IonQ (NYSE: IONQ) is without doubt one of the hottest shares on Wall Avenue proper now. Shares of the corporate soared by practically 400% within the final three months of 2024.

However is IonQ a inventory that traders should purchase and maintain for the long run? Let’s discover out.

Begin Your Mornings Smarter! Get up with Breakfast information in your inbox each market day. Sign Up For Free »

Picture supply: Getty Photographs.

Understanding IonQ’s enterprise

IonQ designs quantum computers, which function on a completely different set of ideas than a conventional laptop. The main points of what makes quantum computer systems completely different could be complicated — whereas conventional computer systems function on bits, which may solely exist as a price of 0 or 1, quantum computer systems function on qubits, which could be anyplace in between these two attainable states. That enables quantum computer systems to function a lot sooner than conventional computer systems, they usually can carry out calculations which can be too time-consuming or advanced for standard computer systems.

Certainly, the leap from conventional computing to quantum computing might be analogous to the evolution from steam energy to rocket engines. It may usher in a brand new degree of computation that may clear up issues that appear unimaginable at present.

The sensible functions are seemingly limitless: monumental developments in drug improvement, medical breakthroughs, vastly improved climate and local weather fashions, engineering developments, and maybe even artificial general intelligence (AGI).

So, as a frontrunner in quantum computing, it is no surprise that IonQ is attracting a lot consideration.

The place will IonQ be in 5 years?

A lot of the joy surrounding IonQ is as a result of general potential of quantum computing. Nevertheless, that potential is a double-edged sword.

If it continues to make important developments within the expertise, the corporate is nicely positioned to profit over the following 5 years. However, if these technological developments fail to materialize, or if a competitor beats IonQ to them, it is attainable that it may lose help amongst traders.

That is as a result of it stays a younger firm that lacks a gradual stream of earnings and the optimistic free money stream that helps a mature enterprise.

As of its most up-to-date quarter (ending on Sept. 30), IonQ reported revenue of $12.4 million. That will appear to be an honest sum of money, however let’s put it in context. Meta Platforms made $40.6 billion in income in its most up-to-date quarter. That works out to $450 million per day, or $19 million per hour.

In different phrases, IonQ’s potential could also be large, however its precise footprint at present stays tiny when in comparison with the true company titans.

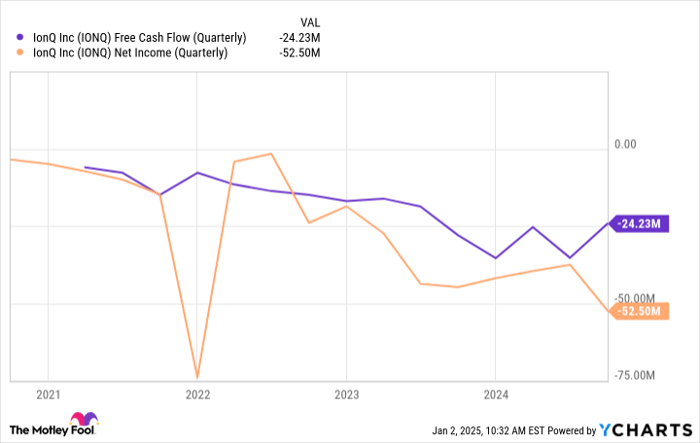

Living proof: IonQ stays unprofitable and is but to document 1 / 4 with optimistic free cash flow.

IONQ free cash flow (quarterly); information by YCharts.

Granted, these circumstances aren’t uncommon for a younger firm that’s engaged on a brand new and modern expertise. Nevertheless, traders ought to concentrate on the dangers.

For traders prepared to remain the course for a few years to return, IonQ has ample money on its balance sheet at $365 million. Which means it might probably fund operations for a number of years, given its most up-to-date money burn charge of roughly $100 million per yr. After that, the corporate might want to do a number of of the next:

- Generate money from its operations,

- Elevate extra funding through the debt markets, or

- Elevate funds by a secondary inventory providing.

IonQ is a viable enterprise that generates a modest quantity of income. Nevertheless, the corporate is not worthwhile proper now, and it would not generate optimistic free money stream. That places it inventory out of bounds for worth traders and even some development traders.

Briefly, that is an thrilling firm in a promising area. The place the inventory will find yourself 5 years from now actually relies on what breakthroughs (if any) happen in quantum computing. Subsequently, you must train warning with IonQ inventory.

Must you make investments $1,000 in IonQ proper now?

Before you purchase inventory in IonQ, contemplate this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the 10 best stocks for traders to purchase now… and IonQ wasn’t certainly one of them. The ten shares that made the reduce may produce monster returns within the coming years.

Think about when Nvidia made this listing on April 15, 2005… for those who invested $1,000 on the time of our advice, you’d have $823,000!*

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of December 30, 2024

Randi Zuckerberg, a former director of market improvement and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Jake Lerch has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Meta Platforms. The Motley Idiot has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.