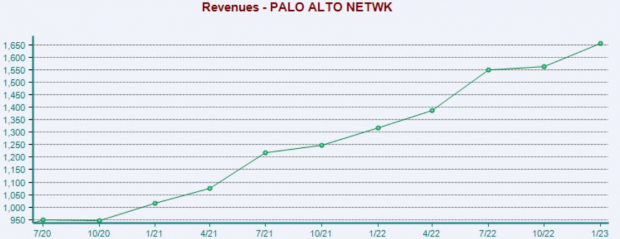

Revenues period remains to unwind, with the coverage docket reducing each week. Up until now, revenues have actually mainly been better-than-feared, assisting buoy the marketplace throughout a somewhat-cloudy financial expectation.

As well as simply the other day, we got quarterly arise from cybersecurity titan Palo Alto Networks PANW. Palo Alto shares have actually been heated in 2023 thus far, up greater than 40% and also commonly outshining the basic market.

Financiers were excited with the quarterly outcomes, equally as they were last quarter, as we can see shown by the graph below.

Photo Resource: Zacks Financial Investment Research Study

Allow’s dive deeper right into the quarterly launch and also just how the business presently accumulates.

Quarterly Outcomes

PANW published solid outcomes, going beyond the Zacks Agreement EPS Price Quote by 20% and also providing a moderate profits shock. Remarkably, it showed the business’s 13 th successive quarter of defeating both revenues and also profits assumptions.

Photo Resource: Zacks Financial Investment Research Study

Additionally, the business’s staying efficiency commitment expanded 35% year-over-year to $9.2 billion, with Invoicings seeing development of 26% from the year-ago quarter. Remarkably, the business’s operating earnings (non-GAAP) amounted to $407 million, enhancing a well-founded 61% from the year-ago quarter.

Nikesh Arora, CHIEF EXECUTIVE OFFICER, claimed,” Our group once more implemented well in a market that remains to come to be much more difficult. Our technique of providing best-of-breed items within our 3 systems is assisting consumers streamline their safety and security designs and also combine suppliers.”

Complying with the solid outcomes, PANW increased its capital margin assistance right into a series of 37.5% – 38.5% for its existing (FY23).

Existing Standing

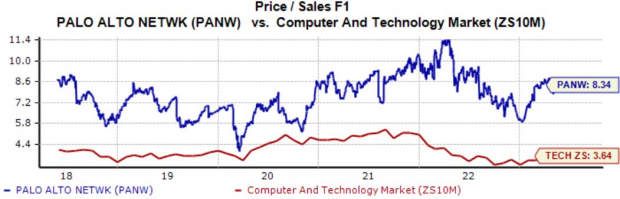

PANW shares might not lure value-focused financiers, with the existing 8.3 X onward price-to-sales proportion resting well over the 7.5 X five-year average and also the Zacks Computer system and also Modern technology industry standard.

Still, the costs comes to be much more sensible when considering the business’s fast development.

Photo Resource: Zacks Financial Investment Research Study

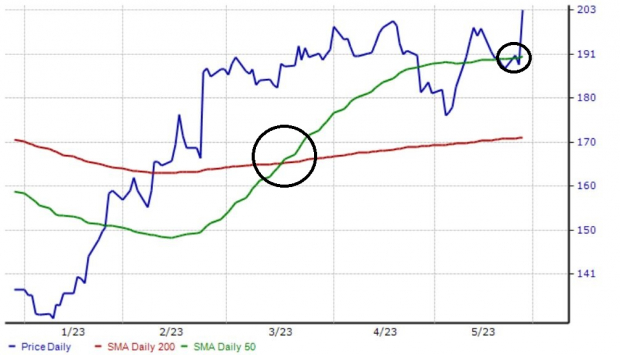

Shares have actually just recently observed the gold cross and also discovered assistance at the 200-day relocating standard, as we can see detailed in the graph below. The $200 per share limit persisted, yet the current quarterly outcomes supplied shares the gas they required to appear.

Photo Resource: Zacks Financial Investment Research Study

Profits

The Q1 revenues cycle brought us several shocks, the majority of which have actually aided maintain belief in check.

As well as simply today, we obtained a huge shock from cybersecurity titan Palo Alto Networks PANW, with the business uploading a double-beat and also elevating capital margin assistance.

Free Record: Must-See Hydrogen Supplies

Hydrogen gas cells are currently utilized to supply reliable, ultra-clean power to buses, ships and also also medical facilities. This innovation gets on the edge of a large innovation, one that can make hydrogen a significant resource of America’s power. It can also entirely reinvent the EV sector.

Zacks has actually launched an unique record disclosing the 4 supplies specialists think will certainly provide the greatest gains.

Download Cashing In on Cleaner Energy today, absolutely free.

Palo Alto Networks, Inc. (PANW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights and also viewpoints revealed here are the sights and also viewpoints of the writer and also do not always mirror those of Nasdaq, Inc.