February was a tough month for the securities market. With restored anxieties of rising cost of living, and also more price walks this year, market indexes sold almost -5% in the month. However recently the marketplace might have discovered assistance as it completed the week highly. The S&P 500 plainly recovered at the 200-day relocating standard, providing bulls a clear side in the short-term.

The marketplace isn’t clear yet. Today is noted by a prompt testament from Jerome Powell before congress and also crucial work information in the 2nd fifty percent of the week. Furthermore, we will certainly see revenues from a number of previous development supply beloveds, and also an extremely ranked compounder supply.

Picture Resource: Zacks Financial Investment Research Study

Monday

Monday is mosting likely to get on the light side for brand-new information. Manufacturing facility orders will certainly be launched at 10 am EST, which will certainly be it for financial information. No significant revenues launches either.

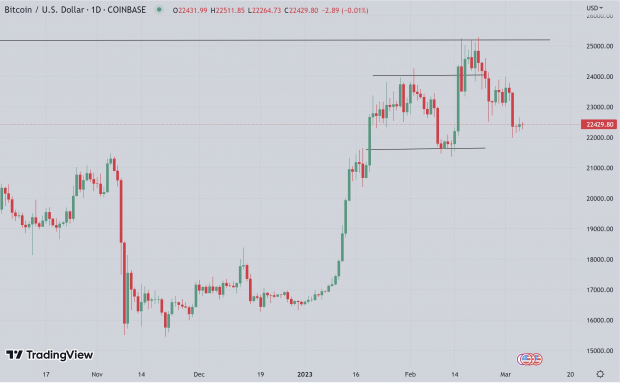

After the weekend break there are still a lot of anxieties to absorb. Bitcoin has actually combined at the end of a variety this weekend break after obtaining hammered on Friday. After questions regarding the feasibility of Silvergate Financial Institution SI ended up being public, crypto markets tanked.

Picture Resource: TradingView

Tuesday

On Tuesday points get going in earnest. In the early morning, Fed Chair Powell will certainly be indicating before the Us senate. Market individuals will certainly be paying attention carefully to Powell’s unsupported claims as also small brand-new variances in his speech can relocate the marketplace dramatically.

The main issues currently concern whether the reserve bank will certainly be elevating 25 bps or 50 bps, and also just how much greater prices will certainly need to go. Last month, financial information revealed a welcome stagnation in the price of rising cost of living, yet is it sufficient? With limited labor markets maintaining salaries securely greater, it will certainly be hard to minimize rising cost of living dramatically.

One of the most hawkish viewers think that there requires to be a reputable stagnation in financial development to accomplish the Fed’s 2% rising cost of living objectives.

Likewise on Tuesday, will certainly be a revenues record from Sea Limited SE SE was among the best supplies throughout the post-Covid boom, yet has actually considering that remedied dramatically. After a close to 10x run-up the supply has actually sold and also remained down for time.

Also after the big sell-off, Sea Limited is still trading at 52x 1 year forward revenues. However points might be boosting for the supply. SE presently holds a Zacks Ranking # 2 (Buy), suggesting a higher revenues modification pattern.

Picture Resource: Zacks Financial Investment Research Study

Wednesday

Wednesday early morning Jerome Powell will certainly be indicating before your house of Reps with the exact same issues. As constantly, what Powell states is definitely crucial to future assumptions of rate of interest and also the economic climate.

The marketplace will certainly additionally be obtaining the initial of numerous information factors on work. Last month, ADP work revealed 106,000 brand-new economic sector tasks, which got on the weak side. This month the number is anticipated to be 210,000. A number in line, or listed below assumptions need to rate by the market as a signal that labor markets are loosening up. However a warm print might stir rising cost of living anxieties.

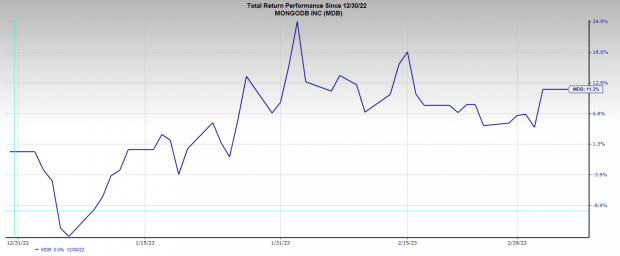

MongoDB MDB will certainly be reporting on Wednesday early morning too. MDB was one more supply that had a substantial run-up throughout the boom, just ahead collapsing down in 2022. Points might be reversing however, as MDB is currently up greater than 10% YTD with boosting revenues assumptions. MDB presently flaunts a Zacks Ranking # 2 (Buy).

Sales are predicted to expand 26% YoY to $335 million, and also revenues assumptions have actually turned favorable, a welcome brand-new pattern for several high development technology firms.

Picture Resource: Zacks Financial Investment Research Study

Thursday

Extra work information appears on Thursday early morning, this set in the kind of Out of work Insurance claims. Like ADP, capitalists intend to see constant slowing down of the labor market. As well limited and also anxieties of even more price walks for longer will certainly alarm the marketplace. Conversely, a fast stagnation in work can cause economic crisis panics. In either case, this information is mosting likely to be carefully inspected.

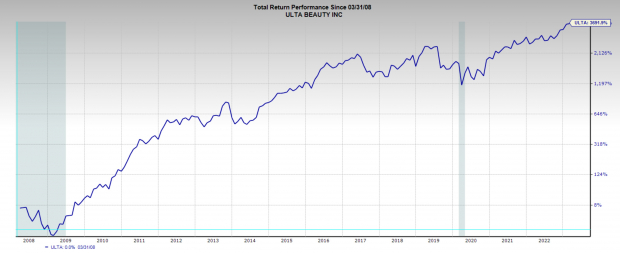

Ulta Appeal ULTA, the retail cosmetics titan will certainly be reporting after the marketplace shuts on Thursday. ULTA supply efficiency is something to admire. Over the last 15 years the supply is up 3600%. As well as it is off to a solid beginning this year, currently up 12% YTD.

Moreover, ULTA presently has a Zacks Ranking # 2 (Buy), suggesting a solid revenues modification pattern. Incomes forecasts have actually been updated throughout durations, and also last quarter EPS stunned to the benefit by 30%. Zacks Incomes Shock Forecast is anticipating 8% revenues beat.

Picture Resource: Zacks Financial Investment Research Study

Friday

To assemble the week, the marketplace will certainly be obtaining the last work record. The last work record blew assumptions out of the water, revealing 517,000 brand-new tasks, which was method also warm for capitalists. This record anticipates a much more affordable 225,000 brand-new tasks, and also a joblessness price of 3.4%.

One more record over assumptions will actually shock the marketplace as capitalists definitely do not intend to see work this limited. The genuine danger of an also limited labor market is high wage rising cost of living. If salaries continue to be expensive it can trigger a wage-price spiral, which would certainly suggest that the rising cost of living circumstance has actually ended up being alarming.

5 Supplies Ready To Dual

Each was handpicked by a Zacks specialist as the # 1 favored supply to acquire +100% or even more in 2021. Previous referrals have actually risen +143.0%, +175.9%, +498.3% and also +673.0%.

A lot of the supplies in this record are flying under Wall surface Road radar, which offers an excellent possibility to participate the first stage.

Today, See These 5 Potential Home Runs >>

Silvergate Capital Corporation (SI) : Free Stock Analysis Report

Sea Limited Sponsored ADR (SE) : Free Stock Analysis Report

Ulta Beauty Inc. (ULTA) : Free Stock Analysis Report

MongoDB, Inc. (MDB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights and also viewpoints revealed here are the sights and also viewpoints of the writer and also do not always show those of Nasdaq, Inc.