IT safety options supplier CyberArk Software program CYBR has turn into a notable standout within the tech sector after exceeding third quarter expectations on Wednesday.

Hitting all-time highs of $318 a share this week, CyberArk’s inventory has now rallied practically +40% 12 months so far and at present covets a Zacks Rank #1 (Sturdy Purchase).

Picture Supply: Zacks Funding Analysis

CyberArk’s Sturdy Q3 Outcomes

Reporting robust Q3 outcomes, CyberArk CEO Matt Cohen acknowledged the corporate’s trade management in id safety helped ship robust internet new annual recurring income (ARR), document income, elevated profitability, and money move.

File Income

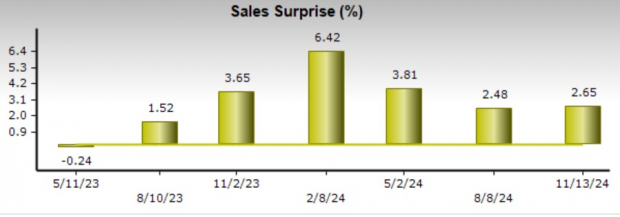

CyberArk posted document quarterly gross sales of $240.1 million, topping Zacks estimates of $233.9 million and hovering 25% from $191.24 million a 12 months in the past.

Optimistically, Complete ARR spiked 31% 12 months over 12 months to $926 million. CyberArk has surpassed high line estimates for six consecutive quarters posting a median gross sales shock of three.84% in its final 4 quarterly experiences.

Picture Supply: Zacks Funding Analysis

Elevated Profitability

Most compelling is that CyberArk additionally achieved a quarterly document for adjusted earnings per share with This autumn EPS hovering 124% to $0.94 in comparison with $0.42 a share within the comparative quarter. Even higher, this crushed the Zacks EPS Consensus of $0.45 by 109%.

CyberArk has reached or exceeded earnings expectations for 13 consecutive quarters posting a really spectacular common EPS shock of 97.68% within the final 4 quarters.

Picture Supply: Zacks Funding Analysis

Money Circulation

Free money move stretched to $51.56 million from $13.62 million in Q3 2023. Capable of strengthen its stability sheet, CyberArk’s money & equivalents have ballooned to $1.23 billion with the corporate coming into the 12 months with $355.93 million.

CyberArk’s Income Steering

For This autumn, CyberArk expects income within the vary of $297 million-$303 million, representing development of 33%-36%. CyberArk expects full-year fiscal 2024 income to extend by 31%-32% to $983 million-$989 million.

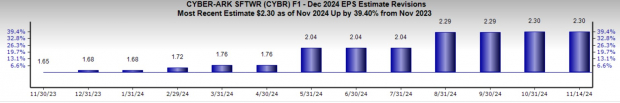

EPS Development & Revisions

Based mostly on Zacks estimates, CyberArk’s annual EPS is now anticipated to increase 105% in FY24 to $2.30 versus $1.12 in 2023. Plus, FY25 EPS is projected to extend one other 45% to $3.35 per share. Resulting in CyberArk’s robust purchase score and its sensible value efficiency this 12 months has been a compelling development of earnings estimate revisions for FY24 as proven under.

Picture Supply: Zacks Funding Analysis

Backside Line

CyberArk is without doubt one of the most intriguing tech shares to observe in the intervening time and it might be no shock if CYBR retains drifting larger as earnings estimate revisions are more likely to rise within the coming weeks.

Should-See: Photo voltaic Shares Poised to Skyrocket

The photo voltaic trade stands to bounce again as tech firms and the financial system transition away from fossil fuels to energy the AI increase.

Trillions of {dollars} shall be invested in clear power over the approaching years – and analysts predict photo voltaic will account for 80% of the renewable power growth. This creates an outsized alternative to revenue within the near-term and for years to return. However you need to choose the correct shares to get into.

Discover Zacks’ hottest solar stock recommendation FREE.

CyberArk Software Ltd. (CYBR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.