Revenues period remains to unwind, with a considerable listing of business reporting daily.

We’re well right into the period up until now, with lots of business publishing better-than-expected lead to the face of a been afraid profits “armageddon.”

As well as arises from Palo Alto Networks PANW today have definitely amazed, with shares rising complying with the launch.

As we can see from the graph below, PANW shares have actually presented a solid rebound in 2023, up greater than 30% year-to-date as well as squashing the S&P 500’s efficiency.

Picture Resource: Zacks Financial Investment Research Study

It increases a legitimate concern: With shares rising, exactly how does the firm presently accumulate? Allow’s take a more detailed check out the most recent quarterly launch as well as a couple of various other elements.

Palo Alto Networks Q2

Palo Alto Networks reported profits of $1.05 per share, going beyond the Zacks Agreement EPS Quote of $0.78 by 35% as well as expanding a large 81% year-over-year.

Relating to the leading line, PANW produced $1.7 billion in quarterly profits, decently in advance of assumptions as well as climbing up 26% from the year-ago quarter.

Furthermore, the firm’s Payments expanded 26% year-over-year to $2 billion.

On the quarter, Nikesh Arora, CHIEF EXECUTIVE OFFICER, stated, “We remain to see our groups perform well in the middle of macroeconomic obstacles, aiding clients combine their protection styles.”

As well as to cover it off, PANW gave advice for FY23 Q3; the firm anticipates overall invoicings in a series of $2.2– $2.25 billion, with the midpoint mirroring a 23.5% year-over-year adjustment. Better, Palo Alto anticipates Q3 profits to be in the $1.695 billion– $1.725 billion array, standing for year-over-year development of about 23%.

The firm is definitely familiar with going beyond quarterly quotes, with this print mirroring the 12 th successive dual beat.

Assessment & & Development Expectation

PANW shares currently trade at a 7.3 X price-to-sales proportion, a tick listed below the 7.5 X five-year average however over the Zacks Computer system as well as Modern technology field standard.

Picture Resource: Zacks Financial Investment Research Study

The firm lugs a Design Rating of “D” for Worth.

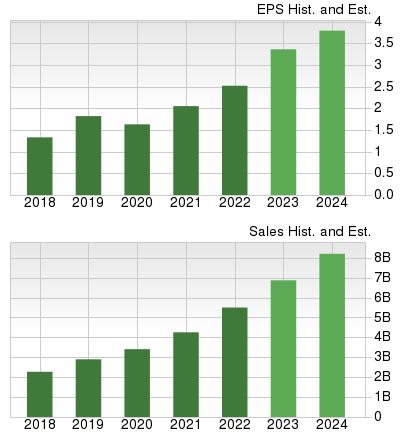

Furthermore, PANW lugs a desirable development account, with profits anticipated to climb up 35% in its existing as well as an additional 17% in FY24.

The forecasted profits development begins the rear of anticipated year-over-year profits upticks of 25% in FY23 as well as 22% in FY24.

Picture Resource: Zacks Financial Investment Research Study

Profits

Capitalists applauded on PANW’s quarterly outcomes, sending out shares rising in today’s session. The firm defeated on both the leading as well as profits, proceeding a fad well in position.

Furthermore, PANW gave uplifting advice for its forthcoming quarter, placing the cherry on the top. Currently, Palo Alto Networks PANW is a Zacks Ranking # 3 (Hold).

5 Supplies Ready To Dual

Each was handpicked by a Zacks professional as the # 1 preferred supply to obtain +100% or even more in 2021. Previous suggestions have actually skyrocketed +143.0%, +175.9%, +498.3% as well as +673.0%.

The majority of the supplies in this record are flying under Wall surface Road radar, which offers a terrific possibility to participate the very beginning.

Today, See These 5 Potential Home Runs >>

Palo Alto Networks, Inc. (PANW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as point of views revealed here are the sights as well as point of views of the writer as well as do not always mirror those of Nasdaq, Inc.