 7% in FY26 to $9.32 per share.

Picture Supply: Zacks Funding Analysis

Inventory Efficiency & Valuation Comparability

Correlating with Walmart’s regular development, WMT has soared over +60% within the final 12 months. This has impressively outperformed the benchmark S&P 500’s +21%, with Goal’s inventory down -17%.

Picture Supply: Zacks Funding Analysis

Whereas shrink and different stock points has triggered TGT to lose its mojo lately, Goal’s inventory trades at its least expensive ranges in over a decade at 13.7X ahead earnings. Compared, Walmart shares are at a 35.4X ahead earnings a number of, with the benchmark at 23.1X.

Picture Supply: Zacks Funding Analysis

Backside Line

Traders might really feel inclined to put money into Goal’s inventory at a big low cost to Walmart when it comes to its P/E valuation. In the meantime, Walmart’s enlargement is tough to miss, with each shares touchdown a Zacks Rank #3 (Maintain). Goal’s valuation and Walmart’s development are definitely appropriate for long-term buyers, however there might nonetheless be higher shopping for alternatives forward amid current market volatility.

7 Finest Shares for the Subsequent 30 Days

Simply launched: Consultants distill 7 elite shares from the present record of 220 Zacks Rank #1 Sturdy Buys. They deem these tickers “Most Seemingly for Early Worth Pops.”

Since 1988, the complete record has crushed the market greater than 2X over with a mean achieve of +24.3% per 12 months. So be sure you give these hand picked 7 your instant consideration.

Target Corporation (TGT) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.