It’s in all probability a superb signal when one of many best traders of all time holds a giant stake in a inventory that we’re contemplating for a portfolio addition.

Considered one of Warren Buffett’s long-held positions, American Specific simply delivered its fourth consecutive earnings beat. A Zacks Rank #2 (Purchase) inventory, American Specific continues to defy its skeptics.

A worldwide supplier of bank card cost merchandise and travel-related providers, the corporate operates by way of 4 segments: US Client Companies, Industrial Companies, Worldwide Card Companies, and International Service provider and Community Companies. Its product providing contains cost and financing merchandise; community providers; accounts payable expense administration merchandise; and journey and life-style providers.

As well as, American Specific operates lounges at airports below the Centurion Lounge model title. The corporate sells its services to shoppers, small companies, medium-sized firms, and huge firms by way of cellular and on-line purposes, buyer referral packages, third-party service suppliers, and in-house gross sales groups.

The Zacks Rundown

American Specific AXP shares have outperformed the market by a large margin over the previous yr, and the pattern seems to be persevering with in 2025.

The corporate is a part of the Zacks Monetary – Miscellaneous Companies business group, which ranks within the prime 27% out of greater than 250 Zacks Ranked Industries. As a result of it’s ranked within the prime half of all Zacks Ranked Industries, we count on this group to outperform the market over the subsequent 3 to six months.

This business is a part of the Zacks Finance Sector, which is the top-ranked sector in the mean time.

Historic analysis research counsel that roughly half of a inventory’s worth appreciation is because of its sector and business group mixture. In truth, the highest 50% of Zacks Ranked Industries outperforms the underside 50% by an element of greater than 2 to 1.

American Specific inventory is hitting a sequence of 52-week highs on growing quantity. Whereas there are various methods to make the most of this bullish transfer, choices present us with flexibility, enabling us to tailor our technique to the present market atmosphere.

Choice Necessities

Earlier than we analyze right this moment’s commerce, let’s overview some possibility fundamentals as a refresher. There isn’t any want to fret about advanced mathematical formulation or equations. Through the years I’ve discovered that the extra difficult a technique is, the much less seemingly it’s to work over the long term.

Choices are standardized contracts that give the customer the correct – however not the duty – to purchase or promote the underlying inventory at a set worth, which is named the strike worth. A name possibility provides the customer the correct to purchase a selected safety, whereas a put possibility provides the customer the correct to promote the identical. The investor who purchases an possibility, whether or not a put or name, is the choice purchaser, whereas the investor who sells a put or name is the vendor or author.

These contracts are legitimate for a particular time frame which ends on expiration day. There are weekly choices, month-to-month choices, and even LEAPS choices that are longer-term choices which have an expiration date of larger than one yr.

Choices include time worth and intrinsic worth. In-the-money choices include each parts; at-the-money and out-of-the-money choices consist solely of time worth. At choices expiration, choices lose all time worth.

Beneath we’re going to discover a name possibility buy technique.

Multiply Your American Specific Returns

American Specific inventory is in a worth uptrend and is an efficient candidate for a name possibility buy:

Picture Supply: StockCharts

When performed appropriately, buying and selling choices gives enormous revenue alternatives with restricted threat.

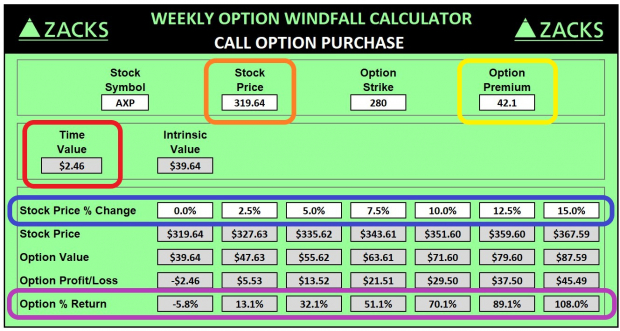

In right this moment’s commerce, we’re going to focus on the March 21st expiration date and the 280-strike worth. Buying this selection provides us the correct, however not the duty, to purchase 100 shares of AXP inventory at $280 on or earlier than March 21st, which is a bit over 1 month from now.

The desk beneath shows the chance/reward profile for this commerce. American Specific inventory is presently buying and selling at $319.64 (orange field). We’re buying 1 March 21 280-strike name at 42.1 factors, which is the choice premium. Since choices account for 100 shares of the underlying inventory, the whole price for this name possibility commerce is $4,210 as we are able to see within the yellow highlighted field.

Picture Supply: Zacks Funding Analysis

The highest (blue) row reveals the efficiency of American Specific inventory based mostly on completely different proportion situations at expiration. The underside (purple) row reveals the corresponding proportion return for our name possibility commerce. We will see that if AXP stays flat, this commerce would encounter a minor lack of 5.8%. If AXP strikes up 5%, this commerce will understand a 32.1% revenue. If AXP advances 15%, we might understand a 108% revenue.

This illustration reveals the inherent leverage that choices present. A inventory investor who purchased 100 shares of AXP must contribute $31,964, which is a a lot larger funding. A 15% improve within the inventory worth would yield a $4,794 revenue.

Alternatively, on this instance the choice dealer solely must contribute $4,210 to regulate the identical quantity of underlying AXP shares. A 15% transfer in AXP inventory would web a $4,549 possibility revenue – a virtually an identical revenue quantity with lower than one-seventh of the funding!

Additionally be aware that this selection accommodates comparatively little time worth. The two.46 factors value of time worth (purple field) equate to only 0.8% of the underlying inventory worth. A great way to handle threat when shopping for name choices is to attenuate time worth and maximize intrinsic worth, as time worth decays quickly within the days main as much as possibility expiration.

Backside Line

With American Specific displaying indicators of outperformance, the stage is about for AXP inventory to proceed its bullish run. A sturdy backing from the monetary sector ought to assist push shares to new heights.

An effective way to make the most of this transfer is through low-risk name choices. This permits us to leverage American Specific inventory returns with the facility of choices. You’ll want to preserve observe of how AXP inventory performs as we transfer additional into the brand new yr.

7 Greatest Shares for the Subsequent 30 Days

Simply launched: Specialists distill 7 elite shares from the present record of 220 Zacks Rank #1 Sturdy Buys. They deem these tickers “Most Doubtless for Early Worth Pops.”

Since 1988, the complete record has crushed the market greater than 2X over with a mean acquire of +24.3% per yr. So you’ll want to give these hand picked 7 your fast consideration.

American Express Company (AXP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.