The banks and different Finance sector firms gave us a great begin to the Q3 earnings season. Nevertheless, we are going to see if this favorable pattern will proceed this week because the Q3 reporting cycle actually ramps up, with greater than 450 firms reporting outcomes, together with 109 S&P 500 members. By the top of this week, we can have seen Q3 outcomes from 36% of S&P 500 members, representing all key sectors of the market.

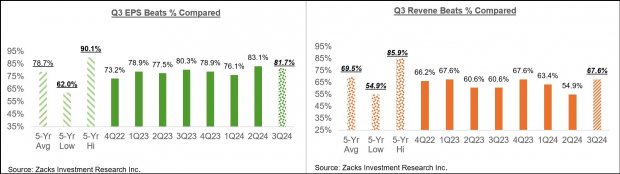

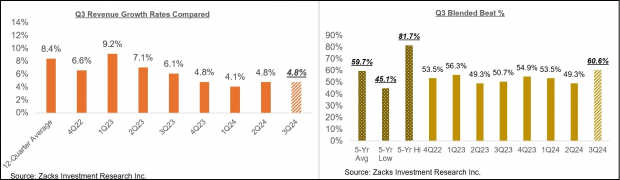

By means of Friday, October 18th, we have now seen Q3 outcomes from 71 S&P 500 members that collectively account for 15.6% of the index’s whole market capitalization. Complete earnings for these firms are up +6.3% from the identical interval final yr on +4.8% increased revenues, with 81.7% of the businesses beating EPS estimates and 67.6% beating income estimates.

The proportion of those 71 index members beating each EPS and income estimates is 60.6%.

It is a higher efficiency than we have now seen from this group of 71 index members in different current durations, because the comparability charts beneath present. The primary set of comparability charts reveals the earnings and income development charges.

Picture Supply: Zacks Funding Analysis

The second set of comparability charts compares the Q3 EPS and income beats percentages in a historic context.

Picture Supply: Zacks Funding Analysis

The comparability charts beneath highlight the income efficiency and the blended beats share for this group of 71 index members.

Picture Supply: Zacks Funding Analysis

The Earnings Massive Image

As famous earlier, we have now greater than 450 firms reporting outcomes this week, together with 109 S&P 500 members. The notable firms reporting this week embrace Common Motors and 3M on Tuesday, Coca-Cola KO and Boeing on Wednesday morning, Tesla TSLA, IBM, and Lam Analysis after the market’s shut that day, UPS UPS and Southwest Airways within the morning session on Thursday, and Colgate-Palmolive on Friday.

Taking a look at Q3 as a complete, combining the outcomes which have come out with estimates for the still-to-come firms, whole earnings for the S&P 500 index are anticipated to be up +3% from the identical interval final yr on +4.7% increased revenues.

The chart beneath reveals the Q3 earnings and income development tempo within the context of the place development has been within the previous 4 quarters and what’s anticipated within the coming three quarters.

Picture Supply: Zacks Funding Analysis

However the modest development tempo in Q3, the mixture earnings whole for the interval is anticipated to be a brand new all-time quarterly document, because the chart beneath reveals.

Picture Supply: Zacks Funding Analysis

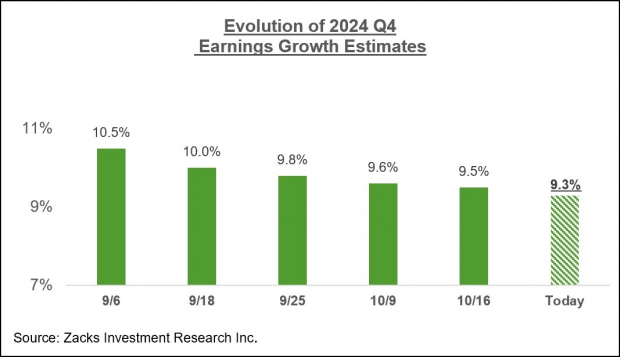

For the final quarter of the yr, whole S&P 500 earnings are anticipated to be up +9.3% from the identical interval final yr on +5.2% increased revenues.

Not like the unusually excessive magnitude of estimate cuts that we had seen forward of the beginning of the Q3 earnings season, estimates for This fall are holding up lots higher, because the chart beneath reveals.

Picture Supply: Zacks Funding Analysis

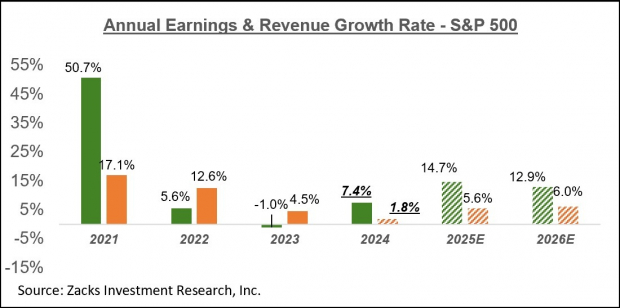

The chart beneath reveals the general earnings image on a calendar-year foundation, with the +7.4% earnings development this yr adopted by double-digit positive factors in 2025 and 2026.

Picture Supply: Zacks Funding Analysis

Please notice that this yr’s +7.3% earnings development improves to +9.3% on an ex-Power foundation.

For an in depth take a look at the general earnings image, together with expectations for the approaching durations, please try our weekly Earnings Tendencies report >>>> Earnings Results Provide Reassuring Economic View

7 Greatest Shares for the Subsequent 30 Days

Simply launched: Consultants distill 7 elite shares from the present record of 220 Zacks Rank #1 Sturdy Buys. They deem these tickers “Most Doubtless for Early Worth Pops.”

Since 1988, the complete record has overwhelmed the market greater than 2X over with a mean acquire of +23.7% per yr. So you should definitely give these hand picked 7 your instant consideration.

CocaCola Company (The) (KO) : Free Stock Analysis Report

United Parcel Service, Inc. (UPS) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.