Insights on efficiency attribution for institutional buyers

Success for institutional buyers is constructed on operational excellence, efficiency attribution, threat administration, and money administration. Over the course of 2024 we’ll discover these themes intimately and spotlight how every is integral to a high-performing multi-asset class portfolio.

Efficiency attribution: the muse of deeper insights

Taken at face worth, efficiency attribution is a backward-looking evaluation that may solely let you know the place your returns have been generated. Alternatively, for stylish institutional buyers, efficiency attribution evaluation provides far more and could be the muse of deeper portfolio insights. On this article we discover how efficiency attribution powers future portfolio success for contemporary, technology-minded allocators.

Informing portfolio selections with efficiency attribution

Asset allocation as an institutional investor is a Sisyphean process that requires fixed consideration. Markets are all the time altering and efficiency attribution helps allocators perceive the place the strengths and weaknesses are of their portfolios. Insights gleaned from efficiency attribution can assist decision-making in supervisor choice and publicity administration, each of which in the end inform asset allocation.

Efficiency attribution evaluation helps allocators perceive if there’s any strategic tilt to their portfolio and whether or not that tilt had contributed extra returns. From there allocators could make comparisons to their portfolio and coverage benchmarks to know whether or not supervisor choice is driving outperformance or whether or not outperformance is pushed by market-wide upward tendencies in particular sectors or asset lessons.

Nasdaq Solovis permits allocators to know what segments of a multi-asset class portfolio is driving out efficiency and the way every examine to coverage benchmarks.

Understanding the place energetic administration is producing outperformance

Understanding efficiency drivers by means of efficiency attribution evaluation additionally helps institutional buyers perceive how energetic administration is contributing to outperformance. These insights may help inform future funding selections which might be more economical for allocators, reminiscent of passively managed methods or direct possession of property, versus by means of an asset supervisor. This identical evaluation can be utilized to know what impacts forex publicity has on the portfolio.

The effectiveness and timeliness of funding selections, from implementation to execution could be assessed with efficiency attribution. Had been you capable of choose managers and assemble the portfolio in a approach that correctly captures the technique or had been you sluggish to implement given the funding automobiles and lagged funding timelines of sure asset lessons like non-public markets?

With Nasdaq Solovis, asset house owners can view their portfolio holdings in a spread of various publicity or sector roll-ups. The platform permits customers to research a “combined bag” of manager-level publicity knowledge, direct holdings, and marketable securities multi functional multi-asset class view.

Pictured above is a Nasdaq Solovis instance of a “combined bag” portfolio publicity breakdown. Leap Worldwide Developed is a public firm with fund-level publicity, the GPIP holdings are a number of drawdown funds with fund-level publicity, Greenfarm Progress II is a personal fund with holding-level publicity, and Boutique World Fund and Worldwide Prospect Fund are public holding-level exposures.

Understanding threat by means of the lens of efficiency attribution

One other utility for efficiency attribution is knowing the danger/return trade-off of investments. Efficiency attribution and ex-post threat evaluation permit allocators to make use of historic efficiency to know how an funding could be affected by threat sooner or later. Along with Sharpe ratios and monitoring error, these evaluation assist allocators higher align their portfolios to their desired benchmarks and threat profiles. Threat evaluation by means of efficiency attribution permits asset house owners to match their portfolios to coverage benchmarks or broader business measures just like the

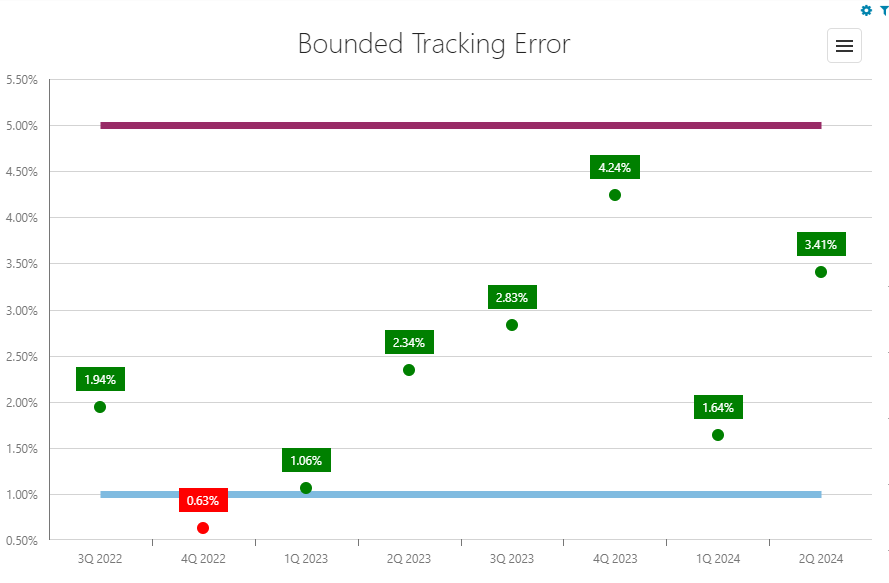

The picture above demonstrates how an asset proprietor can use Nasdaq Solovis to set higher and decrease monitoring error bounds and monitoring when portfolio holdings are in or out of threat price range limits.

Click on right here to study extra about how Nasdaq Solovis helps asset owns plan for and keep away from threat from market occasion.

Efficiency Attribution: a pillar of the Nasdaq Solovis platform

Efficiency Attribution, together with money administration, operational excellence, and threat administration are the 4 foundational pillars of the Nasdaq Solovis platform. Nasdaq Solovis helps asset house owners acquire instantaneous insights throughout a whole multi-asset class portfolio and create context quick to drive decision-making.