Toast (NYSE: TOST) is a restaurant expertise firm with merchandise for processing funds, taking orders, and extra. And one yr from now, Toast inventory is more likely to be buying and selling increased than it’s at this time.

Income is rising at greater than 20% yearly, and administration is demonstrating that it is aware of how you can run a worthwhile enterprise. These two issues are encouraging sufficient, however there’s another factor that makes me much more optimistic concerning the long-term prospects of this firm.

Do not overlook this adoption development with Toast

Within the second quarter, round 8,000 new restaurant places began utilizing Toast’s expertise. Admittedly, the second quarter is normally a robust one for the corporate, however this was a report quantity of internet new places. And it solutions a serious query that shareholders had.

In 2023, Toast launched a brand new price that outraged clients, main administration to shortly reverse the choice. However there are different restaurant expertise corporations on the market, and shareholders have been left questioning whether or not Toast had misstepped and alienated customers from its platform.

Given the report variety of internet new places in Q2, it seems Toast did not undergo an excessive amount of reputational injury. That being the case, there’s good motive to consider its progress fee may speed up.

When Toast reaches 20% market share in a particular market, administration calls this a flywheel market. It appears its present clients turn out to be model evangelists in these flywheel areas. Merely put, the corporate has famous stronger adoption charges, decrease bills, and consequently, increased earnings, in flywheel markets.

In 2021, Toast had 20% or larger market share in solely 5% of U.S. markets. In 2023, that jumped to 31% of U.S. markets. And it continues to climb in 2024, in accordance with administration.

The corporate solely has 13% market share within the U.S. as a complete, however increasingly markets are reaching a tipping level the place taking extra share will get simpler.

Excited about this from a big-picture perspective, Toast seems to be on a path to claiming an enormous share of the general restaurant space within the U.S., which means the enterprise may have a few years of progress forward of it.

Extra than simply progress

For a while, I have been a believer in Toast’s progress potential. I used to be a doubter when it got here to its backside line, however this firm is proving me mistaken in actual time.

Toast gives {hardware} units to clients at a gross loss, and cost processing is low margin. Against this, its software program subscription merchandise are excessive margin. That is nice, however it takes time for the software program earnings to get large enough to offset the losses elsewhere within the enterprise. Nevertheless, as this chart exhibits, Toast’s gross profit margin is leaping increased just lately as income soars.

Knowledge by YCharts.

Additional boosting operational effectivity is the aforementioned flywheel impact that helps Toast save on gross sales and advertising bills.

So, on one hand, the advance with Toast’s profitability is a pure byproduct of its progress, and alternatively, administration is making different strikes to assist the underside line as nicely. Basic and administrative (company) bills have been down a whopping 22% yr over yr in Q2.

With income rising, margins rising, and administration exercising self-discipline, Toast simply reported its first quarterly operating profit as a publicly-traded company. Its Q2 working earnings of $5 million could also be modest, however it’s a step in the proper route.

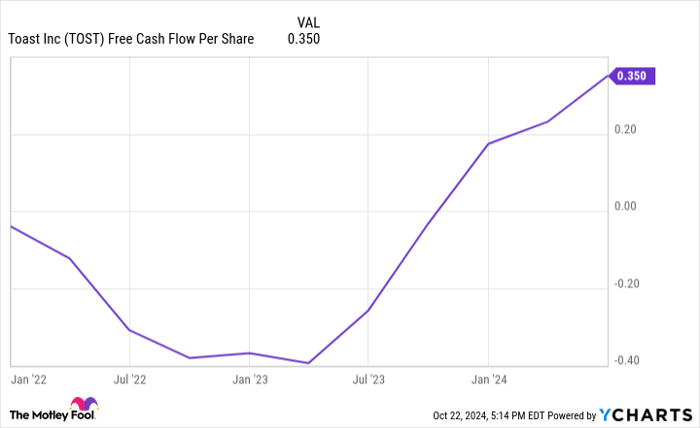

Toast’s free cash flow per share can be climbing increased at a formidable fee as you may see under.

Knowledge by YCharts.

Wanting towards 2025 and past

With Toast, traders are introduced with a worthwhile progress alternative that would very nicely decide up extra steam within the coming yr. And searching on the inventory, it trades at an affordable valuation of lower than 4 times sales. That units shares up properly for beneficial properties as enterprise momentum will get going.

For these trying to purchase Toast inventory at this time, it could have upside potential over the following yr, however there’s one thing to bear in mind: It could take longer than a yr to play out.

Analysis firm Boston Consulting Group revealed a long-term examine in 2006 that discovered that an organization’s valuation moved a inventory value greater than something over a single yr. However over three years, progress was the most important issue for sending a inventory increased.

Valuation is largely pushed by investor sentiment, and any variety of issues can impression sentiment each positively and negatively, making predictions troublesome. Due to this fact, Toast inventory may not rise over the following yr if investor sentiment drops its valuation decrease.

Fortuitously, the valuation is already cheap on this case. If progress continues over the following three or extra years, affected person Toast shareholders must be rewarded.

Don’t miss this second likelihood at a probably profitable alternative

Ever really feel such as you missed the boat in shopping for essentially the most profitable shares? Then you definitely’ll wish to hear this.

On uncommon events, our professional group of analysts points a “Double Down” stock suggestion for corporations that they suppose are about to pop. When you’re anxious you’ve already missed your likelihood to speculate, now’s the most effective time to purchase earlier than it’s too late. And the numbers communicate for themselves:

- Amazon: for those who invested $1,000 after we doubled down in 2010, you’d have $21,154!*

- Apple: for those who invested $1,000 after we doubled down in 2008, you’d have $43,777!*

- Netflix: for those who invested $1,000 after we doubled down in 2004, you’d have $406,992!*

Proper now, we’re issuing “Double Down” alerts for 3 unbelievable corporations, and there will not be one other likelihood like this anytime quickly.

*Inventory Advisor returns as of October 21, 2024

Jon Quast has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Toast. The Motley Idiot has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.