Westlake Firm WLK logged an earnings of $232 million or $1.79 per share in the 4th quarter of 2022, below $644 million or $4.98 per share in the year-ago quarter. The lower line missed out on the Zacks Agreement Price Quote of $2.24 per share.

The lead to the documented quarter were injured by lowered list prices, undesirable sales mix modifications, greater power prices as well as reduced quantities in particular item groups.

Sales dropped about 6% year over year to $3,299 million in the quarter. It missed out on the Zacks Agreement Price Quote of $3,310.6 million. Westlake was influenced by softer need in many locations as well as item groups in the quarter.

Westlake Corp. Cost, Agreement as well as EPS Shock

Westlake Corp. price-consensus-eps-surprise-chart|Westlake Corp. Quote

Sector Emphasizes

Sales in the Efficiency as well as Important Products sector dropped about 4% year over year to $2,361 million in the documented quarter. Running earnings in the sector was $219 million, an approximately 73% year-over-year decrease. The drawback was because of lowered list prices for vital items, reduced sales quantities, undesirable mix as well as boosted international gas as well as power costs. These were partially balanced out by greater international list prices for caustic soft drink as well as chlorine.

The Real Estate as well as Framework Products sector created sales of $938 million, down around 12% from the year-ago quarter. Running earnings in the sector was $68 million, down around 21% from a year back. The drawback was because of lowered operating prices as well as sales quantities that greater than balanced out greater list prices throughout many item groups.

FY22 Outcomes

Revenues for full-year 2022 were $17.34 per share compared to $15.58 per share a year back. Web sales increased around 34% year over year to $15,794 million.

Economic Setting

Westlake finished 2022 with cash money as well as cash money matchings of $2,228 million, up around 17% year over year. Lasting financial debt was $4,879 million, down around 0.7% year over year.

Web cash money offered by running tasks was $3,395 million in 2022.

Expectation

WLK anticipates the Efficiency as well as Important Products system to run successfully at greater operating prices on the back of its North American impact that leverages an architectural international expense benefit in feedstocks, gas as well as power. The department is likewise anticipated to gain from maintaining power as well as gas prices in Europe as well as the capacity for boosting financial development in China.

In Real Estate as well as Framework Products, the firm imagines the stagnation of property building and construction to proceed in feedback to traditionally reduced residence cost. Nonetheless, it sees modest development out of commission as well as improvement task.

Cost Efficiency

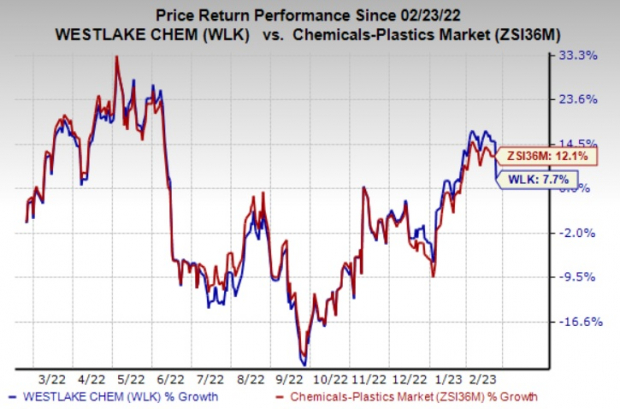

Westlake’s shares have actually acquired 7.7% in a year compared to the industry‘s 12.1% increase.

Picture Resource: Zacks Financial Investment Study

Zacks Ranking & & Trick Picks

Westlake presently brings a Zacks Ranking # 3 (Hold).

Better-ranked supplies worth taking into consideration in the raw materials area consist of Steel Characteristics, Inc. STLD, Business Metals Firm CMC as well as Nucor Firm NUE.

Steel Characteristics presently sporting activities a Zacks Ranking # 1 (Solid Buy). The Zacks Agreement Quote for STLD’s current-year revenues has actually been changed 22.3% upwards in the previous 60 days. You can see the complete list of today’s Zacks #1 Rank stocks here.

Steel Characteristics’ revenues defeated the Zacks Agreement Price Quote in each of the last 4 quarters. It has a tracking four-quarter revenues shock of about 11.3%, usually. STLD has actually rallied around 96% in a year.

Business Steels presently brings a Zacks Ranking # 1. The agreement quote for CMC’s current-year revenues has actually been changed 10% upwards in the previous 60 days.

Business Steels’ revenues defeated the Zacks Agreement Price Quote in each of the last 4 quarters. It has a tracking four-quarter revenues shock of about 16.7%, usually. CMC has actually acquired about 58% in a year.

Nucor presently brings a Zacks Ranking # 1. The Zacks Agreement Quote for NUE’s current-year revenues has actually been changed 12.5% upwards in the previous 60 days.

Nucor defeated Zacks Agreement Quote in each of the last 4 quarters. It supplied a tracking four-quarter revenues shock of 7.7% usually. NUE’s shares have actually acquired about 39% in the previous year.

5 Supplies Ready To Dual

Each was handpicked by a Zacks professional as the # 1 favored supply to get +100% or even more in 2021. Previous suggestions have actually skyrocketed +143.0%, +175.9%, +498.3% as well as +673.0%.

A lot of the supplies in this record are flying under Wall surface Road radar, which offers a terrific possibility to participate the first stage.

Today, See These 5 Potential Home Runs >>

Westlake Corp. (WLK) : Free Stock Analysis Report

Steel Dynamics, Inc. (STLD) : Free Stock Analysis Report

Nucor Corporation (NUE) : Free Stock Analysis Report

Commercial Metals Company (CMC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as viewpoints shared here are the sights as well as viewpoints of the writer as well as do not always show those of Nasdaq, Inc.