Recently upright a busy note. On Thursday mid-day a financial institution run Silicon Valley Financial institution SIVB followed, as well as by Friday mid-day markets remained in panic setting. All significant supply indexes went adverse on the year as well as capitalists expected some federal government treatment over the weekend break. Thankfully, they obtained it. The Federal Book together with assistance from the United States Treasury, opened up a brand-new financing program called the “Financial institution Term Financing Program,” in an initiative to backstop the depositors at SIVB.

The prospective results of this occasion are fairly considerable as well as consist of worries regarding more financial institution runs, inadequately utilized financial institutions, as well as moving rate of interest plan. Since Monday early morning, an additional organization, First Republic Financial Institution FRC appears to be managing comparable problems as Silicon Valley Financial Institution. Shares were down -66% with early morning trading Monday.

When it comes to Fed rate of interest plan, the assumptions of future prices walkings are moving unbelievably quick. Simply recently, markets started to rate in the high possibility of the Fed returning to 50 basis factor walkings, a really hawkish growth. However by Friday, investors turned around that assumption, as well as were once again rates in 25 basis factor walkings. And also since Monday early morning, plan assumptions have actually expanded much more dovish, rates in the opportunity of no walking in the following FOMC conference, as well as a fast cut in rates of interest by year end.

If all that had not been sufficient, we are additionally obtaining crucial information on rising cost of living as well as joblessness today.

Photo Resource: CME Team

Monday

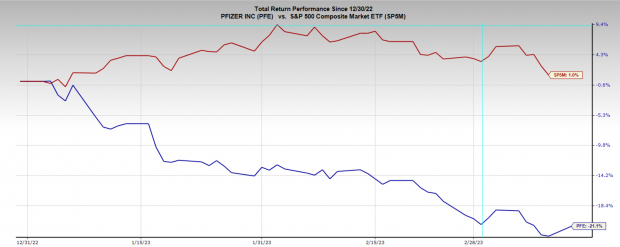

In various other information, Pfizer PFE determined to place a few of that injection cash to function, as well as consented to obtain Seagen SGEN for $43 billion. After withdrawing from hostile deal-making in the last couple of years, it resembles big-pharma believes there are some bargains out there. French drugmaker Sanofi SNY additionally consented to buy Provention Biography PRVB for $2.9 billion.

Currently down -21% YTD, PFE capitalists are enthusiastic this purchase can restore an aging line of product.

Photo Resource: Zacks Financial Investment Study

Tuesday

On Tuesday early morning we are obtaining a variety of rising cost of living information. CPI, as well as Core CPI numbers are essential factors to consider for the Fed as well as its rate of interest plan. Experts presently anticipate YoY CPI to cool down from 6.4% last month to 6.1% as well as Core CPI to go from 5.6% last month to 5.5%.

Wednesday

Wednesday will certainly see retail sales numbers, manufacturer consumer price index as well as core PPI, realm state production, company stocks as well as the homebuilder study.

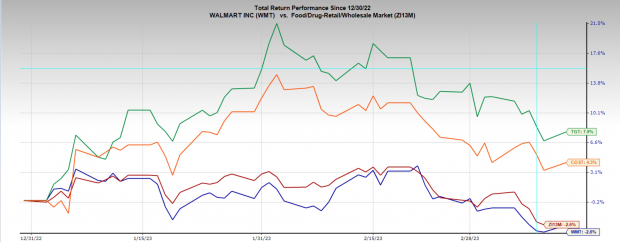

Retail sales are anticipating large declines ahead in this record, which must have a substantial influence on the leading retail supplies such as Target TGT, Walmart WMT, Costco PRICE as well as others. Last month saw retail sales expand by 3%, a solid analysis, however experts are forecasting that number to turn adverse this month to a -0.4% decrease.

Photo Resource: Zacks Financial Investment Study

The toughness of the united state customer is mosting likely to be an additional crucial variable for the Fed when making its plan choices. One more solid analysis from retail sales as well as the marketplace must anticipate a lot more hawkishness from policymakers.

Thursday

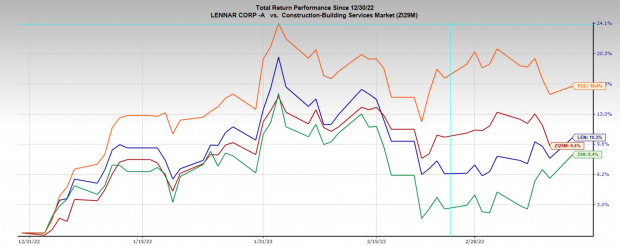

Thursday attributes Philly Fed production, structure licenses, real estate begins as well as unemployed cases information. First unemployed cases are yet an additional crucial sign for Fed plan, while real estate begins must offer a hint to the near-term future of realty rates.

Also despite increasing rates of interest, homebuilders have actually been a brilliant place for the securities market. Lennar Corp LEN, D.R. Horton DHI, as well as Toll Brothers Inc TOL together with the homebuilders ETF XHB have all surpassed the wide market YTD.

Photo Resource: Zacks Financial Investment Study

Friday

Friday early morning will certainly assemble the week with information for commercial manufacturing, united state leading financial index, as well as customer view.

Profits

This is a massive week. The means the marketplace responds to every one of the coming financial information along with the creating problems in the financial market will certainly claim a great deal regarding the wellness of this market.

Following Wednesday, Mach 15 is the FOMC conference where the Fed will certainly introduce rate of interest plan, as well as perhaps offer hints regarding its sight on the state of the marketplace.

It seems like points get on a precipice. It is time to continue to be versatile, broad-minded, as well as take the chance of averse. Today as well as following week will certainly be crucial to the instructions of the marketplace for the remainder of the year.

Free Record Exposes Exactly How You Might Make money from the Expanding Electric Car Sector

Internationally, electrical auto sales proceed their amazing development also after exceeding in 2021. High gas rates have actually sustained his need, however so has developing EV convenience, attributes as well as innovation. So, the eagerness for EVs will certainly be about long after gas rates stabilize. Not just are makers seeing record-high revenues, however manufacturers of EV-related innovation are generating the dough also. Do you understand just how to money in? Otherwise, we have the excellent record for you– as well as it’s FREE! Today, do not miss your possibility to download and install Zacks’ leading 5 supplies for the electrical automobile change at no charge as well as without responsibility.

>>Send me my free report on the top 5 EV stocks

Sanofi (SNY) : Free Stock Analysis Report

Pfizer Inc. (PFE) : Free Stock Analysis Report

Target Corporation (TGT) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

Toll Brothers Inc. (TOL) : Free Stock Analysis Report

Lennar Corporation (LEN) : Free Stock Analysis Report

D.R. Horton, Inc. (DHI) : Free Stock Analysis Report

First Republic Bank (FRC) : Free Stock Analysis Report

SVB Financial Group (SIVB) : Free Stock Analysis Report

Seagen Inc. (SGEN) : Free Stock Analysis Report

SPDR S&P Homebuilders ETF (XHB): ETF Research Reports

Provention Bio, Inc. (PRVB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as point of views revealed here are the sights as well as point of views of the writer as well as do not always mirror those of Nasdaq, Inc.